Consumer energy debt rising as energy suppliers fail financial resilience tests

DAVID TURVER

Introduction

Ofgem has recently reported that debt and arrears for energy consumers is at a record high and still rising sharply. If suppliers are unable to collect money they are owed, it obviously calls into question their financial stability. Ofgem realised this and introduced new rules to ensure energy suppliers had sufficient financial strength to cope with revenue shortfalls.

So, how well are energy suppliers meeting these new rules? Let’s dig in.

Consumer Energy Debt

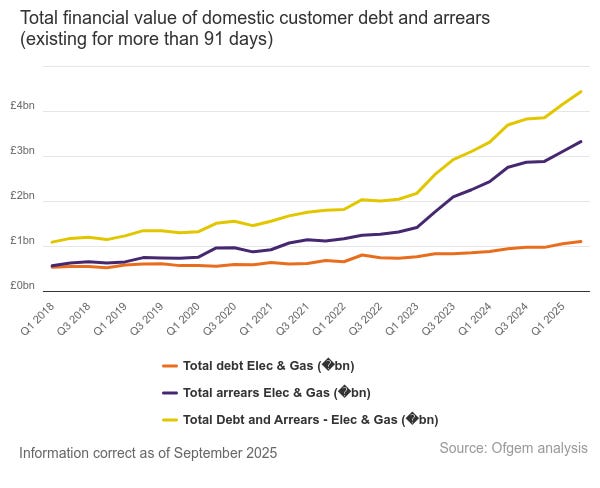

Let us begin by looking at the scale of the energy debt and arrears problem as shown in Figure 1.

Consumer debt, defined as the amount outstanding for people on a formal arrangement with suppliers to repay outstanding debts, rose to a record £1.1bn in the second quarter of 2025. Arrears, defined as customers who are in debt to suppliers for more than 91 days, but do not have a formal repayment plan in place, rose to £3.32bn. Total debt and arrears amounted to a record £4.43bn and the trend is still sharply up.

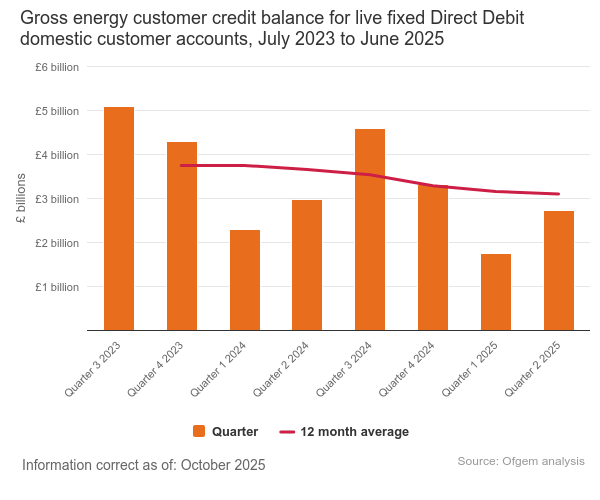

This debt is partly offset by consumer credit balances as shown in Figure 2.

At the end of 2Q25, consumer balances were £2.7bn, however the 12-month trend is on a downward trajectory and positive consumer balances cannot be used to repay debt from other consumers.

Ofgem does include an allowance for consumer debt in the price cap, so in effect we all cover the debts of those who cannot pay their bills. Now Ofgem has announced it will force consumers to pay an extra £5 on their bills so £500m of bad debt incurred by others can be wiped out.

Ofgem Financial Resilience Rules

Back in 2023, Ofgem realised that energy suppliers might be vulnerable to external price shocks and to rising consumer debt problems. They introduced a minimum capital requirement and ring-fencing of customer credit balances.

Ofgem decided that by March 2025, all suppliers should have a minimum Capital Floor of £0 adjusted net assets per domestic dual fuel customer and be working towards a Capital Target of £115 adjusted net assets per domestic dual fuel customer, or half that per meter point.

Suppliers were expected to maintain the Capital Floor at all times and those that are below the floor would be in breach of their license conditions and could be subject to enforcement action.

Those that have adjusted assets below the target but above the floor are deemed to be in the intermediate position and be subject to transition controls until they have submitted a credible capitalisation plan. The transition controls include a sales ban, effectively banning taking on new customers.

Ofgem publishes a financial resilience transparency report and the most recent version boasts of adjusted net assets of £7.5bn across the sector, up from minus £1.7bn during the energy crisis. However, the big picture across the whole sector masks a more troubling position in some of the individual suppliers.

Energy Supplier Performance – Capital Floor

Ofgem publishes a list of licensed electricity suppliers and this analysis has focused on the big suppliers and a selection of smaller suppliers. By looking at the published accounts of the licensed suppliers, we can identify Net Assets, Adjusted Net Assets and the number of customers or meter points.

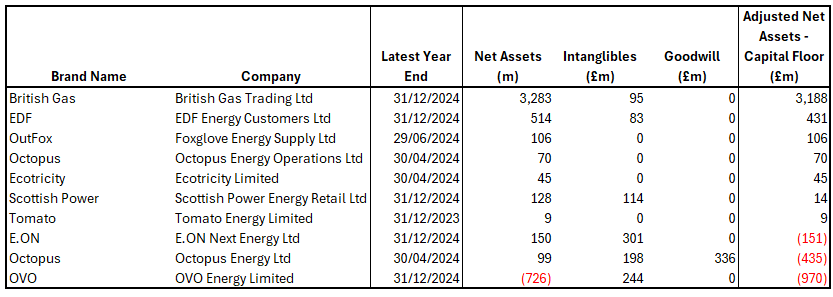

Figure 3 shows supplier performance against the capital floor requirement.

Net assets, adjusted downwards for intangibles should always be above zero. Sadly, three of the largest suppliers do not appear to meet this test.

Ovo Energy Limited owns several subsidiary companies that also hold licenses for the supply of electricity and gas; however Ovo Energy Limited appears to be the main supply company. In their 2024 accounts, Ovo Energy Limited show net assets of £-726m, they also show £244m of intangibles, making their adjusted net assets £-970m. This is well below the capital floor and Ovo has admitted that it is not in compliance with Ofgem’s regime. This non-compliance should have led to enforcement action from Ofgem, but as of 14th November 2025, it is still offering customers to switch to Ovo, see Figure 4.

A spokesperson for Ovo has said: “We have taken proactive measures to align with Ofgem’s new capital rules, working constructively to meet the requirements.”

Ovo is struggling to raise new capital from investors, maybe because it is selling electricity to EV owners at 7p/kWh, below the average wholesale cost, currently around 8p/kWh, or £80/MWh.

Octopus has two licensed companies, the main one being Octopus Energy Limited (OEL) and the second being Octopus Energy Operations Limited (OEOL), which is the vehicle that holds the customers transferred in from Bulb. For Octopus, we only have accounts up to the end of April 2024. The main company, OEL shows an improvement in Net Assets from £-64.3m in 2023 to £99.4m in 2024. However, the balance sheet also shows £335.6m of goodwill and £198.2m of other intangible assets. This means their adjusted net assets in 2024 are negative at £-435m, again well below the minimum capital floor. Octopus is also offering to take on new customers on its website, so does not appear to be subject to Ofgem enforcement action.

Octopus has said it has agreed a plan with Ofgem to meet the target. In July Octopus announced it was spinning off its Kraken technology company, with completion expected within a year. However, in an interview last month in the FT, the spin off timetable appeared to have slipped to “the next year or two”. So it isn’t clear whether the plan remains on track.

E.ON Next also has negative adjusted net assets of £-151m, again well below the minimum capital floor and it too is still open for business from new customers.

We can compare these three big players with relative minnow Tomato Energy for which we only have 2023 accounts. These accounts showed adjusted net assets of £9m, just above the minimum threshold. However, in April Ofgem stopped Tomato from taking on new customers in April because it did not meet its financial targets and has now apparently gone bankrupt. Clearly, just making the minimum threshold is not enough to maintain solvency.

Other large players like British Gas, EDF and Scottish Power easily met the minimum capital floor threshold and smaller players like Outfox and even our old friend Ecotricity had assets well above the minimum.

Energy Supplier Performance – Capital Target

To calculate supplier performance compared to the capital target we need to know the number of customers for each supplier. We should note that the definition of customer may vary by supplier and not all suppliers disclose their customer numbers in their accounts. For instance, sometimes a customer is defined as one household even though they may receive both gas and electricity and sometimes they each gas and electricity account counts as a separate customer. Bearing this in mind, where the company has disclosed the number of customers, these are treated as though the company needs to maintain £115 per customer as adjusted net assets. Where meter points are disclosed, the £57.50 per meter point is treated as the threshold.

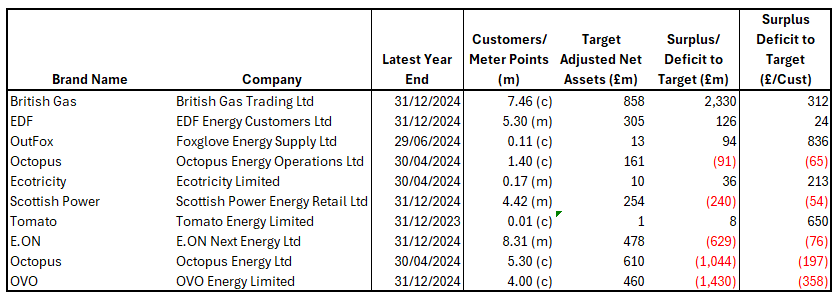

Figure 5 shows the performance of suppliers against Ofgem’s capital target.

As expected Ovo, Octopus and E.ON do not meet the more stringent capital target rules. OVO is £1.43bn short of the target or £358 per customer. OEL is over £1bn short, or £197 per customer. OEOL also fails to meet the capital target by £91m or £65 per customer. E.ON is £629m short or £76 per meter point. Even though Scottish Power meets the capital floor requirement, it does not have enough assets to meet the capital target and is short by £240m or £54 per meter point. Scottish Power is also trying to attract new customers despite being in the grey zone between the capital floor and the capital target.

EDF is above the capital target by £24 per meter point and Ecotricity also exceeds the target by £213 per meter point. The giant British Gas comfortably exceeds the target by £312 per customer, but relative newcomer OutFox has £836 per customer more than is required by Ofgem.

Conclusions

Growing energy debt is putting the finances of energy suppliers at risk. Ofgem has recognised the risks of default and of volatile energy markets and introduced rules to ensure energy suppliers have sufficient capital to withstand shocks.

While Ofgem is rightly enforcing the rules against minnows like Tomato Energy, it is reluctant to implement enforcement measures against the big players that have insufficient capital to meet even the minimum capital floor of zero adjusted net assets.

If breaking rules has no consequence for the big players, then the rules are pointless. We must call time on this charade. By capping prices and setting minimum financial thresholds Ofgem is squeezing suppliers at both ends which is unsustainable. Ofgem is asleep at the wheel as it presides over this mess of price controls, consumer subsidies for bad debts and capital shortfalls, putting our energy supply at risk.

You can help reduce energy costs by writing to your MP to ask them to demand Ed Miliband cancels AR7. Net Zero Watch have a page that helps you do this with just a few clicks:

https://www.netzerowatch.com/email-your-mp

This article (Ofgem Asleep at the Wheel) was created and published by David Turver and is republished here under “Fair Use”

Leave a Reply