The effects of ending the two child limit on Universal Credit

NEIL O’BRIEN

The Budget after the 2015 election announced that there would be a limit on claims for the child element of Universal Credit (UC) at two children, for births after 6 April 2017.

This means that if you are claiming UC and have one child you get £3,500 a year on top of your other benefits, and if you have two you get £7,000 extra, but if you have further kids you won’t get more money from UC. You will still get extra Child benefit though, as the two-child limit does not apply to Child Benefit.

The most recent DWP statistics show that in April 2025 there were 453,600 Universal Credit households that were not receiving the child element for at least one child because of the policy.

Despite being announced a decade ago, this is a policy still rolling out, because it only applies to births after 2017.

There were 651,300 households on UC with three or more children – so far the households affected by the policy represents 72% of all households with three or more children claiming UC.

This proportion has been increasing over time, as more households with three or more children include a child born on or after 6 April 2017. As this share grows and benefit levels grow, the policy is forecast to save taxpayers £3 – 4 billion a year.

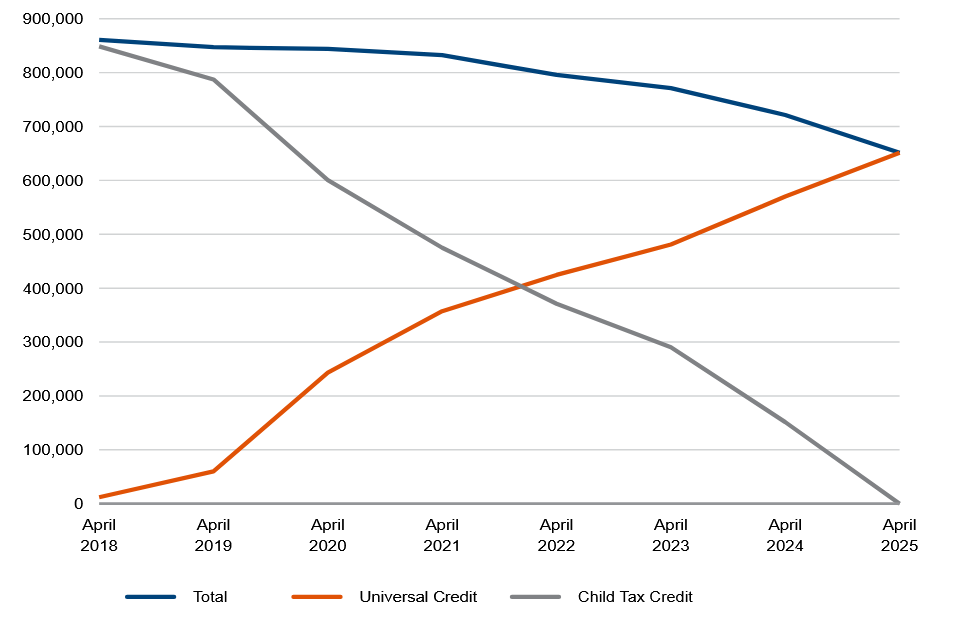

The total number of Universal Credit or Child Tax Credit households or with three or more children has been falling quite substantially since the limit was introduced, down by about 200,000 in the last five years – the blue line below. Studies also show it has also raised employment rates a bit.

Who’s affected by the limit?

Of the UC households affected by the policy, just over half (251,830 or 54%) of households affected by the policy are single households and just under half (217,960 or 46%) are couple households.

Most have three children. Obviously there are more children for whom the parents don’t get additional UC payments in larger families:

.

There are more households affected in urban areas, with greater numbers of claims shown in a darker colour below:

.

The benefit cap

One issue to look out for in the Budget is the interaction with the overall Household Benefit Cap. This separate measure was introduced to stop people living in expensive areas from making very large benefit claims. There are currently 120,000 households subject to the household benefit cap. If the two child limit in UC is abolished, and the benefit cap rates are unchanged, more households will hit the Benefit Cap limits.

The exact interaction of the two child limit and the Household Benefit Cap is not straightforward to work out.

The benefit cap currently only applies to households that work less than 16 hours a week. 59% of households affected by the two child limit have someone in some kind of work, and most of them would be exempt from the Benefit Cap. On the other hand 194,000 have no-one in work, so could be affected by it. The affected households breakdown like this:

- Single, one earner: 101,280

- Single, no earners: 150,550

- Couple, two earners: 57,400

- Couple, one earner: 117,140

- Couple, no earners: 43,420

But on top of that the Benefit Cap also has a long list of exemptions. Still, we can assume that more people will hit the cap if the two child limit is abolished, and I suspect this will become the next campaigning focus for the Labour left.

I assume that Reeves will not change the Benefit Cap – any increase would score as a further wider cost on top of the £8.5 billion a year of extra spending caused by the summer’s welfare u-turn plus the u-turn on two child limit.

Conclusion

Polls show that by a margin of more than two to one people think the two child limit should be kept. This includes a large majority of Labour and Lib Dem voters. In recent weeks I have heard Labour people making the argument that there will be educational gains from ending the cap, but a recent IFS study finds no evidence of an effect.

On Wednesday Rachel Reeves will say that she has “no choice” but to once again break her promises and raise tax again. The reality is that this is a choice she is making, not least that she can spend more on benefits.

This article (The effects of ending the two child limit on Universal Credit) was created and published by Neil O’Brien and is republished here under “Fair Use”

••••

The Liberty Beacon Project is now expanding at a near exponential rate, and for this we are grateful and excited! But we must also be practical. For 7 years we have not asked for any donations, and have built this project with our own funds as we grew. We are now experiencing ever increasing growing pains due to the large number of websites and projects we represent. So we have just installed donation buttons on our websites and ask that you consider this when you visit them. Nothing is too small. We thank you for all your support and your considerations … (TLB)

••••

Comment Policy: As a privately owned web site, we reserve the right to remove comments that contain spam, advertising, vulgarity, threats of violence, racism, or personal/abusive attacks on other users. This also applies to trolling, the use of more than one alias, or just intentional mischief. Enforcement of this policy is at the discretion of this websites administrators. Repeat offenders may be blocked or permanently banned without prior warning.

••••

Disclaimer: TLB websites contain copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available to our readers under the provisions of “fair use” in an effort to advance a better understanding of political, health, economic and social issues. The material on this site is distributed without profit to those who have expressed a prior interest in receiving it for research and educational purposes. If you wish to use copyrighted material for purposes other than “fair use” you must request permission from the copyright owner.

••••

Disclaimer: The information and opinions shared are for informational purposes only including, but not limited to, text, graphics, images and other material are not intended as medical advice or instruction. Nothing mentioned is intended to be a substitute for professional medical advice, diagnosis or treatment.

Disclaimer: The views and opinions expressed in this article are those of the author and do not necessarily reflect the official policy or position of The Liberty Beacon Project.

Certain segments of the population need no incentive to have high numbers of offspring. Inevitably, these segments will be the beneficiaries of the new policy. Maybe a clause should be introduced whereby the entitlements for the third, fourth, fifth child etc, should depend on them all having the same parents. Exemptions could be made for adoptions etc, but why encourage single parent households, inevitably single mothers having children to multiple fathers?