IAIN DAVIS

In my previous article I suggested that the UK’s proposed “mandatory” digital ID, called the BritCard, was a bait and switch psyop. I posited that the arguments presented by Keir Starmer’s purported Labour government, to supposedly justify the BritCard rollout, coupled with the timing of the announcement, the apparent inability to understand public opinion, and the lack of necessity for the BritCard, indicated that there was something amiss with the so-called government’s BritCard proposition.

It seems to me that the purpose of the BritCard gambit is to frame the Overton Window for the public debate about digital ID in the UK. People can accept or reject it, imagining the BritCard represents the totality of digital ID infrastructure. If the population rejects the BritCard they may well do so under the misapprehension they have defeated digital ID in the UK.

Subsequent developments have strengthened my view.

Digital ID is a global policy initiative that governments around the world, including the British government, are following, not leading. It is the United Nation’s (UN’s) Sustainable Development Goal (SDG) 16.9 which promises to “by 2030, provide legal identity for all, including birth registration.”

Even before the ink was officially dry on SDG 16.9, the ID2020 group, tasked with meeting the “identity” sustainability target, outlined what achieving SDG 16.9 would mean in practical terms:

[C]reate technology-driven public-private partnerships to achieve the United Nations 2030 Sustainable Development Goal of providing legal identity for everyone on the planet.

ID2020 further clarified the global policy objective:

By 2030, enabling access to digital identity for every person on the planet.

The objective of SDG 16.9 is to force not just approved “legal identity” but digital ID on every human being on earth. To this end, the UN has already created a nascent global digital ID database called ID4D. The ID4D Global Dataset aim to capture the data of “all people aged 0 and above.”

Run by the World Bank Group—a UN specialised agency—ID4D informs us:

The World Bank Group’s Identification for Development (ID4D) Initiative harnesses global and cross-sectoral knowledge, World Bank financing instruments, and partnerships to help countries realize the transformational potential of identification (ID) systems. [. . .] The aim is to enable all people to exercise their rights and access better services and economic opportunities in line with the Sustainable Development Goals.

At first reading this might not seem so bad. Therefore, it is very important to be clear about what it implies.

Your access to all “services” and all “economic opportunities” will be dependent upon you possessing the requisite digital ID; the entire economy—all services and all economic activity—must comply with “Sustainable Development Goals.” This means everything will be ordered by the global governance system, not by national governments. Finally, “partnership” means public-private partnerships.

If you think I may have put an unwarranted pejorative spin on the ID4D statement consider that the UN’s SDG 16.9 makes no mention of “digital ID,” only “legal identity.” Yet, ID2020, the UN’s own body responsible for implementing SDG 16.9, had already committed to the global rollout of digital ID before the UN officially announced its global governance ID agenda.

The UN “regime” is not an honourable or trustworthy organisation and we must interpret its goals and public statements carefully to understand the actual implications. With far less fanfare, and allowing for a suitable cooling-off period, in 2023, the UN finally came out of the closet and simply said it wanted “Digital IDs linked with bank or mobile money accounts.”

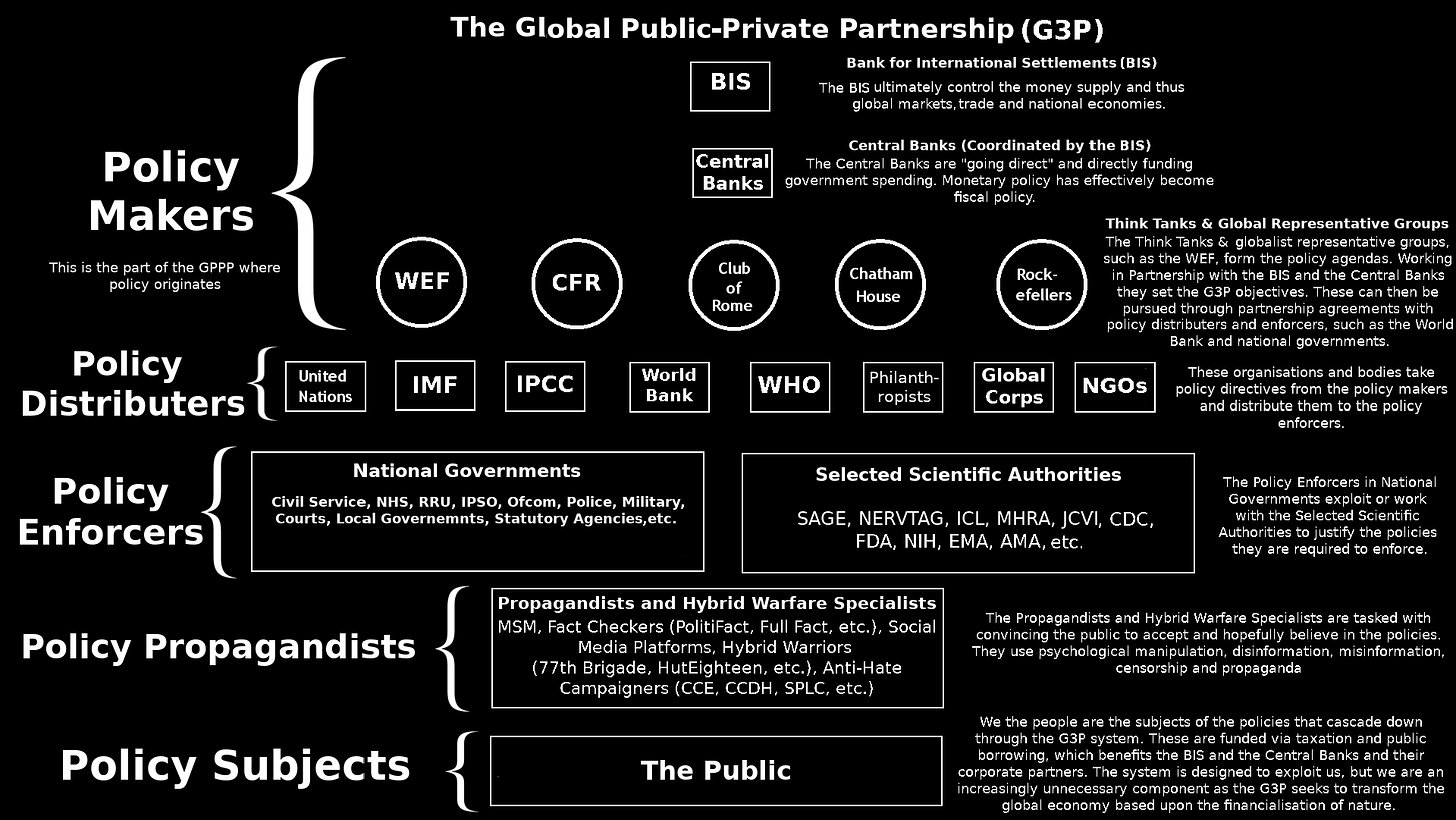

The global public-private partnership (G3P)—essentially a nexus between central banks, international policy think tanks, the UN, multinational corporations, NGO’s and other “philanthropic” organisations, and governments—is propelling the global rollout of digital ID. ID4D “partners” include the Gates Foundation, the Omidyar Network, and the World Economic Forum (WEF) that represents “leading global companies” seeking to “shape the future.”

Leading WEF Partners include US data and AI giant Palantir. The WEF runs a number of global research “Centres” and Palantir is a key partner in five of them including the Centres for Cybersecurity and for the Fourth Industrial Revolution.

The UN began as a public-private partnership. In 1998, having undergone a “quiet revolution,” it formally shifted away from being an intergovernmental organisation to become a public-private global governance regime that promotes “business-friendly legislation.”

Like the UN ID4D project, the central bank of central banks—the Bank for International Settlements (BIS)—envisages a “unified ledger” that will oversee every transaction on earth. The power to control all commerce extends to all business to business (B2B) transactions. The Bank of England and the Federal Reserve Bank of New York are among the central banks working on the associated BIS-led Project Agora :

The project aims to test the desirability, feasibility and viability of a multi-currency unified ledger for wholesale cross-border payments. [. . .] The project is a public-private collaboration that seeks to use new technology to improve the correspondent banking model.

To appreciate what this new global monetary system is designed to achieve we need to understand “tokenization.” McKinsey explains:

Tokenization is the process of creating a digital representation of a real thing. [. . .] [T]okenization is a digitization process to make assets more accessible, [. . .] tokenization is used for cybersecurity and to obfuscate the identity of the payment itself, essentially to prevent fraud. [. . .] [T]okenized financial assets are moving from pilot to at-scale development. McKinsey analysis indicates that tokenized market capitalization could reach around $2 trillion by 2030 (excluding cryptocurrencies like Bitcoin and stablecoins like Tether). [. . .] Larry Fink, the chairman and CEO of BlackRock, said in January 2024: “We believe the next step going forward will be the tokenization of financial assets, and that means every stock, every bond … will be on one general ledger.”

The BIS has been planning to seize the opportunity presented by tokenisation operating on a “one general” or a unified ledger for some time:

A new type of financial market infrastructure – a unified ledger – could capture the full benefits of tokenisation by combining central bank money, tokenised deposits and tokenised assets on a programmable platform

Digital ID is inextricably linked to “onboarding”—accessing and using—programmable digital currencies (PDCs) such as stablecoins and central bank digital currency (CBDC). The push to get us to adopt programmable digital currency is also a public-private global project. The BIS spells out why digital ID is a prerequisite for using programmable digital currency:

Identification at some level is [. . .] central in the design of CBDCs. This calls for a CBDC that is account-based and ultimately tied to a digital identity. [. . .] A digital identity scheme, which could combine information from a variety of sources [. . .] will thus play an important role in such an account based design. By drawing on information from national registries and from other public and private sources, such as education certificates, tax and benefits records, property registries etc, a digital ID serves to establish individual identities online. [. . .] [S]ystems in which the private and official sector develop a common governance framework and strive for interoperability between their services, [. . .] represent the furthest-reaching model. These allow administrative databases to be linked up, further enhancing the functionality and usefulness of digital ID.

The BIS is quite clear about the interoperable model that will “allow administrative databases to be linked up.” In such a model your biometric—biological identifier—digital ID (e-ID) will be constructed by your use of the “interoperable” system framework.

Your e-ID will provide both public and private organisations access to your data. For example, as long as they have the required access permission, approved private finance “partners” can check your identity attributes, such as your qualifications, tax records, history of any welfare payments you may have received, and assess the value of any of your other e-ID attributes, such as property or other assets you might own. This can help them decide if they will offer you credit, how much interest to charge you, whether to offer you insurance or not, and at what price, etc.

In addition, every time you make a transaction with your PDC—by virtue of it being directly connected to your e-ID—public and private parties with sufficient access permissions to the application programmable interface (API) layer will be able to use your e-ID attributes to make decisions about processing payments, in real time, such as allowing or disallowing your transactions.

The BIS illuminates:

APIs ensure the secure exchange of data and instructions between parties in digital interactions. [. . .] Crucially, APIs can be set up to transmit only data relevant to a specific transaction. [. . .] An example is “open banking”, which allows third-party financial service providers to access transaction and other financial data from traditional financial institutions through APIs. For example, a fintech [Financial Technology company] could use banks’ transaction data to assess credit risk and offer a loan at lower, more transparent rates than those offered by traditional financial institutions. [. . .] Payment APIs may offer software that allows organisations to create interoperable digital payment services to connect customers, merchants, banks and other financial providers. [. . .] [T]he recipient’s bank (or financial services provider) needs to agree to the transaction on the customer’s behalf. During this [. . .] step, it is verified that the transaction satisfies rules and regulations. [. . .] Once there is agreement, in [the next] step funds are transferred and made available to the recipient immediately.

Such a system could, and it may offer all kinds of cost savings and other benefits. But behavioural and, ultimately, social and economic control, is what the likes of the UN, the BIS, and their partners desire. Speaking in October 2020, BIS General Manager Agustín Carstens explained why PDCs are nothing like any form of money we are currently familiar with:

The key difference with the CBDC is the central bank will have absolute control on the rules and regulations that will determine the use of that expression of central bank liability, and also we will have the technology to enforce that.

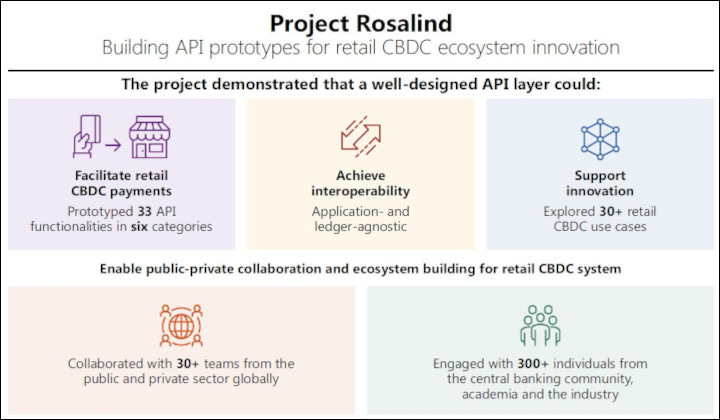

Again, “interoperability,” enabling universally recognised e-ID to be assigned to all transactions, using internationally accepted PDCs, allows API’s to precisely control any transaction, anywhere, between any parties, by using digital agreements, often called “smart contracts.” The BIS collaborated on Operation Rosalind with the Bank of England to develop the smart contract functionality we will all be subjected to in the UK once we accept e-ID and, as planned, PDCs.

Distributed Ledger Technology (DLT)—most likely blockchain—will record, oversee and control all digital transactions on a “unified ledger.” The Operation Rosalind social engineers concluded:

Ledger API layer: This layer translated smart contracts into API calls and transformed API requests into a format understood by, and actionable for, the central bank ledger. [. . .] This could support many use cases, such as third-party payment initiation, external smart contract applications and budgeting applications.

Smart contracts on the API layer could be used to automatically initiate “third party payment” such as taking taxes, fines, private penalty charges, utility payments, and so on, directly from your “digital wallet.” Using smart contracts, your e-ID assigned PDC can be programmed, in real time, to control what you buy, from whom, where and when.

Bo Li, the former Deputy Governor of the People’s Bank of China, and the current Deputy Managing Director of the International Monetary Fund (IMF), speaking at the Central Bank Digital Currencies for Financial Inclusion: Risks and Rewards symposium, explained the power that programmable digital currency provides to those with the approved ledger permissions:

CBDC can allow government agencies and private sector players to program [CBDC] to create smart-contracts, to allow targeted policy functions. For example[,] welfare payments [. . .], consumption coupons, [. . .] food stamps. By programming, CBDC money can be precisely targeted [to] what kind of [things] people can own, and what kind of use [for which] this money can be utilised. For example, [. . .] for food.

Whatever falsehoods the government or the media might tell you about digital ID, the fact is digital ID is a global governance policy initiative and the objective is to control our behavior and our lives. Digital ID (e-ID) is the keystone for a global system of oppression and once we have accepted e-ID the rollout of a global network of programmable digital currencies (PDCs) will immediately follow.

Whether we accept BritCard or not, the UK government has already adopted what the BIS called “the furthest reaching model” of e-ID. The system is managed by the UK government’s Office for Digital Identity Attributes. The “Office” has registered the current slew of private companies that have won bids to provide “digital ID and attribute services” to all of us in the UK. Notable e-ID and attribute service providers include Deloitte (Go Verify) and Mastercard.

In order to become a “trustworthy digital verification service (DVS),” global corporations like Deloitte and Mastercard must adhere to the UK Digital Identity and Attributes Trust Framework. The framework sets the “technical and operating standards for use across the UK’s economy [that] will help to enable international and domestic interoperability.” International interoperability will ensure all the data harvested from the UK population is available to the architects of global governance. Possibly via the ID4D or the BIS unified ledger, for example.

In order to ensure both domestic and international interoperability between all e-ID products and services, the DVS-provider must use the approved “data schema.” Section 14 of the framework provides all the technical information-exchange standards that will enable interoperability.

The interoperability standards allow all the data harvested from you to be stored and transmitted “in a machine-readable format” that is “interoperable with other certified services and relying parties” both “in the UK and internationally.” This means, for instance, that data seized from your use of your digital biometric driving licence, or passport, can be connected to the separate “trustworthy” DVS provided by, for example, the issuer of your bank card.

This interoperable system means that a single, government issued BritCard is completely unnecessary and achieves nothing whatsoever. The e-ID framework that the government has been developing for years, and already has in place, does not need and does not benefit from BritCard.

Yet, when more than 2.8 million people apparently signed a government petition opposing Britcard, in response, the government said:

We will introduce a digital ID within this Parliament. [. . .] [T]he new digital ID will build on GOV.UK One Login and the GOV.UK Wallet to drive the transformation of public services. Over time, this system will allow people to access government services – such as benefits or tax records – without needing to remember multiple logins or provide physical documents.

Beyond the demonstrable reality that the government doesn’t care what we think, this statement is gibberish. The GOV.UK One Login system was designed around the interoperable UK Digital Identity and Attributes Trust Framework. Farcically, One Login’s hopeless cybersecurity failings led the government to revoke the “framework” accreditation for its own service in May of this year. The government then handed multi-million pound contracts to PA Consulting and the US Tech Giant Accenture to try and fix all the One Login problems and hopefully regain its own interoperable framework accreditation.

BritCard is not framework compliant and is not listed as a DVS-provider. The BritCard concept has not been put out for either market or public consultation. BritCard does not exist in any meaningful sense and is nothing but a PR stunt. The only question is what is the purpose of the stunt. There are some telling clues.

Palantir is a “data-mining juggernaut” that works closely with US intelligence and national security agencies. It is a UK strategic defence partner, and operates the UK NHS Federated Data Platform which “connects vital health information across the NHS.”

Palantir also operates a number of its own strategic partnerships with other global corporations. For example, its partnership with KPMG affords KPMG access to “Palantir Foundry”—Palantir’s AI software platform. The government then awarded KPMG the contract to promote and rollout Palantir’s NHS Federated Data Platform across the country. This is understandable because Palantir Foundry is also the AI software platform digitally transforming the UK government.

Palantir’s partnership with the UK digital verification service (DVS) provider Deloitte enables both companies to “break down institutional barriers, organize fragmented data, and transform information into decisive action.” It’s partnership with Accenture will supposedly deliver “transformational outcomes,” and it partnership with fellow US intelligence cut-out Oracle will “accelerate AI” for businesses and governments. This is why the UK government has given Oracle the contract to do just that.

With its vast array of networked connections into the heart of the British state, it is no surprise that the UK government is heavily reliant on Palantir Gotham to plan missions and run investigations “using disparate data.” This will enable state operatives—or Palantir operatives, depending on how you look at it—to “produce actionable intelligence based on the full ecosystem of available data.” For Palantir, that “available data” in the UK appears to be pretty much all of it.

In the UK, Gotham is fully “interoperable with any legacy system,” quickly makes “connections across massive scale, dispersed datasets,” and enables the sharing of “investigative reports” either “internally” or with “partner agencies,” who ever they may be. If it existed, BritCard would add nothing other than additional hassle.

Once again, interoperability, is the key to hoovering up data from all “dispersed datasets” and Palantir is among the North American, UK, and European global technology firms to have already invested in the interoperable digital attributes framework in the UK. Louis Mosley, Executive Vice President (EVP) of the UK and Europe for Palantir Technologies, told the House of Commons Science, Innovation and Technology Committee—which was deliberating on the UK governments e-ID plans:

Interoperability is our [Palantir’s] bread and butter. As the Chair described, one of the core value-adds of the software is the fact that it can interact with and read and write data from pretty much every system out there. [. . .] [W]e provide an enormous amount of control and governance to the organisations that use our software.

With this mouthwatering and unprecedented control and governance on the near horizon, what on earth possessed the government to seemingly throw the whole thing into jeopardy by trying to stamp digital ID onto a very resistant British population? When it came to office a little over a year ago, Labour categorically rejected digital ID. Then Home Secretary Yvette Cooper said: “It’s not in our manifesto. That’s not not our approach.” What’s changed? Has Starmer’s government lost its collective mind?

Or is there a more plausible explanation?

In a very revealing interview with former BBC political editor John Pienaar for Times Radio, Louis Mosley made a series of claims regarding why Palantir had decided—and very publicly announced—it will not back BritCard. Bizarrely, Mosley said he had “personal concerns about digital ID.” He added that Palantir will “help democratically elected governments implement the policies they have been elected to deliver.” He noted, however, that digital ID was not in Labour’s election manifesto and that the decision to adopt digital should be taken at “the ballot box.” Therefore, he demurred, the BritCard project “isn’t one for” Palantir.

Of course, harvesting every possible scrap of data to enable “control” of the population wasn’t in the Labour Party’s manifesto either, but that hasn’t stopped Palantir from enthusiastically diving into that project. As for Mosley’s personal qualms about such things, if he holds them, he is definitely working for the wrong intelligence-linked “data-mining juggernaut.”

It was Pienaar who perhaps made the most interesting comment of all:

Among the other views, privately expressed by ministers, about the digital ID, a program, which at least one senior politician, who thought this wasn’t going to happen, it was just be too difficult. Do you think it’s gonna happen?

Pienaar is a member of the Establishment. He is privy to the the off-the-record discussions of ministers. His observation is worth thinking about.

Mosely replied:

One of my concerns about it is the technical feasibility of it or, maybe better expressed, the technical necessity of it. No doubt, we have all had the experience of engaging with parts of government where the online experience leaves something to be desired. It needs improvement.

However, we are in a world now where, I think, there are at least a dozen unique identifiers for each of us in government. We have passports, we have driving licenses, we have unique tax codes, we have national insurance numbers. Now, each of these sits in a silo and doesn’t talk to the other, isn’t harmonised. There’s no way for government to easily jump from one to another.

That could be achieved, in the back-end, with relatively little effort and I think that would go a long way to improving that citizen experience. I don’t see the need for an additional form of identification on top of the many that already exist.

Over the last decade or so, ably assisted by mega-corporations like Palantir, Deloitte, and Oracle, successive British governments have been putting the interoperable digital ID infrastructure together. Mosley casually refers to this as the “back-end.”

Our adoption of digital ID is absolutely essential to the state’s, and its private partners’, long-term plans. At some point, we have to be convinced to use it.

Let’s assume Pienaar is right: the government knows we will not accept e-ID. How, then, does it coerce us into adopting it?

It announces a Mickey Mouse, pretend digital ID and deliberately raises the specter of government overreach in our lives. It knows we will react viscerally and anticipates the backlash. In so doing, it focuses the public debate on the introduction of a single, government issued e-ID which it doesn’t need and has put no effort into developing. Waiting for us is the real digital ID system that government and its corporate partners, like Palantir, have actually been engineering.

Along comes the saviour, in this instance embodied by Palantir and Louis Mosley, pointing out to us that we don’t need BritCard. We just need to improve the “back-end” of the governments system so that all our cards and licenses can “talk to the other” in harmony. And that is the essence of genuine digital ID.

It seems highly likely that we will reject BritCard. An ignominious defeat will be heaped on the government and talked about incessantly by the media as it extols how we Brits will never succumb to digital ID.

It’s just that we need to tweak the “back-end” a bit to improve our “citizen experience” as we interact with the online public-private state.

BritCard is a bait and switch psyop. Don’t fall for it.

This article (UK Digital ID: The BritCard Bait and Switch) was created and published by Iain Davis and is republished here under “Fair Use”

••••

The Liberty Beacon Project is now expanding at a near exponential rate, and for this we are grateful and excited! But we must also be practical. For 7 years we have not asked for any donations, and have built this project with our own funds as we grew. We are now experiencing ever increasing growing pains due to the large number of websites and projects we represent. So we have just installed donation buttons on our websites and ask that you consider this when you visit them. Nothing is too small. We thank you for all your support and your considerations … (TLB)

••••

Comment Policy: As a privately owned web site, we reserve the right to remove comments that contain spam, advertising, vulgarity, threats of violence, racism, or personal/abusive attacks on other users. This also applies to trolling, the use of more than one alias, or just intentional mischief. Enforcement of this policy is at the discretion of this websites administrators. Repeat offenders may be blocked or permanently banned without prior warning.

••••

Disclaimer: TLB websites contain copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available to our readers under the provisions of “fair use” in an effort to advance a better understanding of political, health, economic and social issues. The material on this site is distributed without profit to those who have expressed a prior interest in receiving it for research and educational purposes. If you wish to use copyrighted material for purposes other than “fair use” you must request permission from the copyright owner.

••••

Disclaimer: The information and opinions shared are for informational purposes only including, but not limited to, text, graphics, images and other material are not intended as medical advice or instruction. Nothing mentioned is intended to be a substitute for professional medical advice, diagnosis or treatment.

Disclaimer: The views and opinions expressed in this article are those of the author and do not necessarily reflect the official policy or position of The Liberty Beacon Project.

Leave a Reply