Two huge stories out of the UK involving Net Zero and Energy Policies.

STU TURLEY

I almost feel sorry for the UK and its citizens. Ed Miliband’s Net Zero policies are an absolute travesty, which will negatively impact the consumers. And we have two hard-hitting stories today, really highlighting the upcoming fiscal collapse in the UK.

The first story, “UK Heat Wave Cuts Wind Output, Exposing Power Supply Gaps”

In a sweltering twist of irony, the United Kingdom’s push toward a renewable-dominated energy future is facing a harsh reality check. As temperatures soar during an unprecedented August 2025 heat wave, wind power generation has plummeted, leaving the nation scrambling to fill the void with fossil fuels. This vulnerability comes hot on the heels of TotalEnergies’ recent legal victory to shut down key North Sea oil fields, amplifying concerns over the UK’s aggressive Net Zero policies that prioritize emission cuts over energy security. Critics argue this approach is tantamount to bad energy management, dismantling reliable oil and gas infrastructure without viable replacements at the ready.

The Heat Wave’s Toll on Renewables

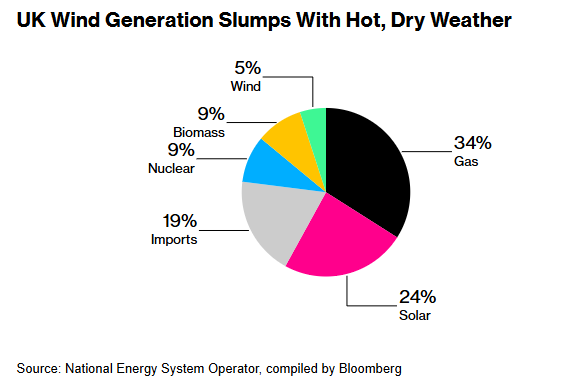

The ongoing heat wave has brought calm, still air across much of the UK, crippling wind turbines that form the backbone of the country’s renewable energy ambitions. On Wednesday, August 13, 2025, wind accounted for a mere 5% of the UK’s electricity generation, a stark drop from typical levels where it often contributes significantly more.

In contrast, natural gas surged to over a third of the power supply, according to data from the National Energy System Operator (NESO). The disparity is even more pronounced in northern Scotland, a hub for offshore wind farms, where gas made up 71% of generation while wind limped along at just 29%.

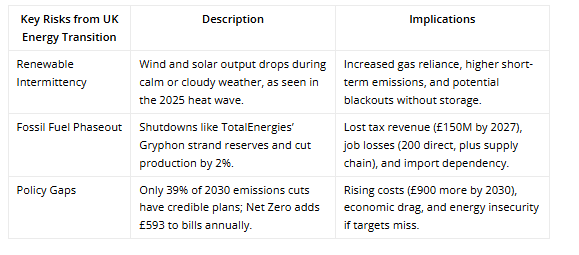

This intermittency issue—where renewables like wind falter during extreme weather—exposes the risks of over-reliance on weather-dependent sources. Heat waves often coincide with high-pressure systems that stifle winds, precisely when air conditioning and cooling demands spike electricity usage. Without sufficient storage solutions or backup capacity, the grid turns to gas-fired plants, driving up costs and emissions in the short term. As the UK aims for a fully low-carbon power sector by 2035 under its Net Zero Growth Plan, such events highlight the fragility of the transition.

Net Zero Policies: Racing Ahead Without a Safety Net

The UK’s commitment to Net Zero by 2050, enshrined in law since 2019, involves phasing out coal, oil, and gas in favor of wind, solar, and nuclear.

Recent policies, such as the ban on new North Sea licenses and requirements for oil companies to assess end-use emissions, accelerate this shift.

The government touts progress: renewables are on track to comprise nearly half of the energy supply by the end of 2025, with wind power helping push fossil gas usage to a five-year low in some periods.

However, the CCC’s 2025 report warns that while the UK can meet its targets, it requires “further policy action,” with only 39% of needed emissions cuts backed by credible plans

Critics point to the dangers of intermittency: solar and wind penetration is growing, but without massive battery storage or flexible backups, gaps like the current wind slump could become commonplace.

The North Sea’s decline, exacerbated by shutdowns like Gryphon’s (covered below), erodes domestic production without immediate alternatives, risking higher imports and vulnerability to global price shocks. Household impacts are already mounting. Net Zero-related costs added £593 to average energy bills in 2023/24, with projections of an additional £900 by 2030 as the renewables shift intensifies.

In a nation still grappling with energy dependency—fossil fuels supply over three-quarters of needs—these policies risk economic instability, job losses, and blackouts if renewables falter.

And the Second story, “TotalEnergies Wins Legal Battle to Shut Down North Sea Oil Fields”

In a significant blow to the UK’s domestic energy production, French energy giant TotalEnergies has secured a High Court victory allowing it to decommission the Gryphon floating production, storage, and offloading (FPSO) vessel in the North Sea. The ruling, handed down on August 12, 2025, paves the way for the shutdown of a key hub that supports five oil and gas fields, effectively stranding millions of barrels of recoverable reserves. Critics argue this decision is a direct consequence of the Labour government’s aggressive Net Zero agenda, spearheaded by Energy Secretary Ed Miliband, which prioritizes emission reductions over energy security and economic stability.

The Gryphon FPSO, anchored approximately 200 miles northeast of Aberdeen, has been operational since 1993 and was responsible for processing output from multiple fields, including its own and those operated by partners like Nobel Upstream. The closure follows TotalEnergies’ announcement earlier this year to cease operations amid rising costs and a punitive fiscal environment in the UK. Nobel Upstream, a minority stakeholder, challenged the move through a judicial review, claiming it would prematurely end production and violate obligations to maximize economic recovery. However, the High Court dismissed the case, citing alignment with the UK’s Net Zero targets as a justifying factor.

This marks a troubling precedent, accelerating the decline of the North Sea basin at a time when global energy demands remain high.

Job Losses: Hundreds at Risk in an Already Struggling Sector

The shutdown of the Gryphon FPSO is projected to result in the direct loss of around 200 jobs, primarily affecting offshore workers, engineers, and support staff in Aberdeen and surrounding areas.

These roles, often high-skilled and well-paid, are part of a broader wave of redundancies sweeping the North Sea oil and gas industry. Since the introduction of the windfall tax in 2022, over 10,000 jobs have been lost across the sector, with major operators like Harbour Energy announcing cuts of 250 positions in May 2025 alone due to the “punitive fiscal regime.”

Unite the Union has highlighted the human cost, noting that the North Sea has shed more than 31,000 jobs from decommissioning activities over the past decade.

The Gryphon closure exacerbates this trend, potentially triggering a domino effect on supply chain jobs in logistics, maintenance, and fabrication. Industry body Offshore Energies UK (OEUK) warns that without policy reversals, thousands more positions could vanish, undermining communities in Scotland that have relied on the sector for generations. As one analyst put it, this is not just about immediate layoffs—it’s about eroding the skilled workforce needed for any future energy transition.

Tax Revenue Hit: £150 Million Down the Drain

The financial implications for the UK Treasury are equally stark. The Gryphon FPSO contributed up to 2% of the UK’s domestic oil and gas production, and its shutdown is estimated to result in a £150 million loss in tax receipts by the end of 2027.

This figure accounts for foregone corporation tax, petroleum revenue tax, and supplementary charges on the approximately 9 million barrels of oil equivalents left unrecovered in the fields.

To put this in perspective, the North Sea oil and gas sector has historically been a major revenue generator, peaking at £10.6 billion in 2008/09 but plummeting to £0.5 billion by 2020/21 due to declining production and policy shifts.

Recent tax changes, including extensions to the energy profits levy, are projected to cause a further $16 billion drop in government revenues over the coming years.

The Gryphon loss alone equates to the equivalent of winter fuel allowance payments for 750,000 pensioners, highlighting the opportunity cost of prioritizing environmental goals over fiscal prudence.

As production falls by 2%, the UK becomes more reliant on imported energy, exposing the economy to volatile global prices and reducing self-sufficiency.

The Soaring Cost of Net Zero: How Policies Have Inflated Energy Bills

The UK’s forced march toward Net Zero by 2050, including the shutdown of assets like Gryphon, has imposed substantial costs on consumers through higher energy bills. Environmental levies and subsidies for renewables, embedded in household and business tariffs, totaled £17.2 billion in 2023/24.

With approximately 29 million households in the UK, this equates to an average additional burden of about £593 per household annually (£17.2 billion ÷ 29 million households).To arrive at this calculation: First, identify the total Net Zero-related costs (£17.2 billion from official figures). Divide by the number of UK households (estimated at 29 million based on recent census data). The result is £593, representing the per-household share of subsidies for schemes like the Renewables Obligation (£89 per year on average) and other green initiatives that add up to £116 or more.

This doesn’t include indirect costs from supply chain disruptions or higher wholesale prices due to intermittent renewables.

Experts forecast even steeper rises: By 2030, the average household bill could surge by £900 annually due to Net Zero mandates, pushing electricity costs up by at least 75% as the grid shifts from reliable fossil fuels to weather-dependent sources.

Since the energy crisis began, bills have already climbed from £603 to £926 per year for electricity alone, with Net Zero policies accounting for 12% of recent increases—far from the promised savings.

Shutting down North Sea operations exacerbates this by increasing import dependency, which drove up costs during the 2022 crisis.

Ed Miliband’s Targets: Fueling a Looming Financial Collapse?

Ed Miliband’s stringent Net Zero targets, including a ban on new North Sea licenses and accelerated decarbonization, are increasingly blamed for steering the UK toward economic peril. His department’s oversight of regulators like the NSTA and Offshore Petroleum Regulator has greenlit decisions like the Gryphon shutdown, using emission reductions as a legal justification despite the economic fallout.

Critics contend this “eco-zealotry” could provoke an economic shock comparable to the 1973 oil crisis, wiping out up to 10% of GDP growth by 2030 through reduced investment, job losses, and higher energy costs.

Miliband’s pre-election pledge of £28 billion annual green spending was scaled back, but his policies still impose billions in subsidies while deterring fossil fuel investments.

The Office for Budget Responsibility (OBR) warns that unchecked climate policies could cost hundreds of millions in lost revenues. Yet, Miliband insists Net Zero will boost growth— a claim disputed by reports showing the sector growing three times faster but at the expense of traditional industries.

With the North Sea in decline and bills soaring, these targets risk a “financial collapse” by eroding competitiveness, inflating public debt through subsidies, and leaving the UK vulnerable to energy shortages. As Reform UK’s Lee Anderson accused in Parliament, Miliband’s approach is “bankrupting Britain” one closure at a time.

In conclusion, TotalEnergies’ legal win underscores the tensions between environmental ambitions and economic realities. While Net Zero advocates celebrate reduced emissions, the costs—in jobs, taxes, and household bills—are mounting, threatening the UK’s energy independence and fiscal health.

Policymakers must reassess this trajectory before it’s too late.

Do you think the UK and even the EU can save themselves?

This article (The UK Net Zero Is In a Downward Fiscal Death Spiral Today) was created and published by Energy News Beat and is republished here under “Fair Use” with attribution to the author Stu Turley

Featured image: iStock

••••

The Liberty Beacon Project is now expanding at a near exponential rate, and for this we are grateful and excited! But we must also be practical. For 7 years we have not asked for any donations, and have built this project with our own funds as we grew. We are now experiencing ever increasing growing pains due to the large number of websites and projects we represent. So we have just installed donation buttons on our websites and ask that you consider this when you visit them. Nothing is too small. We thank you for all your support and your considerations … (TLB)

••••

Comment Policy: As a privately owned web site, we reserve the right to remove comments that contain spam, advertising, vulgarity, threats of violence, racism, or personal/abusive attacks on other users. This also applies to trolling, the use of more than one alias, or just intentional mischief. Enforcement of this policy is at the discretion of this websites administrators. Repeat offenders may be blocked or permanently banned without prior warning.

••••

Disclaimer: TLB websites contain copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available to our readers under the provisions of “fair use” in an effort to advance a better understanding of political, health, economic and social issues. The material on this site is distributed without profit to those who have expressed a prior interest in receiving it for research and educational purposes. If you wish to use copyrighted material for purposes other than “fair use” you must request permission from the copyright owner.

••••

Disclaimer: The information and opinions shared are for informational purposes only including, but not limited to, text, graphics, images and other material are not intended as medical advice or instruction. Nothing mentioned is intended to be a substitute for professional medical advice, diagnosis or treatment.

Disclaimer: The views and opinions expressed in this article are those of the author and do not necessarily reflect the official policy or position of The Liberty Beacon Project.

Leave a Reply