Why is welfare spending rising even faster than expected?

It’s not just Starmer’s direct choices – wider forces are increasing the bill

NEIL O’BRIEN

Rachel Reeves’ Budget at the end of last year revised up forecasts for working age welfare spending significantly.

In fact, over the 5 years from 2025/26 to 2029/30, the government is now planning to spend £36.4 billion more on benefits than they had planned to only a few months earlier.

The difference is shown in the chart below as the little grey gap.

But it isn’t really that little. Spending in 2029/30 alone is now predicted to be nine and a half billion a year higher than it was in the spring forecast. That’s a lot of extra taxpayers’ money over just a couple of months. Overall, between Spring Statement on 26 March and Budget on 26 November, Reeves lost about £150m a day.

What’s going on? It’s not just revolting Labour MPs.

.

By 2030/31 working age welfare will cost £177.5 billion a year, or about a billion pounds every two days. For context, we spend about £20 billion a year on the police in England and Wales, and about £15 billion a year on NHS GPs in England. While in real terms spending on welfare was roughly the same in 2024 as in 2012, the projected growth is a real terms (i.e. faster than inflation) increase.

Stripping out inflation, in today’s money, spending will have increased by £15.6 billion over the five years from 2025/26 to 2030/31.

This growth in spending partly reflects policy choices like the defeat of benefit reforms by Labour MPs and the ending of the two-child benefit cap (though “choice” is a funny word for two things Starmer used to oppose).

But it also reflects rising levels of worklessness and wider deterioration in the forecasts. The OBR explains that working age welfare is being driven up by:

Higher benefit uprating, which increases spending by £3.1 billion in 2029-30. Roughly half (£1.6 billion) is explained by higher CPI uprating for working-age benefits, with the rest mostly due to higher earnings increasing triple lock uprating for pensions (£1.4 billion).

Higher unemployment in the first half of the forecast period, which increases universal credit spending by £1.8 and £1.2 billion in 2026-27 and 2027-28, before tapering off to a £0.5 billion increase in 2029-30.

Higher disability caseloads and average awards, which increase spending by £1.4 billion in 2029-30. Most of this is driven by lower exit rates from PIP and attendance allowance (£0.9 billion), which the latest DWP data shows have fallen substantially since the onset of the pandemic.[]

Policy measures, which increase spending by £9 billion in 2029-30. These include the reversal of the tightened gateway for PIP at Spring Statement 2025 and the extension of winter fuel payment eligibility announced in the summer, which increase spending by £4.0 billion and £1.7 billion respectively. They also include the removal of the two-child limit, costing £3.1 billion.

These changes – higher benefits multiplied by more people claiming them – are spread across different benefits. There are five main benefits where most of the unexpected and increased spending is concentrated:

.

What’s driving all this growth in spending?

In future posts I will come back to the reasons why we are seeing more people on benefits, and growing claim amounts from people on benefits. The short answer is a combination of:

- A labour market reeling from higher taxes and more regulation,

- A series of benefits where people have learned how to play the system, (“system learning” in the jargon) and people have become more likely to seek a claim,

- The growth of mental health claims, particularly among younger people.

In this post I am not going to get too into the detail of these three drivers, except to say that they overlap and combine. But here are some examples of what I mean.

On the first – the economic outlook – I’m particularly struck by the increase in youth unemployment, which is now above Euro area levels for the first time in a long time.

.

These days, now that Jobseekers allowance is a thing of the past, the impact of rising unemployment shows up in terms of increased numbers expected on Universal Credit (shown in the chart below). But a worsening economy also drives up numbers of claimants of other benefits too. By the end of the forecast there are over 700,000 more people claiming those five benefits I mentioned above, compared to what the government expected in spring 2025.

.

On “system learning” and increased willingness to claim, you can see that cleanly by looking at the explosive growth of DLA for children, which is now forecast to rise past a million claimants and hit eight billion in spending.

These aren’t people who are looking for jobs (because they are children) so we can see this growth in the numbers claiming isn’t just about a worsening economy.

.

And what is driving that rise in numbers and spending on Child DLA? We can see what people are claiming for when they come to the end of Child DLA at 16 and have to seek mandatory reconsideration if they want to stay on benefits. We can see how mental health conditions have been driving the increase:

.

Conclusions

I have made the case before that the choices facing Britain are going to get a lot tougher because of the ageing society.

The kinds of numbers I have included above are pretty stark. But these trends are not inevitable. As we have seen before, welfare design and wider economic policy can make a huge difference. What goes up can come down, and vice versa.

And if we want to have the money to spend on things like health, without self-defeating tax hikes that would simply damage the economy, then we are going to have to deal with the ballooning bill for working age welfare spending.

That is not going to be easy, and right now things are going the wrong way under Reeves really fast.

PS – And another thing!

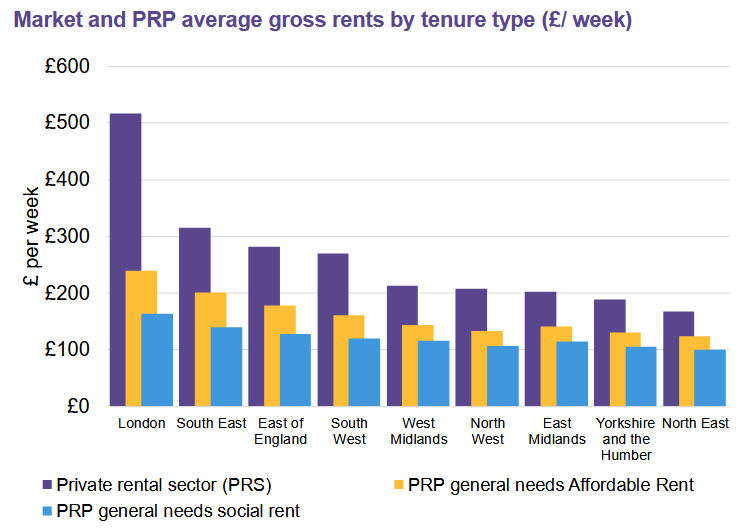

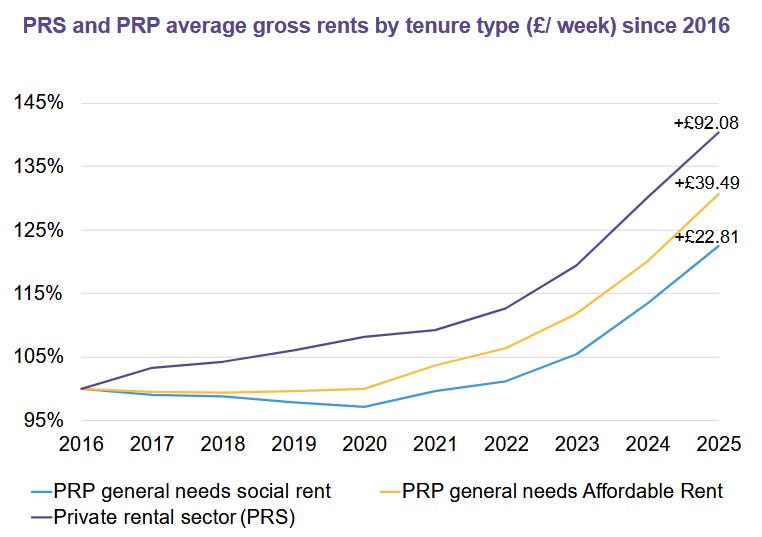

In one way the statistics above don’t capture the full extent of spending and subsidy, on working age benefits, because the figures above are net of subsidies for social housing. Those subsidies are pretty big – particularly in London, where about a quarter of households are in social housing.

The gap between private and social (council house) rents has got bigger over recent years so the implicit subsidy is greater. 83% of households in new social lettings last year received some form of housing-related benefit, so this subsidy mainly shows up in the form of apparently lower (measured) benefit spending. One recent attempt to cost out the total value of the subsidy from lower social sector rents put it at just under £20 billion a year for general needs (i.e. non-sheltered) social housing, concentrated in places like London.

OK, I’ll stop now.

This article (Why is welfare spending rising even faster than expected?) was created and published by Neil O’Brien and is republished here under “Fair Use”

••••

The Liberty Beacon Project is now expanding at a near exponential rate, and for this we are grateful and excited! But we must also be practical. For 7 years we have not asked for any donations, and have built this project with our own funds as we grew. We are now experiencing ever increasing growing pains due to the large number of websites and projects we represent. So we have just installed donation buttons on our websites and ask that you consider this when you visit them. Nothing is too small. We thank you for all your support and your considerations … (TLB)

••••

Comment Policy: As a privately owned web site, we reserve the right to remove comments that contain spam, advertising, vulgarity, threats of violence, racism, or personal/abusive attacks on other users. This also applies to trolling, the use of more than one alias, or just intentional mischief. Enforcement of this policy is at the discretion of this websites administrators. Repeat offenders may be blocked or permanently banned without prior warning.

••••

Disclaimer: TLB websites contain copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available to our readers under the provisions of “fair use” in an effort to advance a better understanding of political, health, economic and social issues. The material on this site is distributed without profit to those who have expressed a prior interest in receiving it for research and educational purposes. If you wish to use copyrighted material for purposes other than “fair use” you must request permission from the copyright owner.

••••

Disclaimer: The information and opinions shared are for informational purposes only including, but not limited to, text, graphics, images and other material are not intended as medical advice or instruction. Nothing mentioned is intended to be a substitute for professional medical advice, diagnosis or treatment.

Disclaimer: The views and opinions expressed in this article are those of the author and do not necessarily reflect the official policy or position of The Liberty Beacon Project.

Leave a Reply