It’s the energy stupid: how low could energy prices go if we ditched Net Zero?

DAVID TURVER

Recently, Lord Frost had an interesting article in the Telegraph where he made the point:

“In Britain we use nearly 30 per cent less energy and 25 per cent less electricity overall than in 2000 – despite the increase in population. The Americans use the same amount of energy as then and 15 per cent more electricity. That’s a big part of the reason why they still have economic growth and we do not.”

Since then, we have also seen the increased offer prices for new renewables capacity to be auctioned in Allocation Round 7 (AR7) which will further increase our electricity bills. The ONS has reported the economy shrank in April and May and Liam Halligan has warned we are on the brink of a debt crisis, because we are borrowing to pay the interest on our debt.

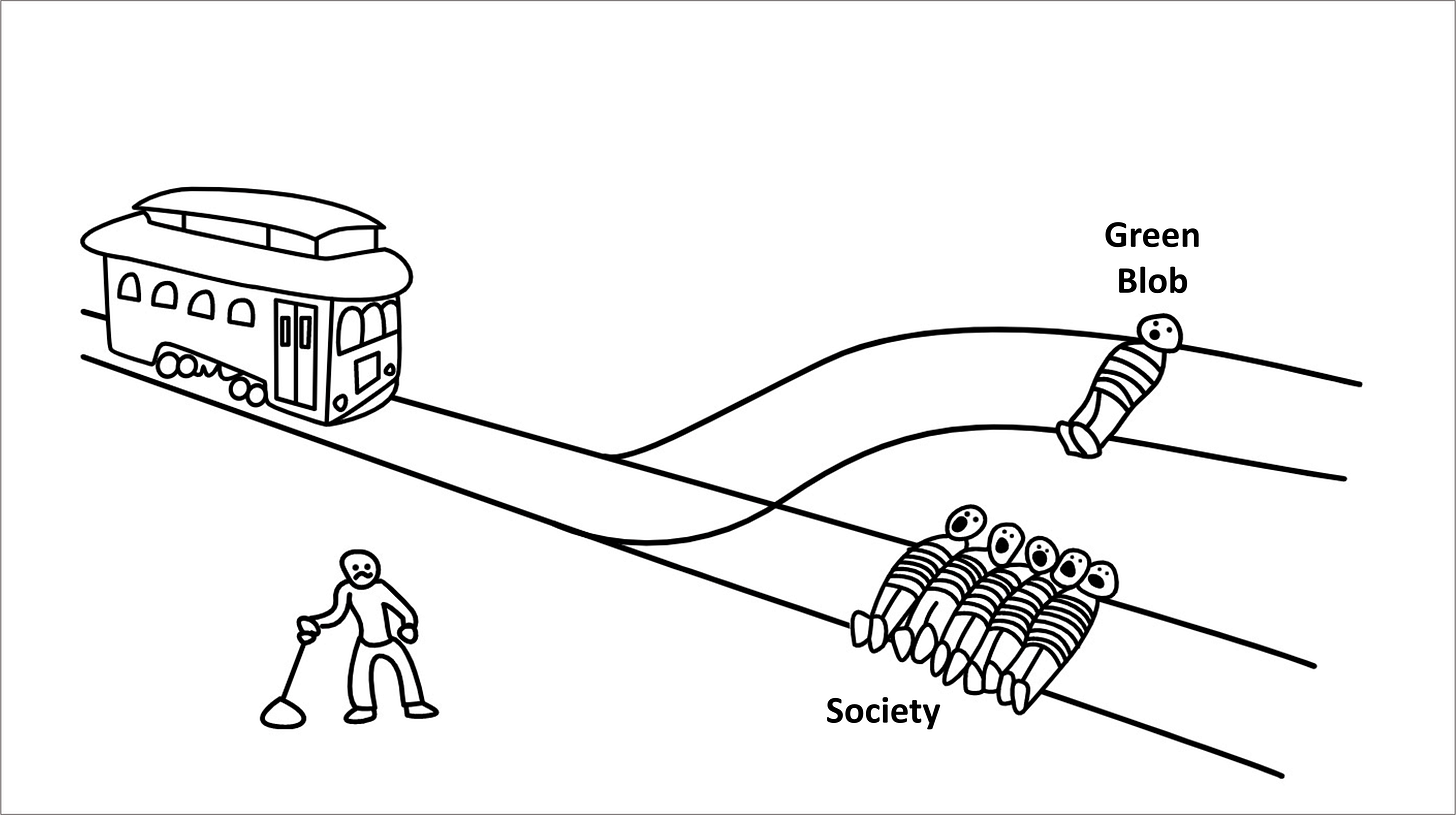

Net Zero is making us face a version of the Trolley Problem. If we sacrifice the Green Blob to save society, how low could energy prices go?

Energy Scarcity Stifles Growth

We can see the truth of Lord Frost’s argument in Figure 1 (data from Our World in Data and World Bank). Many of our economic woes arise because our energy is too expensive, so we use 36% less energy per capita than in 2006. This has stifled economic growth, creating a yawning wealth gap of $14,730 per person compared to where we might have been if we had continued trend growth from 1990-2006.

But what if we ditched Net Zero and instead made cheap energy the primary goal. How low could UK energy prices go?

Ditching Net Zero Would Cut Energy Prices

Currently, UK gas prices are trading at about 80p/therm which converts to just over £27/MWh.

A modern Combined Cycle Gas Turbine (CCGT) operating at an efficiency of 55% could generate electricity at about £50/MWh. We add carbon taxes so the recent market price of electricity is about £73/MWh. This is too high but is still less than half the £161/MWh we paid CfD-funded offshore wind farms in June 2025. If we got rid of all the Net Zero baggage, we could have wholesale prices less than a third the cost of current offshore wind, or less than half the cost being offered in AR7. Retail prices would be much lower too if we got rid of the £12bn in subsidies, £4bn in grid balancing and backup and did not have to spend £80bn by 2030 to expand the grid to connect remote renewables. In domestic terms, wholesale prices could be 5p/kWh and might retail at 12-15p/kWh, compared to today’s price cap around 26p.

Potential for Even Cheaper Gas

But we should not let our imagination stop there. US gas costs less than a third of UK prices. Henry Hub gas currently trades at about $3.15/mmbtu which works out at about £8/MWh. A modern CCGT could produce electricity at about £15/MWh or 1.5p/kWh. There are quite a lot of fixed costs in the electricity network, so retail prices might not fall in proportion. However, it would not be unreasonable to expect retail prices to fall below 10p/kWh. Much cheaper gas would also dramatically reduce heating bills. We would not need the Warm Homes Discount anymore and consumer debt due to energy companies would fall too. At least as important, industry would be competitive again.

This might sound fanciful, but we have been conditioned for decades to accept high prices and energy scarcity. If we lifted the ban on offshore drilling and ended the moratorium on fracking we would see a dramatic fall in UK gas prices, particularly if the EU also lifted its fracking ban too. The scale of the opportunity from cheap and abundant energy is simply too large to ignore.

A Path to Prosperity

Bill Clinton won an election with the slogan “It’s the economy, stupid.” Energy is the economy, so perhaps we should change that to “It’s the energy, stupid.” Cheap energy is the key to prosperity. The scale of the potential is summarised in the table below.

What would we need to do to grasp the opportunity before us. Some of the ideas discussed below are outside the Overton Window of polite conversation. However, we need to acknowledge that we face a version of the Trolley Problem. This is where you face a dilemma of whether to divert a runaway trolley bus to kill one person instead of five. In our version of the problem we must sacrifice either society or the green blob.

If we continue down the current Net Zero path, our economy and wider society faces an existential threat. We must face the unpalatable truth that moving onto the path to prosperity will require measures that will be painful for some, most notably what can be loosely termed the green blob.

First and foremost, the Climate Change Act of 2008 (CCA) would need to be repealed, because probably all the measures discussed below would be open to legal challenge if it stayed in place. Scrapping the CCA might well have other knock-on impacts on international treaties such as the EU-UK Trade and Cooperation Agreement, so these would have to be reset too.

Cut Carbon Taxes

Second, we should focus our efforts that gave the least legal pain for maximum return in lower energy prices. We should start with the various tax and subsidy regimes that impact our energy bills or tax the use of energy.

The UK Emissions Trading Scheme (ETS) is levied on energy intensive industries, the power generation sector and aviation. According to the ONS, the ETS cost £4,069m in 2024. The cost of this is set to rise as the Government has pledged to align the UK and EU trading schemes and EU carbon prices are even higher than ours. The Climate Change Levy is paid by non-domestic energy consumers and cost £1,785m. We could also consider cutting the 5% VAT on energy bills. Abolishing these taxes would support industry and make our energy bills cheaper.

Cut Renewables Subsidies

Now we turn to the thorny issue of renewables subsidies. The most expensive subsidy scheme is Renewables Obligations, which cost £7.7bn in 2024 according to the ONS. This is a subsidy paid to renewables generators in addition to the market price they receive for the electricity they generate. This scheme has been closed to new entrants since 2017, so all beneficiaries have had plenty of time to recoup their initial capital. We should consider a range of measures to cut costs. The softest measure would be to stop indexing the value of certificates in line with inflation. This would at least cap the costs until the scheme starts to decay naturally as generators pass the 20-year limit for subsidies. A more dramatic measure would be to effectively end the scheme altogether by repealing or amending Renewables Order 2015 which is used to set the number of certificates suppliers are obliged to purchase. If this were set to zero, the certificates would have no value and the cost of the scheme would collapse, removing £7.7bn from our electricity bills. Dale Vince is always telling us that wind is the cheapest form of generation, let’s see him put his money where his mouth is.

Next we turn to the thorny issue of Contracts for Difference (CfDs), which cost £2.4bn in 2024. This is a relatively modest sum in the grand scheme of things, but there are large extra costs in the pipeline from contracts awarded but not yet activated. The existing CfD contracts have clauses that award compensation when Qualifying Changes in the Law (QCiL) occur. It will therefore be difficult to do anything to change existing CfDs without breaking contract law. It would probably be too much of a scorched earth approach to strike down these contracts.

However, for projects that are in progress, Opposition Parties could lay a motion before Parliament stating that these contracts will not be honoured if they get into power. Those who cease spending at once could be offered compensation either through direct monetary compensation or “payment in kind” by being offered the ability to participate in building a more sensible generation system. Those who do not heed the warning will have their contracts cancelled with no compensation.

Feed-in-Tariffs cost about £1.9bn per year. The cost of these could be mitigated by stopping any further inflation indexing and ceasing any further payment once the subsidies received exceed the capital cost of the installation. Again, the scorched earth approach would be to end the scheme altogether.

Renewable Energy Guarantees of Origin (REGOs) should also be scrapped.

Cut Curtailment Costs

We pay about £2.5bn in grid balancing costs and a big chunk of this is to pay windfarms to not produce electricity, called curtailment. For example Seagreen, often gets paid to switch off at times when there is too much wind power. However, Seagreen has not activated its CfD so benefits from market prices when it does generate and gets paid not to generate too. The rules should be changed to stop windfarms like this being paid to not generate electricity, especially when they have not activated their CfD.

The most dramatic solution would be to stop curtailment charges altogether. Other ways to cut curtailment costs such as paying only what the market rate would have been if they had been allowed to produce should be explored too.

Reduce Transmission Costs

Ofgem has recently given the green light for the first £8.9bn of extra spending on the electricity grid out of an expected total of £80bn by 2030. They expect this to add £74 to bills. This is a direct cost of connecting remote windfarms to the grid. If we end subsidy support for renewables, this spending would not be needed.

Investors in this scheme should be put on notice that a new Government led by current Opposition parties will not countenance transmission charges going up to pay for these extra transmission lines. There ought to be political risk in investing in white elephant projects that benefit producers at the expense of consumers and investors should expect to take a haircut.

Cut Hydrocarbon Production Taxes

Oil and Gas companies face 78% marginal tax rates. The Energy Profits Levy (aka Windfall Tax) should be abolished and the ban on new North Sea licenses should be lifted. We need to encourage as much domestic production as possible, either to use ourselves or to earn export revenues. We should of course also lift the ban on fracking.

Establish Red Team

Opposition Parties should cooperate to create a Red Team with an overriding objective to crush the cost of energy in the UK. This should include proper engineers, numerate policymakers and of course lawyers to find loopholes in the current legislation governing renewables subsidies. The Red Team should flesh out the ideas above, add new ones, drop the bad ones and build a coherent programme for the first 100 days of a new Government. Then publicise the plan and find a way of laying it before Parliament.

Conclusions

We face an existential crisis from scarce energy and high prices. The Net Zero project should be abandoned and be replaced by a project with the sole aim of delivering cheap and abundant energy, delivered with the same zeal as Net Zero. The scale of the opportunities arising from cheap energy are too large to ignore.

Opposition parties should demonstrate to Government and would-be subsidy harvesters that the Net Zero era is ending. The Green Blob should be left in no doubt that the trolley bus has been diverted and it is coming for them. Time to get out of the way.

This Substack now has well over 4,300 subscribers and is growing fast. If you enjoyed this article, please share it with your family, friends and colleagues and sign up to receive more content. I would be grateful if more people would sign up for a paid subscription, so for a limited time I am offering a discount off annual subscriptions.

This article (What if we Ditched Net Zero?) was created and published by David Turver and is republished here under “Fair Use”

See Related Article Below

The dark future for renewables

ANDREW MONTFORD

Is the penny starting to drop in Downing Street? Angela Rayner’s remarks about the possibility of social unrest over the summer suggest the Cabinet now understands all is not well. And she’s right to point out that economic insecurity and de-industrialisation are important contributory factors, alongside more prominent issues such as immigration.

But I am not sure that Labour has even begun to grasp the scale of the problem it faces. Getting the UK back to growth would be hard enough if we had US power prices. At the sky-high levels that have become the norm in the UK, the task looks almost impossible.

Industry is already starting to collapse under this burden. Jobs are being shed across the country. Meanwhile, energy suppliers are predicting that prices will continue to rise into 2026 and, with Ed Miliband signalling that he intends to stuff windfarm operators’ mouths with gold – your gold – in order to drive forward his Net Zero obsession, there is little or no hope of respite after that.

Worse, we may soon face periods with no electricity at all. The grid is being destabilised by all the wind and solar capacity, and much of our grid infrastructure – the fleet of gas-fired power stations that keep the lights on when the wind isn’t blowing, and the transformers that help get power to where it is needed – has been neglected in favour of spending on Net Zero. It is now hard to see how we will avoid brownouts – electricity rationing in other words – as well as Spanish-style blackouts in a few years’ time.

The situation is dire and getting worse. The only recent good news has been Richard Tice’s letter to windfarm developers, warning them off involvement in the Government’s next subsidy auction. Rumour has it his missive hit its target, and that developers are profoundly worried. If they do stay at home and shun the auction, then it’s a big step towards halting the economic rot.

But the painful reality is that the renewables industry is not nearly worried enough. On its current trajectory, the economy is going to tank. The arrival of the IMF looks now to be only a matter of time. It will be an emergency, and when the storm breaks, the country, and in particular windfarm developers and investors, will be in a completely new political landscape.

For the country, a return to growth will become an existential necessity rather than the vague aspiration it has been under most recent Prime Ministers. At that point, the Government will have to face the two simple facts. Firstly, there will be no growth without cheap electricity. Secondly, there can be no cheap electricity from a grid dominated by wind and solar power. This is a matter of thermodynamics rather than – as politicians and civil servants think – a communications problem. The Westminster Village Idiots are now starting to realise that you can fool the population for some of the time – by lying about the cost of renewables, for example, as ministers and officials have done for 10 years – but not all of the time. As the legendary physicist Richard Feynman noted, ‘for a successful technology, reality must take precedence over public relations, for Nature cannot be fooled’. And nature is currently causing the facts to show up very clearly in your electricity bill, now 50% higher in real terms than it was ten years ago. Ofgem data shows that blame for almost all of the increase can be laid at the feet of Net Zero policies.

Renewables operators, and their investors and lenders, meanwhile, will suddenly find that they have become the bad guys. Across the country, personal finances will have taken a big hit; lives and livelihoods will have been ruined. In those circumstances, the public is likely to take a deeply jaundiced view of the billions handed to wind and solar farms in subsidies each year. To their owners, the monthly payment may therefore soon look less like a financial asset and more like a death warrant.

An unpopular industry, raking in subsidies from hard-pressed consumers at a time when the country desperately needs to get back to growth is not an industry that can survive for long. Wind and solar farms imagine their positions are protected by their contracts with the Government, but they are likely to find themselves corrected. Parliament remains sovereign, and can legislate away any contract it wishes. In a recognised emergency, the courts, and perhaps even the rest of the investment community, are likely to accept the overwhelming public interest. In an emergency, desperate measures become necessary, but they also become possible, and even accepted.

*****

Ditching Ed Miliband’s Net Zero Madness Could Save Every Family £1,000 a Year

.

In the Mail, Reform UK’s Richard Tice argues that scrapping Labour’s “Net Stupid Zero” agenda could save families £1,000 a year. Here’s an excerpt:

This week, Ed Miliband opens his latest renewable energy auction, which allows green developers to bid for lucrative taxpayer-funded contracts.

The eco lobby says the auction, officially titled Allocation Round 7 (AR7), will be the centrepiece of Labour’s plan to decarbonise the grid by 2030, and that this seventh round must be the biggest yet to “keep the dream alive”.

But it’s a dream Britain cannot afford. Inflation is rising. Food prices are once again on the up. And families across the country are cutting back – not just on holidays or takeaways, but on essentials. …

And one of the biggest contributory factors to this crisis is an issue that almost no one in Westminster wants to talk about: Net Zero and the spiralling cost of Britain’s green energy agenda.

Expensive energy is the grenade exploding Britain’s economic model. It is not just about switching on the lights and heating homes.

It powers industry, transports goods and underpins every job and price tag. When energy becomes expensive and unreliable, everything else does too. …

For nearly two decades, clueless politicians from Labour, the Conservatives and the Liberal Democrats have clung to a fantasy: that we could eliminate all hydrocarbon use, build a national grid dominated by wind and solar power and suffer no consequences.

The result? At a time of rising demand we are reliant on an unreliable energy supply and lumbered with higher bills. Three-quarters of the rise in electricity bills over the past decade can be attributed to green energy policies and the multi-billion-pound subsidies paid to renewable investors, according to Net Zero Watch. …

Now suppliers are warning that prices will rise again in 2026. Professor Gordon Hughes, a former energy adviser at the World Bank, has warned they could approach 40p per kilowatt hour by 2030 – up from 25p today, which is a catastrophic increase.

That’s why I took action. Last month, I wrote to major wind farm developers, warning them and their investors to stay away from the AR7 auction. I made it clear that if they press ahead, a Reform government will make them regret it.

As Nigel Farage said a few weeks ago about the renegotiation of green subsidy contracts, investors will see “some haircuts”. Naturally, activists, consultants and subsidy-hunters – the ‘Green Blob’ – erupted in outrage.

But, if these wind farms go ahead, it will be an act of grave economic self-harm. By putting a spanner in the works of Miliband’s mad plan, we can stop the 20-year rise in bills. By 2030, my letter alone might be saving households £1,000 a year.

Worth reading in full.

Featured image: Adobe Stock

••••

The Liberty Beacon Project is now expanding at a near exponential rate, and for this we are grateful and excited! But we must also be practical. For 7 years we have not asked for any donations, and have built this project with our own funds as we grew. We are now experiencing ever increasing growing pains due to the large number of websites and projects we represent. So we have just installed donation buttons on our websites and ask that you consider this when you visit them. Nothing is too small. We thank you for all your support and your considerations … (TLB)

••••

Comment Policy: As a privately owned web site, we reserve the right to remove comments that contain spam, advertising, vulgarity, threats of violence, racism, or personal/abusive attacks on other users. This also applies to trolling, the use of more than one alias, or just intentional mischief. Enforcement of this policy is at the discretion of this websites administrators. Repeat offenders may be blocked or permanently banned without prior warning.

••••

Disclaimer: TLB websites contain copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available to our readers under the provisions of “fair use” in an effort to advance a better understanding of political, health, economic and social issues. The material on this site is distributed without profit to those who have expressed a prior interest in receiving it for research and educational purposes. If you wish to use copyrighted material for purposes other than “fair use” you must request permission from the copyright owner.

••••

Disclaimer: The information and opinions shared are for informational purposes only including, but not limited to, text, graphics, images and other material are not intended as medical advice or instruction. Nothing mentioned is intended to be a substitute for professional medical advice, diagnosis or treatment.

Disclaimer: The views and opinions expressed in this article are those of the author and do not necessarily reflect the official policy or position of The Liberty Beacon Project.

Leave a Reply