UK pay rates for senior civil servants reveal “the blob” that is drowning the UK with an over-paid and poorly performing bureaucracy

hundreds of thousands of pounds more than the political monkey(s) in Downing street – though not the civil servants in Downing Street.

PETER HALLIGAN

From here:

Public sector rich list blows lid on the 120 civil servants earning tens of thousands more than PM

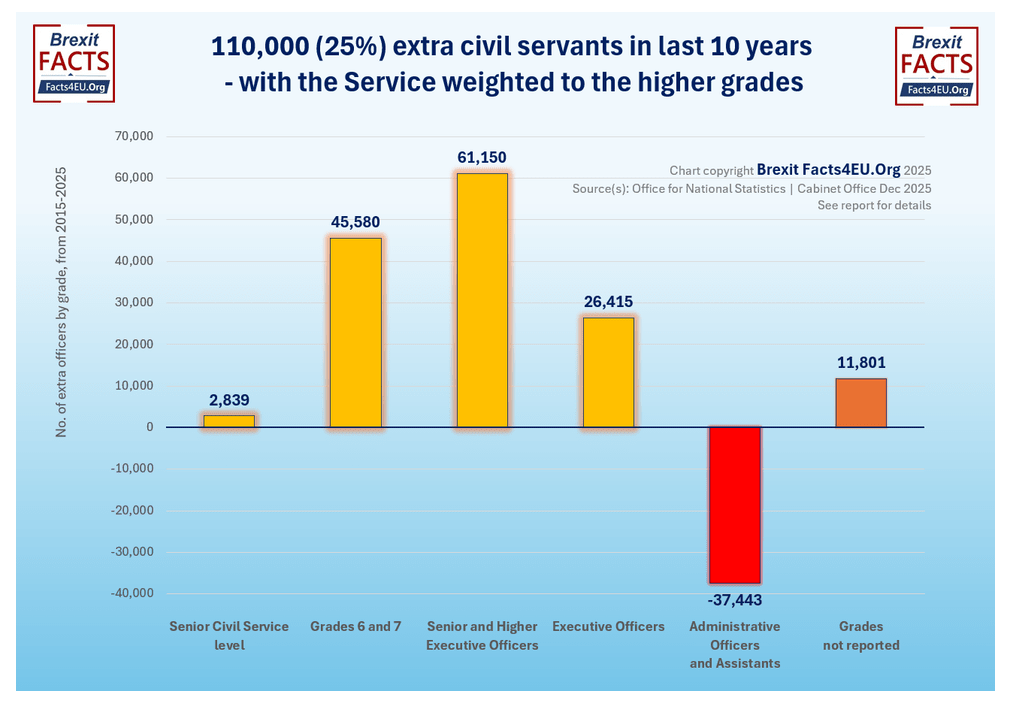

- “Staffing Surge: The Civil Service grew by 110,000 officials (25% increase) from 2015–2025, driving the salary bill up by £6.1 billion, excluding benefits.

- High Earners: 120 civil servants now earn more than the Prime Minister, with some senior figures at HS2 and the Bank of England making over £500,000.

- Shift in Roles: Growth is concentrated in higher-rank positions, while lower-grade roles have declined, highlighting a rise in promotions rather than administrative demand.

“the benefits include generous vacations ad sick leave – per Brave AI:

“The average annual leave entitlement for UK civil servants starts at 25 days per year for full-time employees on modernised terms and conditions, increasing to 30 days after five years of service.

“Additionally, civil servants are entitled to 8 public or bank holidays per year, plus an extra privilege day for the monarch’s birthday, which may be included in the total leave allowance.”

Established civil servants are generally entitled to up to six months of full pay sick leave in any 12-month period, followed by six months of half pay, subject to a maximum of 12 months of sick leave in any four-year period.”

That’s not all, of course!

“UK civil servants are entitled to a total of 52 weeks of maternity leave, with 26 weeks at full pay if they have at least one year of continuous service in the Civil Service.

“According to analysis by Facts4EU, the Civil Service expanded by around 110,000 officials between 2015 and 2025 — a 25 per cent increase in staffing.”

Wow!

“The average full-time civil service salary in the UK increased by 32 per cent over the last ten years, rising from £29,750 in 2014 to £39,240 in 2024.”

“The thinktank found the Civil Service salary bill has skyrocketed by £6.1billion over this period, excluding extra costs such as national insurance, pension and other benefits.”

Total number of civil servants? From Brave AI:

“As of 31 March 2025, the UK civil service headcount stood at 549,660 employees, with the full-time equivalent (FTE) measure at 516,150, reflecting the most recent official data from the Civil Service Statistics 2025 report.

Ah yes – national insurance on civil service salaries – 15% above £5,000 – a real circular firing squad by Rachel from accounts” – national insurance – a employment tax – will cost a additional £39,240 times 550,000 times 15% (no civil servant earns less than the threshold for paying national insurance of £5,000!

Rachel increased the cost of government employees by 3.2 billion pounds all by herself.

Let’s finish with some de\ail on pension benefits:

“Under the current Civil Service Pension Scheme, members receive a pension calculated at 2.32% of their pensionable earnings for each year of service, which is a career average revalued earnings (CARE) formula introduced after reforms under the Public Service Pensions Act 2013.

“ Employer contributions to the defined benefit scheme are substantial, ranging from at least 26.6% to as high as 30.3% of pensionable earnings, depending on salary level. Member contributions are typically between 4.6% and 8.05% of pensionable earnings, with rates varying based on income brackets.”

Wow! 30-38% of salary! – nothing like this exists in the private sector.

Now for the “gold plating”

“The pension is inflation-proofed, with increases linked to the Consumer Prices Index (CPI), a change from the previous Retail Prices Index (RPI) linkage introduced in 2010.”

Inflation linked pension!!! There is s defined contribution scheme the private sector.

“For those who prefer a defined contribution approach, the Partnership scheme offers a DC option where employees do not pay contributions, but any contributions made are matched by the employer up to 3%, and the pension pot can be passed on to a named beneficiary.” An automatic uplift up to 3 per cent of salary – sort of like a guaranteed pay rise!

These numbers are for government civil servants – similar horror stories of over payment and bloated benefits exist in local government also.

“The exact number of local government officers in the UK is not directly specified in the provided context. However, it is noted that local government employs a workforce of approximately 1.4 million people, with around 800 different occupations and a pay bill of about £22 billion annually.”

Thes officers are al part of the overall bloat of “the blob”.

It is out f control and exists in every country in the world.”

For the UK, From Brave AI: “The average salary for local government employees in England was reported as £41,005 per year in 2025. Other conditions on holidaya, sick leave and pensions will be similar.

Here’s a few charts on salaries of the blob:

100,000 more mid-level wonks to do what exactly?!!

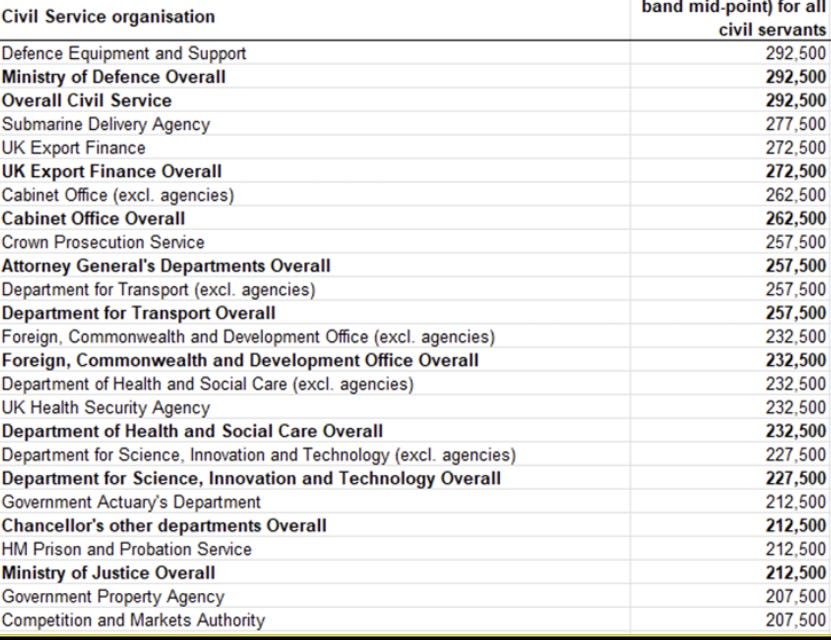

Look at all the quango’s and their mid-pois for senior staff!

I find it Hrd to believe heses are mid-points foe etire departments.

PM Keir Starmer gs a salary of “As of 2025, Keir Starmer’s annual salary as Prime Minister of the United Kingdom is £166,786, which combines his Member of Parliament (MP) salary of £93,904 and a claimed ministerial salary of £75,440.”

Plus fr housing in country states such as Checkers ad no.10 ad unlimited travel – plus a whopping great pension.

“UK Members of Parliament (MPs) are entitled to a pension through the Parliamentary Contributory Pension Fund (PCPF), which operates as a statutory defined benefit scheme comprising the MPs’ pension scheme and the Ministers’ pension scheme. Since 8 May 2015, the scheme has been based on a career average revalued earnings (CARE) model, replacing the previous final salary scheme. Under this scheme, MPs accrue pension benefits at a rate of 1/51st of their pensionable earnings each year, with annual revaluation in line with the Consumer Prices Index.

“The pension contribution rate for MPs is initially 11.09% of their pay, though it is variable and adjusted according to the scheme’s costs.”

And get this:

“Additionally, MPs have the option to exchange part of their pension for a tax-free lump sum at a fixed rate of £12 for every £1 of pension commuted.

Hmmm.. Have a pension pot of £750,000, commute £500,000, get tax free lump sum of £6,000,000!!!

Normal folks get a commutation rate of around 4-8 per cent or so rather than 1200 per cent! Smart actuaries In Parliament.

Meaning if they commute a pension of £50,000 per annum , they might get a lump sum of £625,000! If they change their mind and opt to get a pension back they will get a pension at around a 5 per cent annuity rate which equals £31,250 per annum– how to lose 37.5 per cent of an annual pension if you don’t stay sharp and change your mind!

Never l et it be said that there is not a large taxpayers trough with 650 MPs gorging in it. The House of Lords will have its ow “scheme” for its 800 members.

The blob has well and truly “feathered” its own nest.

Please take a paid subscription or follow/recommend my site to others you think might be interested.

You can also donate via Ko-fi – (any amount three dollars and above).

ko-fi donations here: https://ko-fi.com/peterhalligan

This article (UK pay rates for senior civil servants reveal “the blob” that is drowning the UK with an over-paid and poorly performing bureaucracy) was created and published by Peter Halligan and is republished here under “Fair Use”

••••

The Liberty Beacon Project is now expanding at a near exponential rate, and for this we are grateful and excited! But we must also be practical. For 7 years we have not asked for any donations, and have built this project with our own funds as we grew. We are now experiencing ever increasing growing pains due to the large number of websites and projects we represent. So we have just installed donation buttons on our websites and ask that you consider this when you visit them. Nothing is too small. We thank you for all your support and your considerations … (TLB)

••••

Comment Policy: As a privately owned web site, we reserve the right to remove comments that contain spam, advertising, vulgarity, threats of violence, racism, or personal/abusive attacks on other users. This also applies to trolling, the use of more than one alias, or just intentional mischief. Enforcement of this policy is at the discretion of this websites administrators. Repeat offenders may be blocked or permanently banned without prior warning.

••••

Disclaimer: TLB websites contain copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available to our readers under the provisions of “fair use” in an effort to advance a better understanding of political, health, economic and social issues. The material on this site is distributed without profit to those who have expressed a prior interest in receiving it for research and educational purposes. If you wish to use copyrighted material for purposes other than “fair use” you must request permission from the copyright owner.

••••

Disclaimer: The information and opinions shared are for informational purposes only including, but not limited to, text, graphics, images and other material are not intended as medical advice or instruction. Nothing mentioned is intended to be a substitute for professional medical advice, diagnosis or treatment.

Disclaimer: The views and opinions expressed in this article are those of the author and do not necessarily reflect the official policy or position of The Liberty Beacon Project.

Leave a Reply