New Government data for 2H2024 shows the UK has the highest industrial electricity prices in Europe

DAVID TURVER

Introduction

Every six months, the Government publishes comparisons of energy prices across Europe. The latest data for the second half of 2024 was published a few days ago.

The data covers the 27 countries that make up the EU plus the UK. All prices quoted below are in pence per kilowatt hour and include taxes and levies. This article updates the analysis of EU energy data for the first half of 2024. We will have to wait until the Autumn to update the energy prices for 2023 for IEA countries with 2024 data.

The latest results are just as horrifying as the earlier analysis.

EU and UK Industrial Electricity Prices

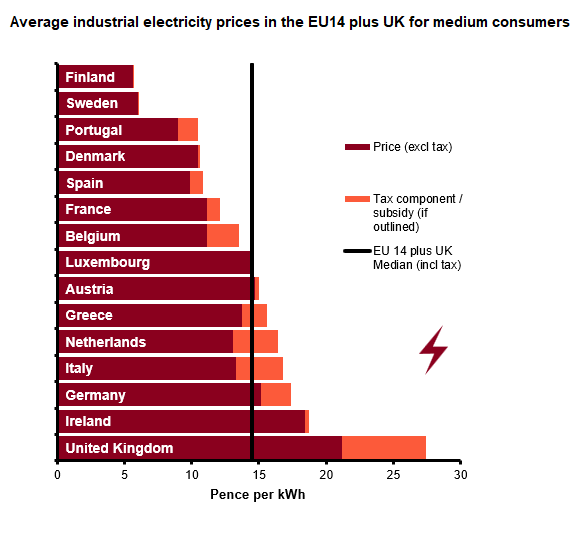

- The Government includes a chart to compare average industrial electricity prices of the EU14 countries (Table 5.4.1) which shows UK prices are almost twice the EU average for medium consumers (see Figure A).

UK industrial electricity prices for medium users are some 89.3% higher than the EU14 median. For large and very large users, the relative position is even worse with UK prices more than 132% and 113% respectively higher than the EU14 median. UK industrial electricity prices are also higher than the rest of the full EU27. Very large users in the UK pay 22.32p/kWh, more than five times more than Finland, with the lowest prices, where large industrial users pay just 4.19p/kWh.

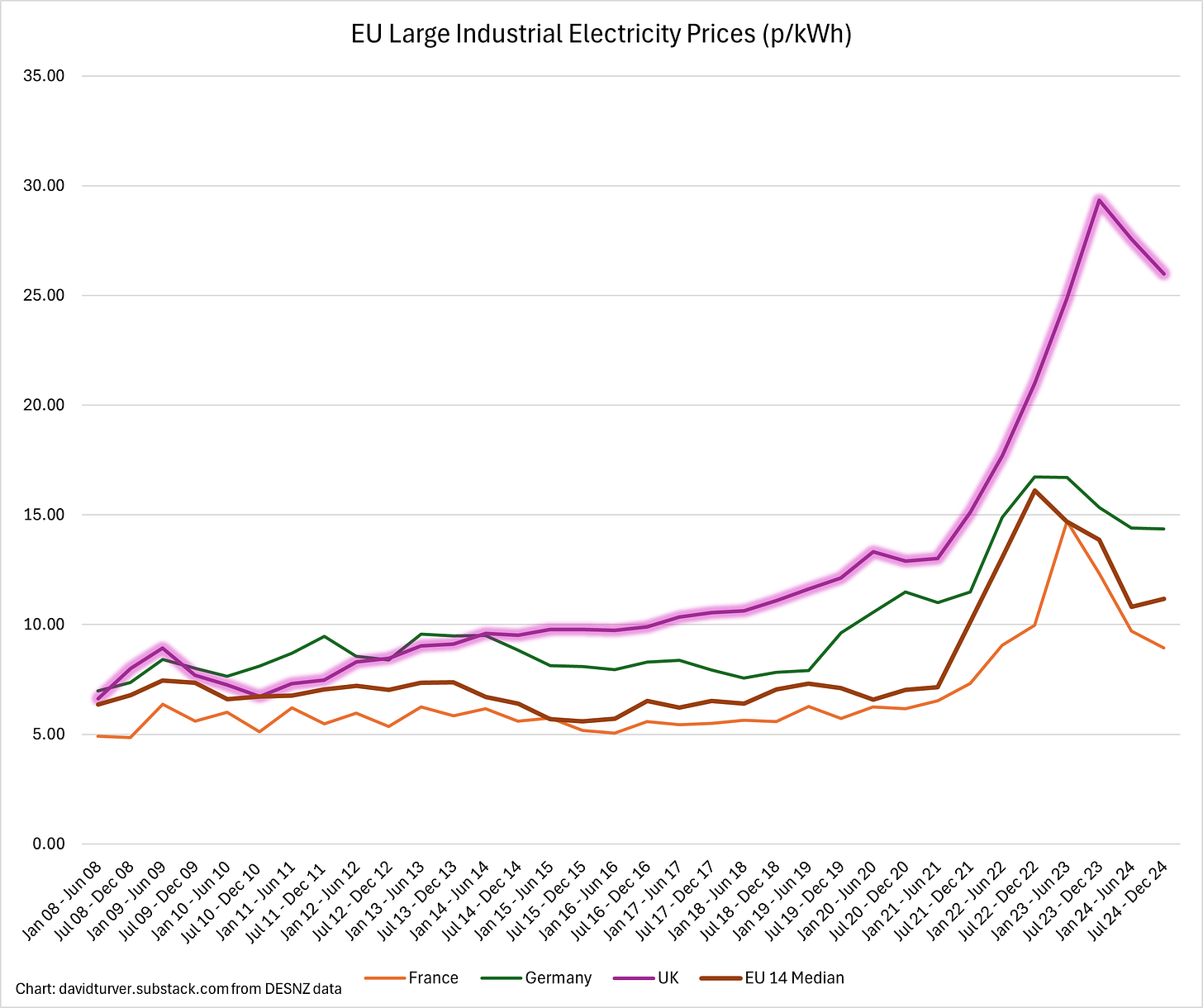

We can see how prices for large users have evolved compared to France, Germany and the EU14 median in Figure B below.

In 2008, UK prices were below those of Germany and only slightly above the EU14 median. By 2020, prices had risen steadily to be well above those of Germany, France and EU14 median. Prices then rose further, partly because of the energy crisis, and have fallen back somewhat but the gap between the EU14 and the UK is still very wide indeed.

We cannot hope to compete in traditional energy intensive industries or industries of the future like making batteries or AI with such extortionate electricity prices. Without drastic action, further deindustrialisation is inevitable.

EU and UK Industrial Gas Prices

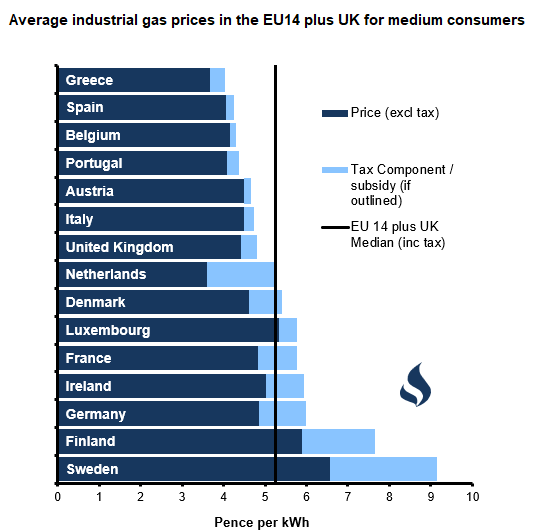

Turning to industrial gas prices (Table 5.8.1) as shown in Figure C, at first glance, the picture looks a little more sanguine.

UK industrial gas prices are below the median of the EU14. This sounds reasonable, until you remember that last year, the Government published data for industrial gas prices across the IEA for 2023 that showed UK prices were some five times higher than the US and Canada. Europe, through its refusal to exploit its own shale gas resources, has priced itself out of international markets. This is a big reason why European deindustrialisation is also inevitable.

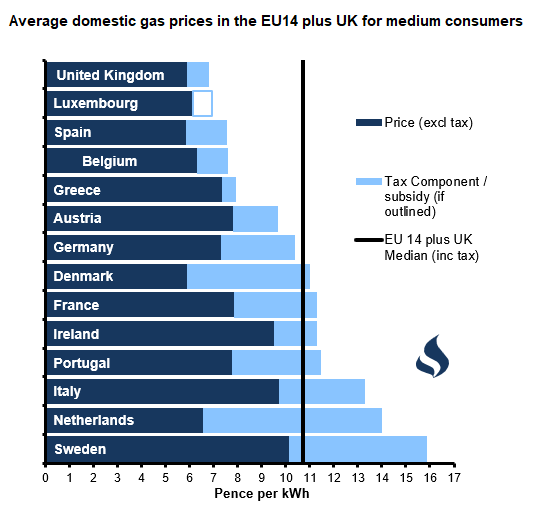

EU and UK Domestic Gas Prices

Domestic gas prices (Table 5.10.1) present an even better picture than industrial gas prices as shown in Figure D.

UK domestic gas prices are pretty much the lowest in the EU14 and well below the EU14 median for the second half of 2024. Luxembourg is a special case where the price excluding taxes and levies is lower than when they are included. However, Bulgaria, Croatia, Estonia, Hungary, Lithuania and Romania all have much lower domestic gas prices than the UK. Hungary has the lowest price at 2.64p/kWh.

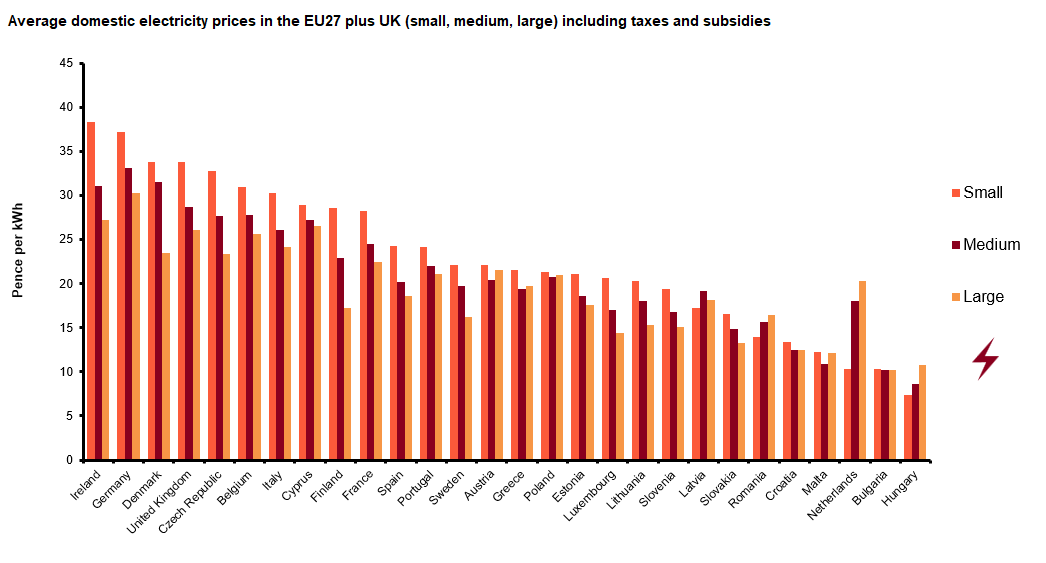

UK and EU Domestic Electricity Prices

Sadly, UK domestic electricity prices (Table 5.6.1) are much less competitive than gas prices, as seen in Figure E.

The UK has improved from the first half of 2024 because we now have the fourth highest domestic electricity prices in the EU14, down from third in the first half. Our prices are below only Ireland, Germany and Denmark, all with large proportions of their power coming from intermittent renewables. UK prices are 25.4% higher than the EU14 median and 43.9% higher than the median for the EU27.

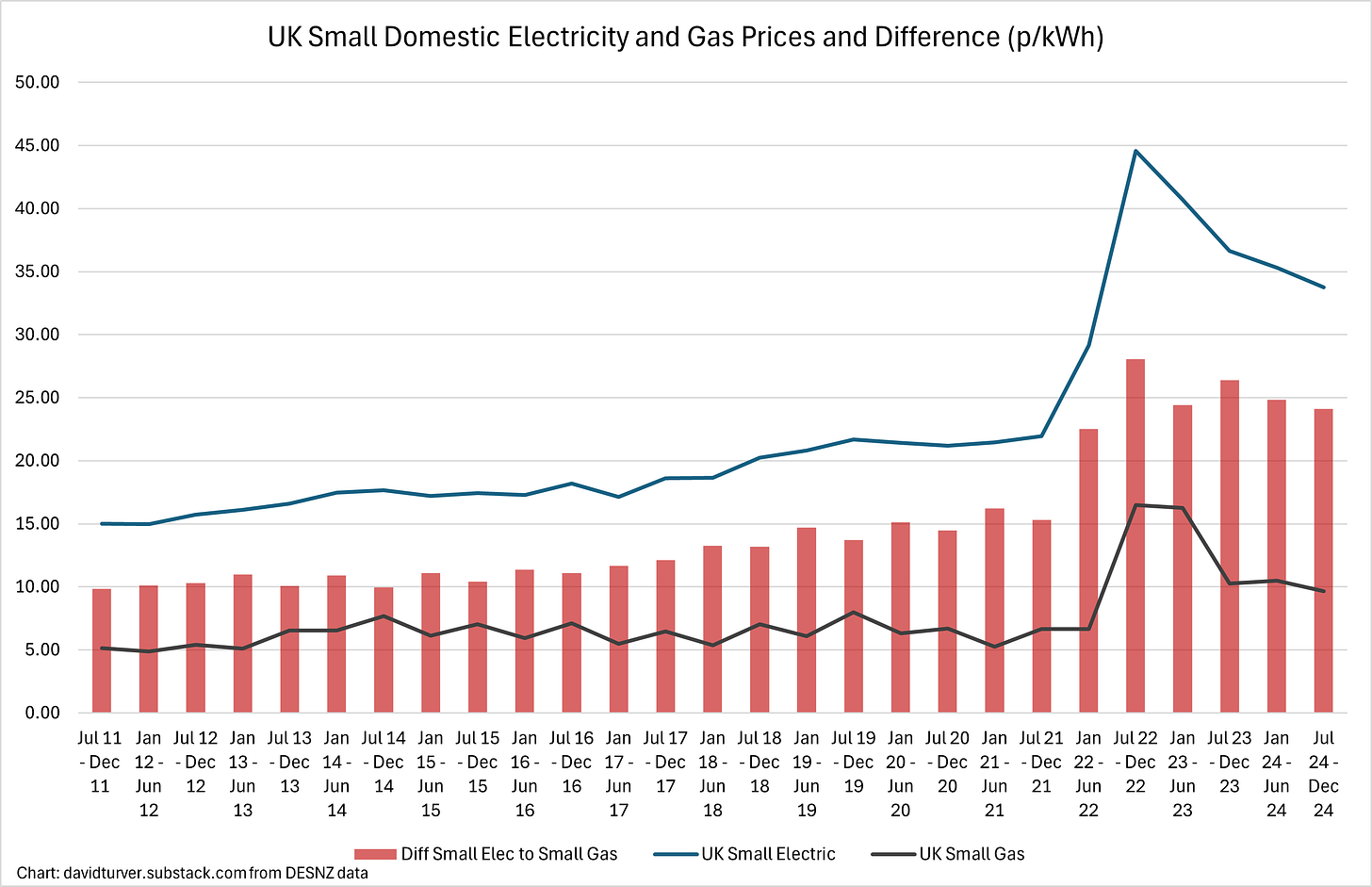

Big Gap Between Gas and Electricity Prices

The data also shows a very large gap between domestic gas and electricity prices, particularly for small users as shown in Figure F.

In 2011, small domestic electricity consumers paid 14.99p/kWh for electricity and 5.16p/kWh for gas, a gap of 9.84p/kWh. In the second half of 2024, these consumers were paying 33.75p/kWh and 9.96p/kWh respectively, making the gap widen to 24.11p/kWh. Small consumers pay 29.4% more for their electricity than large domestic users and 58% more for their gas, reflecting very high standing charges. This shows how high standing charges disproportionately impact the poorest small users.

This large gap between gas and electricity prices perhaps explains why the Climate Change Committee and Ed Miliband are desperate to move the cost of renewables subsidies from electricity to gas.

They want to hide the cost of their ruinous policies in our gas bills, so making gas more expensive so it is easier to sell heat pumps and EVs to the public. Of course, the poorest and most vulnerable will be hit by this most, making more expensive to heat their homes. They never explain how these charges will be levied once we’re all using heat pumps. Classic bait and switch tactics.

Conclusions

When it comes to gas prices, the UK is very competitive compared to the EU average. But this is something of a pyrrhic victory because European gas prices are so much higher than key industrial competitors like the US and Canada.

However, when we turn to electricity prices, the UK is woefully uncompetitive, particularly for industry where our prices are much more than double those in the EU for large users. When we factor in EU prices being very much higher than other international competitors, then we can see the UK position is dire. This level of price differential is an existential threat to the economy.

We can pretend to be “climate leaders” on the world stage by setting a mission for a Net Zero grid by 2030, but this comes at the cost of winning the gold medal in the international industrial electricity price Olympics.

We can also see that it is not the gas price that is driving our electricity prices to such uncompetitive levels, because our industrial gas prices are competitive in Europe. As discussed previously renewables are much more expensive than gas-fired electricity. We pay about £12bn per year in renewables subsidies and over £3bn in the extra costs of grid balancing and backup. There is an extra £112bn of transmission network costs in the pipeline to connect remote, intermittent renewables to the grid that will continue to push up prices.

All this is in direct contradiction to Labour’s number one mission of increasing economic growth. As discussed earlier, Labour’s top two missions of high growth and Net Zero are mutually incompatible; we cannot have top tier growth with such high industrial electricity prices.

Having the highest industrial electricity prices in the EU and by extension the rest of the developed world, ought to be considered a national emergency. The Government’s primary mission should be to cut energy prices because cheap energy is the key to unlocking growth. In addition, the pernicious impact of high fixed charges on our gas and electricity bills is making the poorest suffer most from this madness in energy markets. Surely, the “progressive” thing to do would be to cut energy prices, as discussed here.

It is good to see rising disquiet in the press about high energy prices, but there is precious little sign that Labour is paying attention. We can but hope that reality dawns on the Government before the economy collapses under the weight of Net Zero.

Recently we achieved two significant milestones. First, we have published for more than 100 weeks in a row, putting us in the top 1% of publishers. Second, I am very grateful to have attracted over 100 paying customers which now makes Eigen Values a Bestseller on Substack. Thank you for your continued support.

This Substack now has over 4,100 subscribers and is growing fast. If you enjoyed this article, please share it with your family, friends and colleagues and sign up to receive more content.

This article (UK Industrial Electricity Prices Still Highest in Europe) was created and published by David Turver and is republished here under “Fair Use”

See Related Article Below

Flawed system leaves millions paying too much for energy bills, says GABRIEL MCKEOWN

GABRIEL MCKEOWN

Gabriel McKeown is head of macroeconomics at Sad Rabbit.

Inflationary pressures have eased considerably from the peaks reached in late 2022.

Yet households across the country continue to grapple with the lingering effects of a prolonged cost-of-living crisis.

Prices for essential goods and services remain significantly higher than historical norms.

Despite reassurances of an economic recovery on the horizon, many consumers are yet to experience meaningful relief.

One of the most notable contributors to these persistent high costs has been the energy sector.

Even with a sizeable drop in wholesale natural gas prices, bills are remaining stubbornly high for consumers.

Even with a cut to the price cap on the horizon, this represents a delayed response to wholesale prices that fell many months ago.

Consumers have been stuck paying elevated rates, and are long overdue a reduction in the cap.

This situation has intensified calls for policy intervention and market reform.

The paradox of energy pricing

The energy market has had a tumultuous few years. Wholesale gas prices plummeted in the spring of 2020, as Covid-19 lockdowns strangled economic activity.

They then surged by late 2021 due to supply bottlenecks following the global re-opening.

This was further compounded by the Russia-Ukraine conflict, which saw UK and European wholesale gas prices spike to record levels. They briefly rose by ten times from the pandemic lows.

Households were largely sheltered from this immediate energy cost jump, thanks to the retail price cap administered by Ofgem, combined with massive government subsidies when that proved insufficient.

The price cap had already risen 54 per cent in April 2022 but was set to soar a further 80 per cent in October 2022. This resulted in emergency intervention in the form of the Energy Price Guarantee (EPG).

Turbulence: The energy market has had a tumultuous few years

Turbulence: The energy market has had a tumultuous few years

Yet the market is far from static. Despite British families seeing energy costs leap to record highs in 2022, by early 2023, a combination of mild weather, ample gas storage in Europe and reductions in demand brought wholesale prices down sharply.

Unfortunately for consumers, the regulated price cap was slow to follow. It wasn’t until mid-2023 that the cap fell below the government’s EPG level, providing some relief.

By Autumn 2023, the cap stood at around £1,568 for a typical household. This still far exceeded the pre-Covid average of below £1,000.

Furthermore, as of early 2025, the average bill under the cap remains 52 per cent higher than in the winter of 2021 and 2022. This illustrates how far energy costs have diverged from the baseline.

The supplier-consumer divide

With Europe enjoying relatively mild weather and benefiting from increased non-Russian supplies, wholesale gas prices were on a clear downward trend at the beginning of this year.

Yet households were told to expect higher bills once again.

Gas prices had dropped to levels not seen since mid-2021. But to justify this latest rise, Ofgem pointed to a brief wholesale price spike that occurred during the cap’s assessment window in February.

However, by the time the cap increase was announced, those market prices had already fallen back to previous levels.

Yet this earlier spike had now been baked into consumer rates for months to come.

Consequently, Ofgem declared that the energy price cap would rise by 6.4 per cent from April.

This has resulted in households paying an additional £111 annually, and marked the third consecutive quarterly increase in the cap.

This highlights a crucial flaw in the UK pricing system. The price cap is not a real-time reflection of market prices but is instead based on future wholesale prices averaged over the prior period.

The aim is for this to smooth volatility in prices. But in this case, suppliers had bought much of the energy for spring 2025 during late 2024 and early 2025 when prices were higher.

In effect, household prices right now reflect the wholesale market of several months ago. This leads to a gap between the latest energy prices and the bills facing consumers.

The energy regulator confirmed that energy bills will fall by £129 in July.

Energy supplier profits

The energy supplier sector has undergone a significant transformation during this period.

It has shifted from a group of loss-making firms on the brink of collapse in 2021 to an arguably healthier state overall, thanks to consolidation and improved profitability.

The UK has ended up with an energy system where the risk of high wholesale prices was largely shifted to taxpayers.

This was achieved through significant government subsidies and ongoing elevated bills.

However, the rewards of higher prices were reaped primarily by the producers and some well-hedged suppliers.

This comes at a time when many households are still grappling with energy costs significantly elevated from pre-crisis levels, resulting in widespread energy debt.

More than three million households have now fallen behind on payments, exacerbating the living standard collapse experienced over the past few years.

The promise of market reform

Combatting these issues was a core policy point during much of the election campaigning last year.

Yet Labour, which came to power partly on promises to address the energy crisis, faces growing criticism as high bills persist.

The government has started to implement policies aimed at reforming the energy sector, such as establishing GB Energy, a publicly owned entity designed to increase the UK’s clean energy capacity.

But these measures offer limited immediate relief to households.

To truly address the foundational issues facing the sector, it will require far broader policies.

There needs to be a reassessment of how consumers fit into the energy sector’s business model.

Energy suppliers naturally defend their hedging practices as essential for market stability.

Purchasing energy through forward contracts is necessary to manage risk in rapidly fluctuating markets.

They can claim that this protects both themselves and consumers from unpredictable price swings.

However, the past few years have shown that while suppliers are insulated from short-term market volatility, consumers feel the direct and prolonged impact of past wholesale price spikes.

Even when consumers seek relief from escalating prices via fixed-rate energy deals, which are increasingly available at prices below the current capped rates, these options do not address the structural problems embedded within the UK’s energy pricing model.

An uncertain future

As long as wholesale and retail prices remain disconnected, structural inequities will persist.

Addressing these systemic flaws will require immediate reform of pricing mechanisms. It will also need sustained long-term investments in British energy independence.

A particularly important area of potential reform is a reevaluation of geographical differences in standing charges.

These have drawn criticism for exacerbating regional household inequality.

There is also mounting support for introducing targeted social tariffs. These would provide direct financial relief to vulnerable groups that are most impacted by energy market volatility.

Aligning Britain more closely with several European peers. Along with offering a viable short-term solution, while longer-term structural adjustments are implemented.

Without such actions, British consumers will continue facing elevated bills despite falling wholesale energy prices. This will leave them to bear the brunt of system-wide inefficiencies that have yet to be meaningfully addressed.

This article (Flawed system leaves millions paying too much for energy bills, says GABRIEL MCKEOWN) was created and published by This is MONEY and is republished here under “Fair Use” with attribution to the author GABRIEL MCKEOWN

••••

The Liberty Beacon Project is now expanding at a near exponential rate, and for this we are grateful and excited! But we must also be practical. For 7 years we have not asked for any donations, and have built this project with our own funds as we grew. We are now experiencing ever increasing growing pains due to the large number of websites and projects we represent. So we have just installed donation buttons on our websites and ask that you consider this when you visit them. Nothing is too small. We thank you for all your support and your considerations … (TLB)

••••

Comment Policy: As a privately owned web site, we reserve the right to remove comments that contain spam, advertising, vulgarity, threats of violence, racism, or personal/abusive attacks on other users. This also applies to trolling, the use of more than one alias, or just intentional mischief. Enforcement of this policy is at the discretion of this websites administrators. Repeat offenders may be blocked or permanently banned without prior warning.

••••

Disclaimer: TLB websites contain copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available to our readers under the provisions of “fair use” in an effort to advance a better understanding of political, health, economic and social issues. The material on this site is distributed without profit to those who have expressed a prior interest in receiving it for research and educational purposes. If you wish to use copyrighted material for purposes other than “fair use” you must request permission from the copyright owner.

••••

Disclaimer: The information and opinions shared are for informational purposes only including, but not limited to, text, graphics, images and other material are not intended as medical advice or instruction. Nothing mentioned is intended to be a substitute for professional medical advice, diagnosis or treatment.

Disclaimer: The views and opinions expressed in this article are those of the author and do not necessarily reflect the official policy or position of The Liberty Beacon Project.

Leave a Reply