Claims of cheap renewables are industrial-scale gas-lighting of the public and Parliament

DAVID TURVER

Introduction

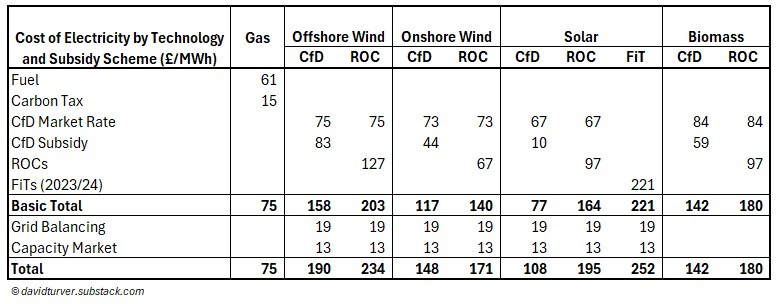

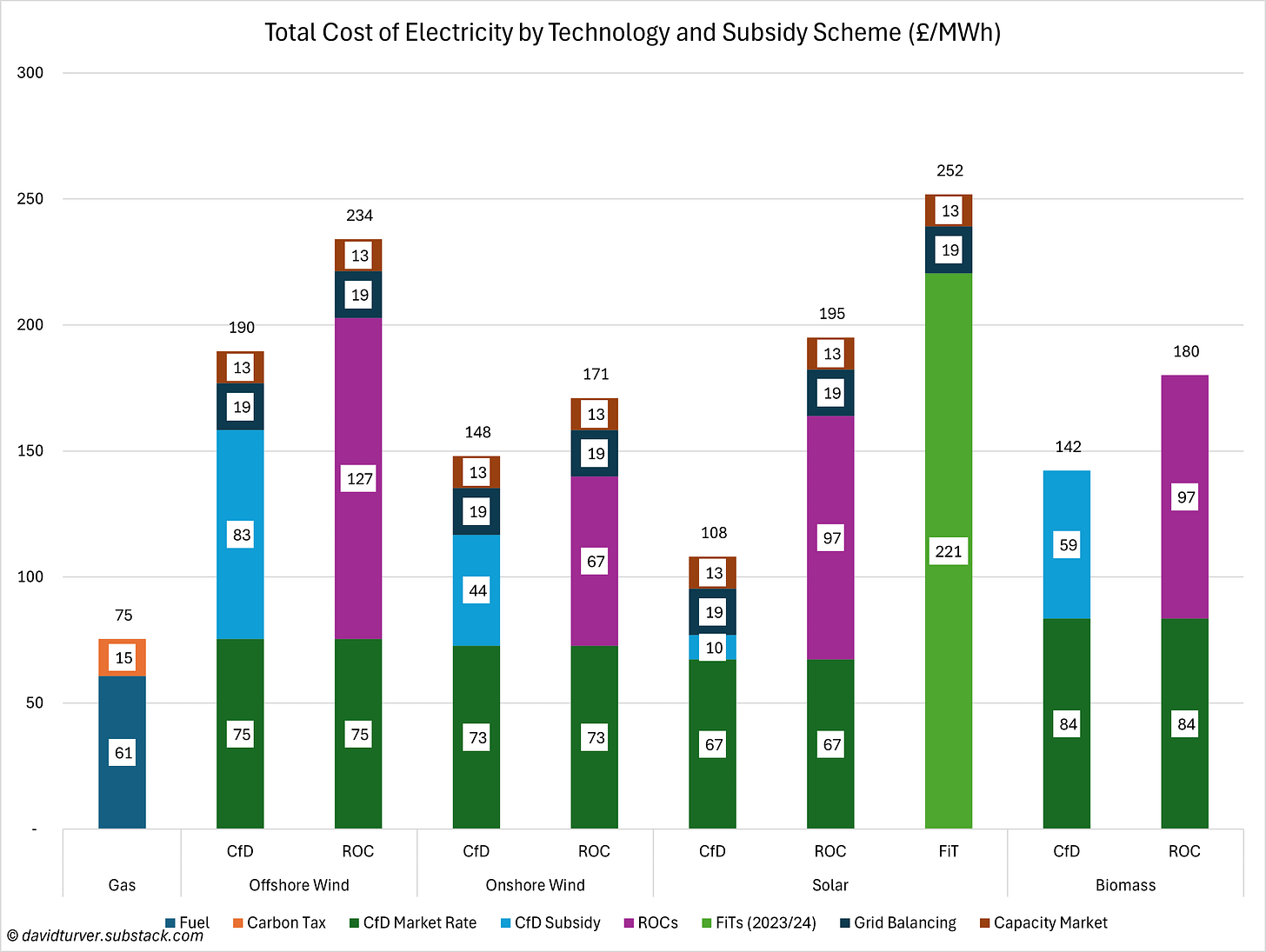

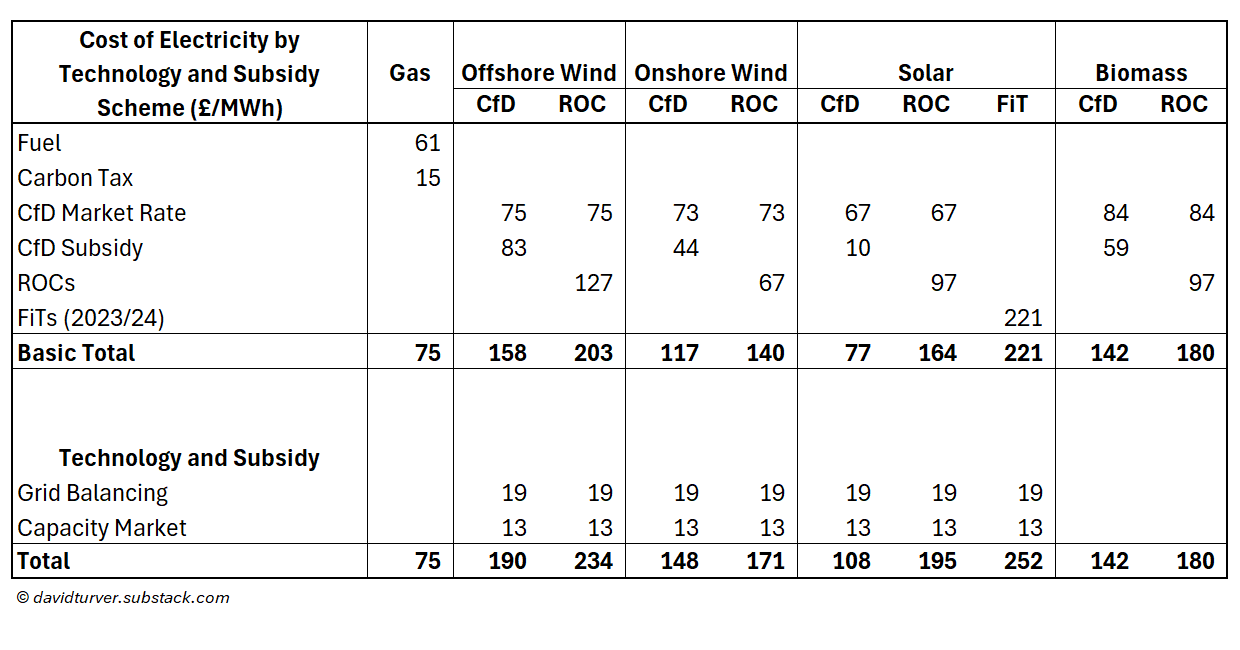

As we discussed last week, I made a submission to the ESNZ Cost of Energy Inquiry that laid out the cost of renewables and ideas on how to reduce our energy bills. Quite remarkably, many of the submissions to the same inquiry, from organisations that really should know better, tried to maintain the fiction that renewables are cheap. Figure 1 below (note the figures may not add exactly to the totals because of rounding) shows a summary table of the current cost of gas-fired electricity and various renewables according to the different subsidy regimes.

In the rest of the article we will look at the claims made in the evidence to the ESNZ inquiry and work through the reasoning that supports Figure 1 above. It is time to lay to rest the lies about “cheap” renewables.

False Claims of Cheap Renewables

The false claims of cheap renewables came from a variety of organisations including Department of Energy Security and Net Zero (DESNZ), energy companies, think tanks and lobby groups. First we have the submission from DESNZ that claimed “the government will be working relentlessly to translate the much cheaper wholesale costs of clean power into lower bills for consumers.” They miss the point entirely about the subsidies that must be added to the cost of renewables. They then contradict themselves by also saying they also want to address the “price disparity between electricity and gas” because “low carbon technologies can be more expensive to run than fossil-fuel powered alternatives.” If renewables were cheaper, they would not need subsidies and there would be no need to transfer those subsidies on to gas bills to make electricity look cheaper. We have known since the 2023 Generation Cost Report that DESNZ is delusional about the cost of renewables, but it is scandalous that they continue to make these assertions.

Next we have Ovo Energy’s submission where they claimed renewable energy is “far cheaper to produce”. Then we have the Octopus Energy’s captive think tank, The Centre for Net Zero claiming “renewables are now among the cheapest sources of electricity”. Climate change think tank E3G – where Lucy Yu, Chief Executive of the Centre for Net Zero is a non-executive director – has also made a submission where they urged ESNZ to make the most of cheap renewables.

Energy Systems Catapult thinks consumers should have access to “cheaper locally generated low-carbon electricity.” Energy UK says delivering “Clean Power 2030 and wider energy security will lead to lower energy bills” ignores the cost of subsidies and calls for households and businesses to be helped to “shift their energy use to times when electricity is cheapest and most abundant.” The Institute for Public Policy and Research (IPPR) claims “renewable generation projects that can produce electricity much more cheaply than gas” and “onshore wind and solar PV which are currently the cheapest forms of electricity generation”.

Most of these submissions only focus on the marginal costs of renewables or the wholesale price and totally ignore the cost of subsidies, grid balancing, backup and extension of the grid to accommodate remote wind and solar farms.

Finally, global energy think tank Ember thinks we should be “building alternative, cheaper sources of power such as wind, solar and other low-carbon technologies”. Ember also tells us that “gas sets the price of electricity in the GB market more frequently than any other major European power market.”

High UK Electricity Prices

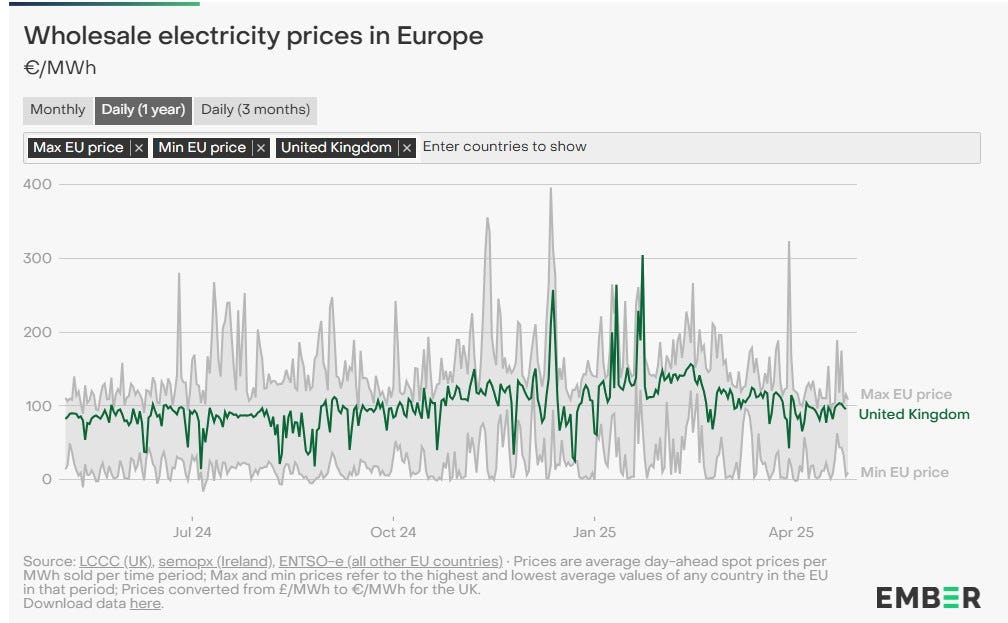

Ember really ought to know better though, because their own data portal shows that UK wholesale prices are below the maximum EU price most of the time (see Figure 2).

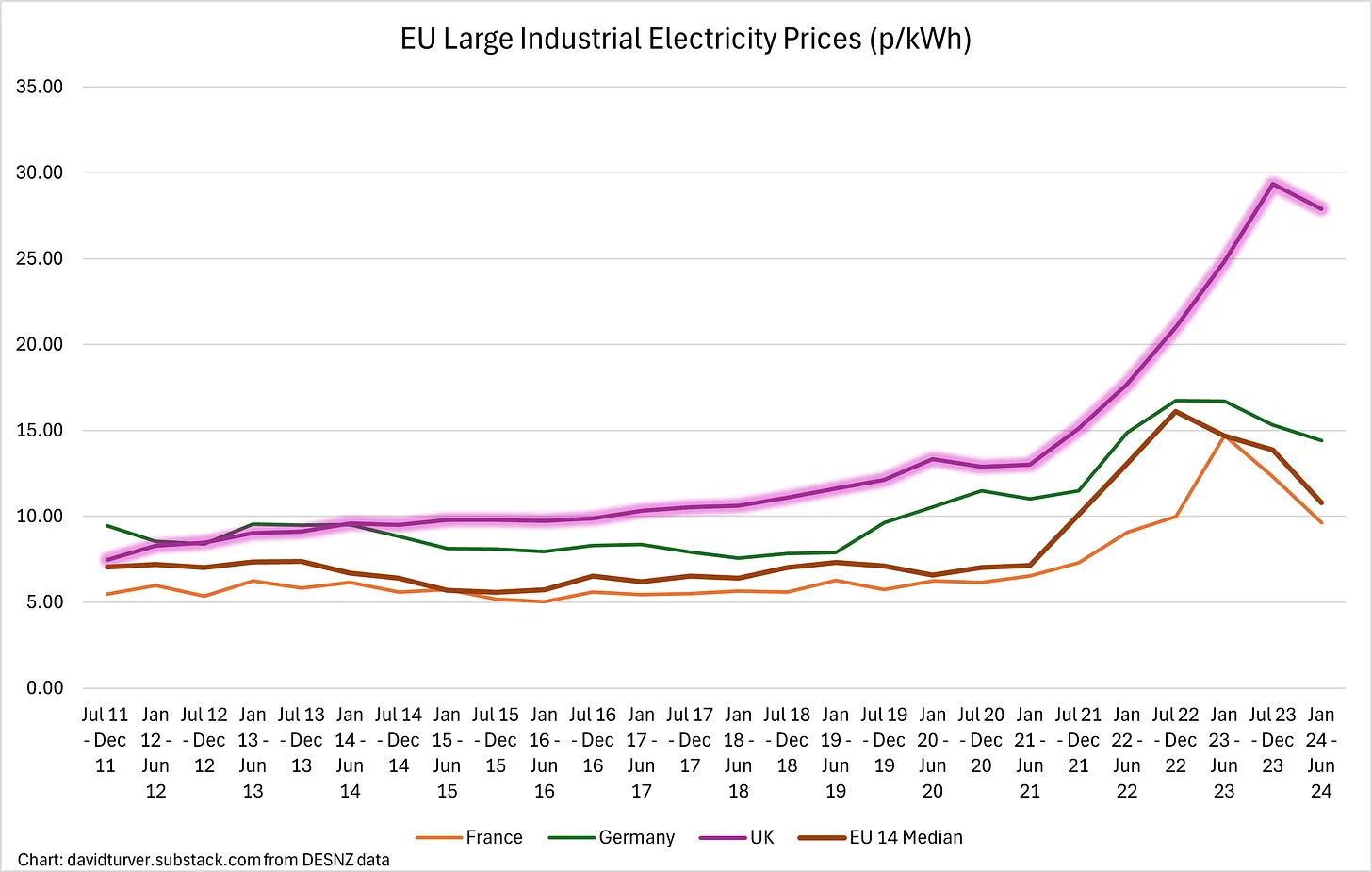

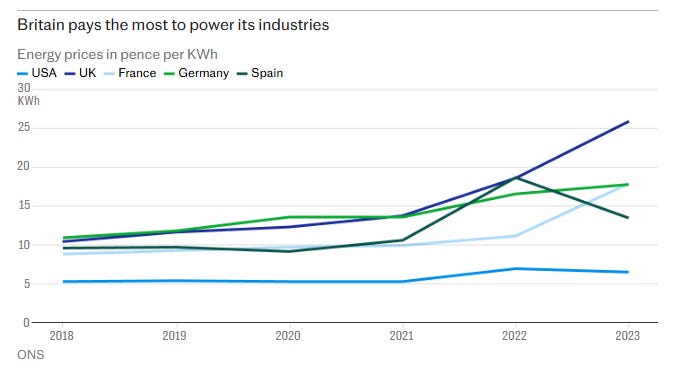

However, for the first half of 2024 UK industrial electricity prices were the highest in Europe and the gap between UK prices and the EU was very wide indeed (see Figure 3).

If the wholesale price is set by gas, then this indicates there must be some other drivers of customer prices.

What are the Costs of Renewables?

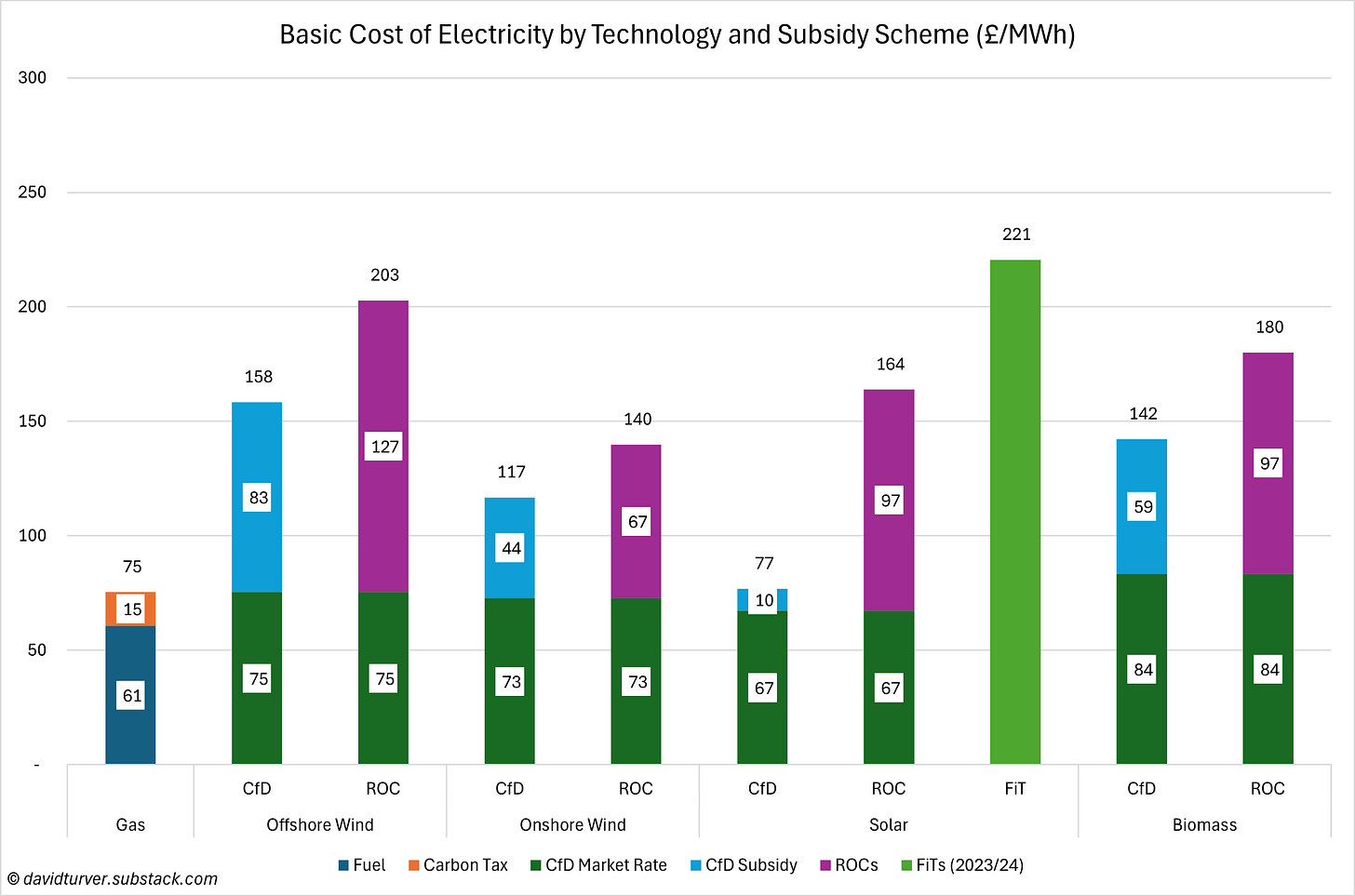

We can explain this mismatch between rhetoric and reality by looking at the current cost of electricity across different technologies and subsidy schemes, see Figure 4 (note the figures might not add up exactly to the total because of rounding).

Starting with gas, the average market price in the Contracts for Difference (CfD) subsidy scheme has been about £75/MWh during April 2025, and this corresponds quite closely to the average day ahead price as reported by Trading Economics. This £75/MWh is made up of about £61/MWh from the cost of gas fuel and the balance of £15/MWh arises from the Emissions Trading Scheme Carbon Tax (assuming £42/tCO2 and 350gCO2/kWh). However, carbon prices are rising towards the EU price, so this component may increase, pushing up the wholesale cost.

Moving now to offshore wind that is subsidised by both CfDs and Renewable Obligation Certificates (ROCs). The current weighted average strike price for CfD-funded Offshore Wind is £158/MWh, with £83/MWh or 52% of revenue coming from subsidies in April 2025. The strike price has been increased by the inflation indexing at the beginning of April and the Neart na Gaoithe (NNG) wind farm recently activating its CfD at a current price of £162.82/MWh. The basic cost of CfD-funded offshore wind is more than double gas-fired electricity. ROC-funded offshore wind is even more expensive. These windfarms receive the market price for their output (assumed to be the same as for CfD-funded generators) plus an average of 1.9 ROCs per MWh of output. Ofgem has set the buyout price for these certificates at £67.06/MWh for 2025/26. This puts the current cost of ROC-funded offshore wind at £203/MWh, with £127/MWh or 63% of revenue coming from subsidies. ROC-funded offshore wind costs 179% more than gas-fired generation.

Newer CfDs have been awarded at lower prices than the average today. However, as we have covered before, there is a challenge getting them built because Norfolk Boreas has had its CfD cancelled and parts of other AR4 projects have been re-bid at higher prices. The current price of the now cancelled Hornsea Project Four, awarded a contract in AR6 is £84.97/MWh. This is some £10/MWh more expensive than gas-fired electricity, even when hampered by a carbon tax. If new projects are not economic at guaranteed index-linked prices that are above gas-fired electricity prices, even with a carbon tax, then we really should abandon the idea that offshore wind is cheap.

Onshore wind is also funded by both CfDs and ROCs. The current average CfD strike price is £117/MWh with £44/MWh or 38% of revenue coming from subsidies. The weighted average market price (IMRP) for onshore wind is slightly lower than offshore wind. CfD-funded onshore wind costs 55% more than gas-fired electricity. ROC-funded onshore wind is more expensive at £141/MWh, with £67/MWh or 48% of revenue coming from subsidies. ROC-funded onshore wind costs 85% more than gas. The current strike price for new onshore wind projects awarded in AR6 is around £73/MWh.

Solar power is subsidised by CfDs, ROCs and Feed-in-Tariffs (FiTs). Several cheaper CfD units have recently come online pushing the weighted average strike price down to £77/MWh. However, CfD-funded solar power still receives £10/MWh in subsidy because the market price for their output is lower at £67/MWh, reflecting price reductions in the middle of the day when solar output is highest. The basic cost of CfD-funded solar power is on a par with gas-fired electricity. The current strike price for new solar projects awarded in AR6 is around £72/MWh. ROC-funded solar power receives an average 1.44 ROC-certificates per MWh or £97/MWh, pushing the cost of this form of solar generation up to £164/MWh or some 117% more than gas-fired power. We covered earlier that in 2023/24 FiT-funded electricity, which is mostly solar, cost £221/MWh or nearly three times the cost of gas-fired electricity. In reality, FiT-funded units will have received two rounds of additional inflationary increases in the FiT prices since 2023/24, making FiT-funded solar power even more expensive today.

Biomass costs us about £142/MWh for CfD funded units and about £180/MWh for ROC-funded units, assuming that technology receives the same £84/MWh baseload market price as CfD-funded units. These are respectively 89% and 139% more expensive than gas-fired power.

Extra Costs of Renewables

I can already hear the voices saying “New onshore wind and solar projects cost about the same as gas-fired electricity, so why don’t we build more of them”. The answer is in the full system costs of running intermittent power sources.

In 2024 the cost of grid balancing was some £2,529m and backup from the capacity market cost some £1,256m. The vast majority of these costs should be attributed to intermittent renewables. Before the rapid increase in renewables, grid balancing cost about £500m per year. Assuming that this might have increased to £700m/yr today because of inflationary pressures, this leaves £1,829m to be attributed to intermittent wind and solar power. The Government’s Energy Trends data (T6.1) shows that wind and solar generated a total of 98,847GWh in 2024. Apportioning the capacity market costs and the remaining grid balancing costs to wind and solar, gives us the total costs of renewables as seen in Figure 5.

Grid balancing adds about £19/MWh and the capacity market adds another £13/MWh to the cost of intermittent renewables. The cost of CfD-funded offshore wind goes up to £190/MWh and ROC-funded units cost us a staggering £234/MWh, some 151% and 210% respectively more expensive than gas. CfD-funded and ROC-funded onshore wind costs £148/MWh and £171/MWh respectively, around 96% and 127% more costly than gas. The cost of solar power from CfDs costs £108/MWh, ROCs, £195/MWh and FiT-funded solar costs a whopping £252/MWh or 43%, 159% and 234% respectively more than gas.

Adding the costs of balancing and capacity market backup to the latest CfDs for onshore wind and solar makes them much more expensive than gas-fired electricity which is why it is not a good idea to award any more contracts. In fact, as more intermittent capacity is added, we can expect the cost of balancing and backup to rise too, perhaps faster than the rate of expansion of renewables.

And these costs do not include the extra distribution and transmission lines needed to transport this renewable power around the country, meaning these costs are under-stating the true cost of renewables.

Conclusions

We have seen above that the Government, OVO energy, proxies for Octopus Energy and various other think tanks are desperate to portray renewables as cheap. However, simple analysis of the available data on the cost of CfD, ROC and FiT subsidies, together with the costs of grid balancing and back up demonstrates that this narrative could not be further from the truth.

The data presented above on the cost of CfDs, ROCs and FiTs is not difficult to access, so they cannot claim ignorance. There appears to be a concerted, industrial-scale effort by institutions to gaslight the public and mislead Parliament into believing that renewables are cheap. This cannot be described as anything other than fraud to further the interests of the green blob determined to continue gorging on subsidies at our expense.

The ESNZ Committee members need to see through this and come to sensible conclusions about how to reduce our energy bills by following the advice in my evidence to their inquiry.

I have also created a short video to illustrate the true cost of intermittent renewables that can be found in the Multi-Media section and on YouTube. Please share widely.

Renewables Are Much More Expensive Than Gas

This is a short video to accompany the main article (link below) that dispels the myth that renewables are cheap.

This Substack now has well over 4,000 subscribers and is growing fast. If you enjoyed this article, please share it with your family, friends and colleagues and sign up to receive more content.

This article (Renewables are More Expensive than Gas) was created and published by David Turver and is republished here under “Fair Use”

See Related Article Below

Net Zero crusade by Ed Miliban is adding billions to their broken system.

Net Zero is a scam, and nothing more than a wealth transfer from the rich to the really rich.

STU TURLEY

The Telegraph, from the UK, reports that Kathryn Porter has a report showing that green levies on energy bills will hit 20 billion pounds by the end of the decade. If you think that green energy is cheaper, you might want to look at Germany, New York, California, New Jersey, Hawaii, and the UK. They all should be listed in the “what not to do for energy policies category.” I enjoyed visiting Kathryn Porter on the Energy Realities Podcast about issues around the Spanish power outages; she is a true energy leader.

UK Electricity Generation Mix in 2025

The UK’s electricity generation mix has undergone significant transformation, driven by commitments to decarbonization and net-zero targets by 2050. As of the 12-month moving average to April 2025, research suggests the mix is approximately as follows:

- Renewables: Account for 41% of the total, with wind being the largest contributor at 21.7%. Other renewables include biomass at 6.9%, solar at 5.2%, and hydro at 1.1%, with an additional 6.1% likely from emerging sources like marine energy. This growth reflects a decade-long trend, with renewables rising from 14.2% in 2015 to 42.2% in 2024, according to Renewable Energy Percentage UK – 41% as of April 2025.

- Fossil Fuels: Comprise 27.2%, predominantly gas at 27.1%, with coal reduced to a negligible 0.1% following its phase-out in September 2024, as noted in Britain’s Electricity Explained: 2024 Review | National Energy System Operator.

- Nuclear Power: Contributes around 14%, providing a stable baseload, with estimates based on monthly data like January 2025, where it was 12%, from Britain’s Electricity Generation – January 2025.

- Imports: Account for approximately 12%, varying by demand and domestic generation, with data from the same January 2025 analysis showing 12% imports.

- Other Sources: The remaining small percentage, likely less than 2%, may include storage and other minor contributions, ensuring the total sums to 100%.

This mix is not static, varying daily due to weather (e.g., wind speeds, sunlight) and demand. For instance, an X post from May 16, 2025, at 11 am showed 35.7% solar, 23.1% wind, 17.1% nuclear, 6.1% gas, 3.6% biomass, 0.4% hydro, and 14.1% imports

From the article “Ed Miliband’s net zero crusade is adding billions to Britons’ energy bills”

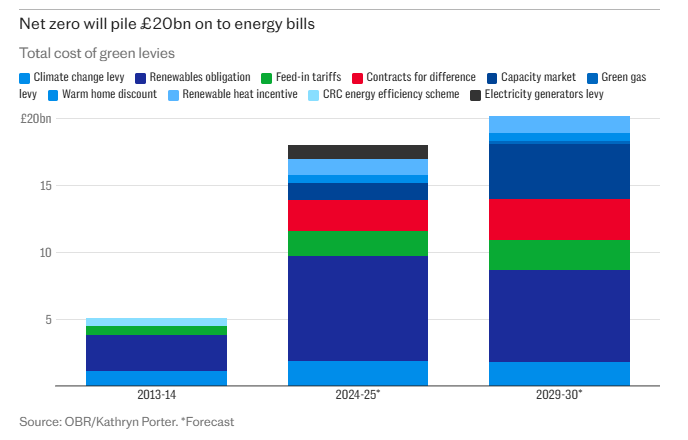

That is despite it being closed to new entrants seven years ago. Its successor, the Contracts for Difference scheme (CfD), is adding another £2.3bn, she says.

.

The scale of the increase in levies over the past decade has alarmed many in the industry who question whether Miliband has a democratic mandate to raise such huge sums via a levy system that few consumers understand.

“If this money was being raised through taxation, it would be scrutinised by the Treasury, the Office for Budget Responsibility, and by voters at general elections,” says Porter.

“But instead, Miliband is taking these subsidies from the pockets of consumers and giving them to renewable generators – without ever having had to win approval for the idea in an election.

“This mattered less in the past because the amounts were much smaller, but they have become far too large to stay in the shadows.”

Hidden costs

Porter analysed 10 levies that are eventually added to the bills paid by households and businesses.

She argues that the imposition of such levies is what has led to the UK paying the highest industrial electricity prices in the world, as well as the fourth-highest domestic power prices.

.

“The costs are paid by consumers based on policy choices designed to support renewable generation and the drive to net zero,” says Porter.

The relative lack of scrutiny applied to such levies worries other energy experts too.

Tom Smout, a leading analyst at energy specialists LCP Delta, says: “Energy levies are central to the economy but are mostly not counted as taxes so they are excluded from the Government’s main balance sheets.

“Taxes are treated differently. They show up in all the government accounts and are scrutinised by the Treasury and the Office for Budget Responsibility. And both those organisations tend to favour progressive taxation because it frees up people’s money and promotes growth.”

Renewables also have other hidden costs that appear on bills, such as connection and network fees.

A gas-fired power station, for example, needs far fewer cables and substations to connect to the grid than the multiple wind farms needed to generate the same output.

Consumers subsidise the cost of those cables and substations via the network charges added to bills.

Wind farms also generate curtailment costs if they have to be switched off, while there are balancing costs to compensate for the intermittency of wind. Those charges, estimated at over £1bn last year, are also added to bills.

All of which means that Miliband’s argument that net zero will reduce bills by £300 by 2030 is looking increasingly shaky.

‘This is really serious’

Chris O’Shea, chief executive of British Gas owner Centrica, reinforced that point this week when he warned politicians against claiming renewables would cut bills.

The shift to renewable power “will not materially reduce UK electricity prices from current levels”, he said. “They may give price stability, and avoid future price spikes based on the international gas market, but they will definitely not reduce the price.”

The article contains a lot more, and I recommend reading the entire article at The Telegraph. It also raises a lot of questions about how energy prices are determined in the United States. We need to be grateful for our current Department of Energy leadership, but we also have to question all decisions going forward. Let’s learn from the past, and make better decisions going forward.

You need to look at the energy policies of your State and your local electric provider. Net Zero is a scam, and nothing more than a wealth transfer from the rich to the really rich.

Here is the Energy Realities Podcast link with Kathryn Porter: “Net Zero’s Spanish Blackout – Special Guest Kathryn Porter”

This article (Net Zero crusade by Ed Miliban is adding billions to their broken system.) was created and published by Stu Turley and is republished here under “Fair Use”

••••

The Liberty Beacon Project is now expanding at a near exponential rate, and for this we are grateful and excited! But we must also be practical. For 7 years we have not asked for any donations, and have built this project with our own funds as we grew. We are now experiencing ever increasing growing pains due to the large number of websites and projects we represent. So we have just installed donation buttons on our websites and ask that you consider this when you visit them. Nothing is too small. We thank you for all your support and your considerations … (TLB)

••••

Comment Policy: As a privately owned web site, we reserve the right to remove comments that contain spam, advertising, vulgarity, threats of violence, racism, or personal/abusive attacks on other users. This also applies to trolling, the use of more than one alias, or just intentional mischief. Enforcement of this policy is at the discretion of this websites administrators. Repeat offenders may be blocked or permanently banned without prior warning.

••••

Disclaimer: TLB websites contain copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available to our readers under the provisions of “fair use” in an effort to advance a better understanding of political, health, economic and social issues. The material on this site is distributed without profit to those who have expressed a prior interest in receiving it for research and educational purposes. If you wish to use copyrighted material for purposes other than “fair use” you must request permission from the copyright owner.

••••

Disclaimer: The information and opinions shared are for informational purposes only including, but not limited to, text, graphics, images and other material are not intended as medical advice or instruction. Nothing mentioned is intended to be a substitute for professional medical advice, diagnosis or treatment.

Disclaimer: The views and opinions expressed in this article are those of the author and do not necessarily reflect the official policy or position of The Liberty Beacon Project.

Leave a Reply