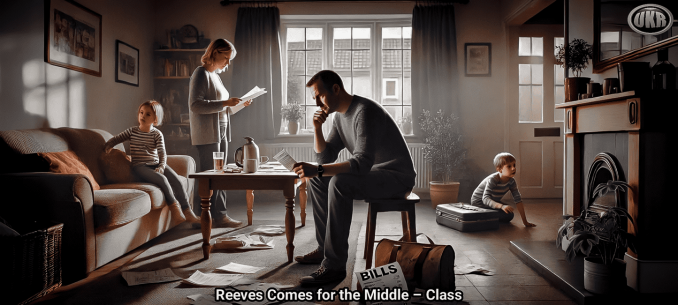

Reeves comes for the middle – class

Reeves takes aim once again at the backbone of Britain, the much put upon middle – class

LAURA PERRINS

If you are Chancellor of the Exchequer Rachel Reeves how do you fill a £20 billion black hole? Well as usual you look to raise taxes on working people and in particular those who have had the temerity to build up some wealth over the years of working. Reeves takes aim once again at the backbone of Britain, the much put upon middle – class. It is worth noting that in the UK, the top 0.1% of earners pay more income tax than the entire bottom 50%.

The British middle – class are already burdened with the highest tax burden since the war. Now, tax rises are pretty much guaranteed from Labour as they scramble to fill the gaping black hole in the finances. Whatever numbers you look at, it is all going downhill in the UK.

As per the Times of London, “Ms Reeves was unable to drive through a mere £5 billion reduction in welfare spending earlier this year, and had to backtrack on means-testing winter fuel payments, suggesting cuts of any kind will encounter tough opposition. With significant austerity in departmental spending already baked in from her last spending review, the chancellor’s room for manoeuvre is exceedingly tight. Despite her promise late last year not to come back with more borrowing or tax rises, it is likely that she will have to renege on the latter. For Ms Reeves, the budget will be a point of maximum political danger. Her credibility is at stake.”

Unemployment is rising to its highest level since the (stupid) lockdown. Britain is on course for the highest rate of inflation in the G7 next year, while suffering the slowest rise in living standards in the group of major western economies. In its latest projections, the IMF warns that inflation is expected to average 3.4 per cent this year, up from 2.5 per cent last year. In turn, it predicts that growth per capita is expected to be a lamentable 0.5 per cent in 2026. So much for ‘going for growth.’

The amazing plan to replace the entrepreneurs, small business owners and others who pay more into the UK economy that they take out and replace them with millions of low skilled people from elsewhere, including housing those who have jumped on a boat at Calais and decided to just break into the country without permission is going well. It is also very expensive.

The invasion of Britain

Laura Perrins 18 Jun

I preferred it the old way, when ‘British policy was to make the world England.’ This is one of my favourite quotes from my favourite films, the Last of the Mohicans by a British soldier in colonial America. He questions why his superiors are bargaining with some colonists for their loyalty and service in fighting the French

What could possibly go wrong? Quite a lot actually.

Already the middle – classes are being primed to pay even more tax. Don’t worry though it will only be those with the ‘broadest shoulders’ that will be asked to pay their ‘fair share.’ Pass the bucket.

The Chancellor is getting her measuring tape out to determine just who can pay more. I hate this language, like they are only coming after a tiny number of people. She will make out that those that do get ‘asked’ to pay more tax are somehow loaded. The uber wealthy. That’s not how it goes.

The very, very loaded, filthy rich who park up their fast cars outside Harrods are mobile, they can move their considerable wealth out of the country. It will be – as it always is – as surely as night follows day – the middle – class who are told to pay even more in tax than they already do.

Also, you are never asked to pay tax. It is a demand. You cannot enter into negotiations with HMRC over your tax bill; you are coerced into paying it. Should you decide to decline the request you can expect yourself on the end of fraud charges.

In fact, Reeves is actually proposing taxing the sale of the family home or “primary residence.”

“The Times has previously reported that Reeves has drawn up plans to impose capital gains tax on the most expensive homes, by ending the primary residence exemption for high-value properties. A threshold of £1.5 million would hit about 120,000 homeowners who are higher-rate taxpayers with capital gains tax bills of £199,973.”

This will be sold has ending the ‘tax give away’ for the very wealthy. In reality this is taxing sale of the family home. That this could even be proposed in a property owning democracy, the land where for the Englishman, his home is his castle, is shocking.

The wording of this – even from the Times – is deeply worrying. It is warmed up socialism and class warfare. First, for instance, a property worth £1.5 million in the south east of England is not the most expensive home. It just isn’t and to make out that it is misleading. Sure, house prices are ridiculous but it is not the fault of those who own the homes that there had not been enough new houses built, together with an explosion in immigration (and divorce) that has led to demand outstripping supply.

Any family home in west London will be over £1.5 million. Every single one. A huge number of family homes even in the east and the south will be over £1.5 million and should these middle – class families decide to sell them, they could potentially face a tax bill of 200k. This is absolutely disgraceful, an attack on the heart of the middle – class.

Then there is this little gem, “Pointing to decisions to impose VAT on school fees, scrap non-dom tax status and increase taxes on private jets, Reeves said that those asking where she might raise taxes should “judge me by my record last year.”

Let’s judge Reeves on her record last year. First, she failed to get through even basic welfare cuts, the bill for sickness benefits alone is set to hit £100 billion by the end of the decade. Also it is telling that she includes her vindicitive nasty little policy of imposing VAT on private school fees in the same sentence as ‘taxes on private jets.’

The VAT on private school fees was not only cruel but it also caused the closure of a number of private schools, including the modest Catholic one my children attended.

VAT – a vindicitive policy

Laura Perrins 17 Jun

Last Thursday my daughter told me that her old school, Bishop Challoner School in Shortlands, will close. The teenage WattsApp group moves fast. When we lived in London all three of the children once attended Bishop Challoner school and I was a governor there.

Also, the EU prohibits the imposition of VAT on educational services as they recognise it is so regressive. Finally, it says a lot that Reeves would put educating your children on your own dime (and saving the state that expensive) in the same category as private jets. To state the obvious, swanning around on a private jet is not in the same category as educating your child. The first is an indulgence, the second is a noble pursuit. Surely, even the socialists can tell the difference.

But there we are. I’m still struggling to figure out whether it is Ireland or the UK who have the greatest disdain for the middle – class but it is a close run thing. Reeves is taking aim yet again.

This article (Reeves comes for the middle – class) was created and published by Laura Perrins and is republished here under “Fair Use”

••••

The Liberty Beacon Project is now expanding at a near exponential rate, and for this we are grateful and excited! But we must also be practical. For 7 years we have not asked for any donations, and have built this project with our own funds as we grew. We are now experiencing ever increasing growing pains due to the large number of websites and projects we represent. So we have just installed donation buttons on our websites and ask that you consider this when you visit them. Nothing is too small. We thank you for all your support and your considerations … (TLB)

••••

Comment Policy: As a privately owned web site, we reserve the right to remove comments that contain spam, advertising, vulgarity, threats of violence, racism, or personal/abusive attacks on other users. This also applies to trolling, the use of more than one alias, or just intentional mischief. Enforcement of this policy is at the discretion of this websites administrators. Repeat offenders may be blocked or permanently banned without prior warning.

••••

Disclaimer: TLB websites contain copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available to our readers under the provisions of “fair use” in an effort to advance a better understanding of political, health, economic and social issues. The material on this site is distributed without profit to those who have expressed a prior interest in receiving it for research and educational purposes. If you wish to use copyrighted material for purposes other than “fair use” you must request permission from the copyright owner.

••••

Disclaimer: The information and opinions shared are for informational purposes only including, but not limited to, text, graphics, images and other material are not intended as medical advice or instruction. Nothing mentioned is intended to be a substitute for professional medical advice, diagnosis or treatment.

Disclaimer: The views and opinions expressed in this article are those of the author and do not necessarily reflect the official policy or position of The Liberty Beacon Project.

Leave a Reply