No evidence that offshore wind investors are creating a ring-fenced cash pool to cover decommissioning liabilities

DAVID TURVER

Introduction

There is a scene at the beginning of the Big Short where Michael Burry asks his new recruit to find all the mortgages contained in some Mortgage-Backed Securities. A similar forensic analysis of the UK offshore wind farm fleet is long overdue. This analysis shows there is a slow burn time bomb relating to decommissioning liabilities for UK offshore windfarms. The Government have set guidelines for how companies are supposed to set aside cash to fund decommissioning once a wind farm has reached end of life, but it looks like these guidelines are being ignored.

This creates a risk that taxpayers may have to step in to fund decommissioning of offshore wind installations if developers and owners default on their liabilities.

Scale of Decommissioning Liabilities

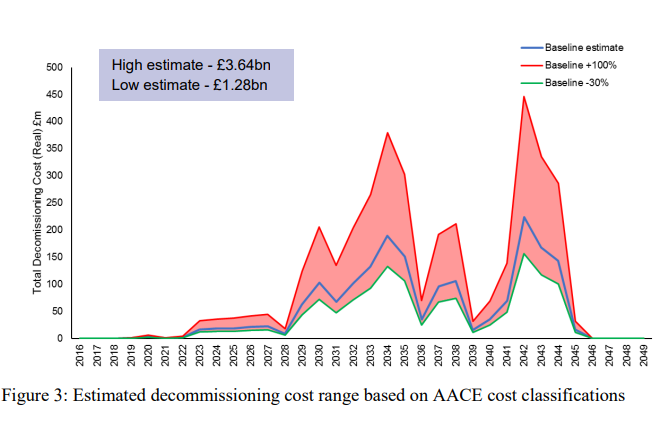

Back in 2018, BEIS estimated the baseline cost of offshore wind decommissioning for 37 offshore windfarms operating or under construction at £1.28b-£3.64n (in £2017), with costs starting to rise sharply from 2028 onwards, see Figure 1.

Since then more windfarms have been added and inflation will have increased the estimates considerably. The Government deemed current estimates of decommissioning costs to be too commercially sensitive to be released under Freedom of Information. However, analysis of the 2024 accounts of a large sample of offshore wind farms indicates that the cash costs of decommissioning are around £293m/GW, so with today’s installed base of ~16GW, decommissioning will cost ~£4.7bn over the coming 10-15 years. Of course this figure will increase as more wind farms are built.

Offshore Wind Decommissioning Regulations

BEIS set out several ways of providing for decommissioning costs in reports from 2018 and 2019 (here and here). The acceptable securities to cover decommissioning costs include upfront cash, reserving ring-fenced cash, letters of credit/bank guarantees or performance bonds. Parent company guarantees and insurance schemes are explicitly frowned upon as “not normally accepted.” However, lobby group RenewableUK has recently pushed (pp17-18) for parent company guarantees to be made more acceptable.

The regulations (5.7.9) say that the Secretary of State retains the right to keep the original developer/owner liable for decommissioning if all or part of the development is sold on to third parties. Moreover, if the development company is wound up, the Government will seek to make a parent company liable for decommissioning.

There is no evidence that owners are building up reserves of cash to fund liabilities and are instead making implicit parent company guarantees of varying quality. Windfarms provide for decommissioning liabilities in their accounts by simply entering a provision to reduce assets. Typically, they calculate the expected cash cost of decommissioning at the end of the useful life of the asset and estimate the present value of the liability using an appropriate discount rate. For example, if the cash cost of decommissioning is estimated at £300m in five years and the discount rate is 5%, then the present value of the provision in the accounts will be ~£235m. They are not creating a pool of ring-fenced cash to fund future liabilities. Effectively, they are relying upon parent companies to provide decommissioning cash when the subsidies run out and the wind farms become uneconomic to run. The recent rights issue from Orsted demonstrates that operators’ finances might not be as strong as we have been led to believe and calls into question the quality of parent company guarantees. We can see we have a ticking timebomb of potentially uncovered liabilities.

Treatment of Decommissioning by Large Operators

We can illustrate the problem by examining the treatment of decommissioning by several offshore windfarms.

Orsted Barrow Wind Farm

Orsted windfarms typically declare a decommissioning provision in the accounts of the wind farm. For instance, in the latest 2023 accounts, Barrow wind farm has declared a decommissioning liability of £46.4m. The windfarm came into operation in 2006 and has an expected life of 20 years, the estimated cash cost of decommissioning using their discount rate of 4.25% is £52.6m. However, when the liability is traced up the ownership chain to Orsted Power (UK) Limited no decommissioning liabilities are declared because they only show the company balance sheet, not a consolidated balance sheet. The Danish parent company declares (Note 3.9) an overall discounted decommissioning liability for their share of their total offshore wind fleet of DKK9.35bn (~£1.1bn) for 2024. None of the cash on the balance sheet (Note 5.4) is ring-fenced to cover decommissioning.

Scottish Power East Anglia One

Scottish Power owns 60% of and operates the East Anglia One (EA1) offshore wind farm. The latest 2023 accounts for EA1 show that the operator reports an asset life of 23 years and expects the windfarm to continue operating until 2043 or 2044. This is an ambitious lifespan because EA1 started collecting subsidies from Contracts for Difference (CfDs) in 2019 which would be expected to expire in 2034. The CfD strike price is currently ~£171/MWh, well above current market rates of ~£75/MWh, so revenues and profits would be very much lower without subsidies. The accounts show a discounted decommissioning cost of £82.3m, giving an estimated cash cost of £189m using their 4.24% discount rate. This liability appears to flow up to Scottish Power Renewables.

However, EA1 is 40% owned by Bilbao Offshore Holding Limited (BOHL) which is the vehicle used by The Renewables Investment Group (TRIG) and others to hold their combined stake. The trouble is that BOHL do not even mention decommissioning in their accounts and do not show a provision for the liability. Investment company TRIG is the ultimate holder of 14.3% of EA1 and makes no specific provision in its accounts for decommissioning any of its assets, although Note 18 says they have issued £34.8m of decommissioning and other similar guarantee bonds for their whole portfolio. However, they also say those bonds have a negligible fair value, meaning they have not made a provision to reduce the asset value of the company.

RWE London Array

The London Array windfarm is operated by RWE who own 30% of the asset and investment group, Greencoat owns 25%. RWE Renewables UK London Array Limited holds RWE’s stake and made a decommissioning provision of £38.6m in its 2024 accounts, using a discount rate of 4.75% and their asset life of 23 years gives an estimated cash cost of £67.4m for their share and an implied cost of £128.7m to decommission the whole windfarm. They expect decommissioning to take place in 2036, some four years after the Renewables Obligation Certificate (ROC) subsidies run out. There is only £4.1m of cash on the balance sheet. RWE Renewables UK holds RWE’s UK renewables portfolio, but their accounts make no mention of decommissioning liabilities. RWE AG in Germany is the ultimate holding company and has made a provision of €1.36bn to decommission its entire solar, onshore and offshore portfolio in its 2024 accounts (Note 22), but there is apparently no ring-fenced cash held.

Interestingly, the Government data in response to the FOI request linked above shows an asset life of only 20 years with decommissioning taking place in 2033.

Greencoat London Array Limited owns Greencoat’s stake in London Array. It is interesting that Greencoat assume the windfarm will have a life of 30 years, seven years longer than the RWE’s assumption for the same windfarm and 10 years longer than the Government. Their latest 2023 accounts (Note 13) declare a £36.8m decommissioning provision with only £4m cash on the balance sheet and no ring-fenced cash. Greencoat UK Wind plc (UKW) owns part of Greencoat’s overall stake in London Array. Their accounts (Note 10) show guarantees provided by the group totalling some £280m, of which £20m is a guarantee for London Array. However, they also say that the fair value of all their guarantees and indemnities is zero, so they do not create a provision to reduce their asset value and there is no ring-fenced cash.

Impact of Expiring Subsidies on Asset Life

Earlier this year, it was announced that Germany’s first offshore wind farm, Alpha Ventus would shut down after 15 years because it was not economic after the subsidies ran out. This shows that the asset lives being assumed by UK operators might be too optimistic. We can illustrate the impact of subsidies running out by looking at another of Greencoat’s offshore windfarms, North Hoyle.

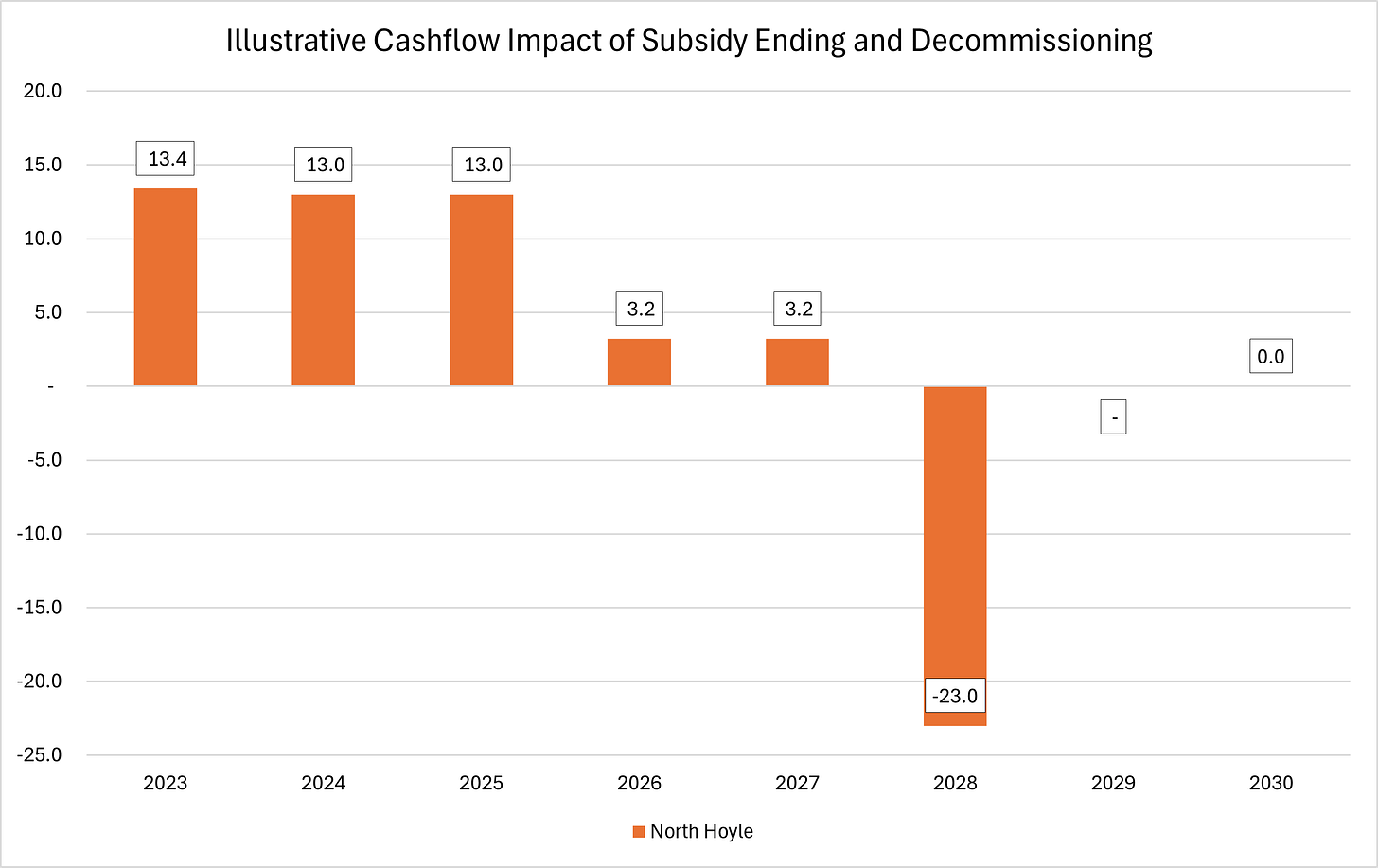

North Hoyle began operation in 2004. If it began earning ROCs in 2005, then they should run out this year. In the most recent accounts for 2024, North Hoyle generated £13m of operating cashflow and paid a £12.1m dividend to the parent company. However, Ofgem’s RER website shows that North Hoyle earned ROCs worth £9.8m, meaning the subsidy-free cashflow would have been only about £3.2m and the dividend correspondingly lower. The ROCs earned show that generation is declining too, with 2024 generation of 155GWh, down from nearly 190GWh in 2020. The accounts show that Greencoat expects the windfarm to have a 30-year life to 2035 and has made a discounted £12.1m provision for decommissioning that equates to a cash cost in 2035 of £23m using their 6% discount rate.

It would not take much of a decrease in generation, reduction in power prices or an increase in operating costs for the subsidy-free cashflow to go negative. RWE has already warned of low wind impacting profits this year. North Hoyle would then be uneconomic and would need to shut down and decommissioned. Figure 2 shows the illustrative impact on cashflows if the windfarm became uneconomic in 2028, far earlier than the assumed asset life.

Positive cashflows of £13m would turn to a negative cashflow of £23m in 2029 and zero thereafter which would have a big impact on asset values and cashflows for the parent company.

Market Losing Confidence

The five-year price charts for both TRIG and Greencoat UKW shown in Figure 3 demonstrate the market is losing confidence in funds focused on renewables.

The share price of each stock is down from the peaks in late 2022 and the net asset value (NAV) – pink lines – of each stock is also down. Both stocks are trading at a significant discount to NAV. As we saw above, the decline in NAV may not tell the whole story because neither TRIG nor UKW have made provision for decommissioning liabilities in their accounts. Not only that, both companies classify almost all their assets as Level 3, meaning they are not based on observable prices, rather they are subject to “significant judgement.” This is a fancy way of saying that the management effectively calculate their own values for the assets they hold.

In 2024, TRIG paid out £183.5m in dividends and bought back £20.9m of shares despite having no ring-fenced cash to cover decommissioning liabilities. Similarly, Greencoat UKW paid £249.8m in dividends and purchased £80.4m of its own shares during 2024. There was no ring-fenced cash for decommissioning, despite the risk that one of its oldest windfarms will drop out of the subsidy regime as soon as this year. Both companies are still buying back shares this year in an attempt to shore up their share prices.

There is another scene in the Big Short where Jared Vennett explains to Mark Baum, that if Mortgage-Backed Securities are dog sh1t, then Collateralised Debt Obligations (CDOs) are dog sh1t wrapped in cat sh1t. In our example, windfarms might be described as Subsidy Backed Securities and Renewables Funds are the equivalent of CDOs. In the film it took the market a while to catch up with reality. In this case, maybe the market is waking up to the decommissioning risks inside the portfolios of these funds. If the windfarms have to be decommissioned earlier than planned, asset values and cashflows will fall. This calls into question their ability to fund the decommissioning of their entire portfolio if they are not forced to create a pool of ring-fenced cash now instead of distributing their cash to shareholders.

Conclusions

Offshore wind decommissioning is a topic that is not discussed enough. Detailed analysis of the accounts of these companies shows they are not creating pools of ring-fenced cash to cover future liabilities. They are effectively relying upon parent company guarantees, a method that is supposedly frowned upon by the Government. While the risks of default from diversified companies like RWE and Scottish Power may be low, Orsted’s recent rights issue announcement and subsequent share price bloodbath shows that the risks inherent in renewables pure plays are much higher than previously thought.

The funds like TRIG and UKW that hold stakes in these windfarms represent a particular risk. UKW looks to be playing fast and loose with asset lives and both do not appear to be properly funding future decommissioning liabilities. Yet, they are distributing hundreds of millions of pounds to shareholders through dividends and share buybacks. This is the offshore wind decommissioning timebomb – a disaster waiting to happen.

The Government should tighten the rules surrounding funding offshore wind liabilities. Companies that hold stakes in these windfarms should be forced to create ring-fenced cash pools that grow to cover the full liability before the subsidies run out.

This Substack now has over 4,500 subscribers and is growing fast. If you enjoyed this article, please share it with your family, friends and colleagues and sign up to receive more content.

I have been invited to speak at the Battle of Ideas Festival in October on the subject of “Why is my energy bill so high?” Early-bird discounted tickets are still available, although they end today (7 September). But regardless you can get 20% off any ticket price by clicking on this link.

This article (Offshore Wind Decommissioning Timebomb) was created and published by David Turver and is republished here under “Fair Use”

••••

The Liberty Beacon Project is now expanding at a near exponential rate, and for this we are grateful and excited! But we must also be practical. For 7 years we have not asked for any donations, and have built this project with our own funds as we grew. We are now experiencing ever increasing growing pains due to the large number of websites and projects we represent. So we have just installed donation buttons on our websites and ask that you consider this when you visit them. Nothing is too small. We thank you for all your support and your considerations … (TLB)

••••

Comment Policy: As a privately owned web site, we reserve the right to remove comments that contain spam, advertising, vulgarity, threats of violence, racism, or personal/abusive attacks on other users. This also applies to trolling, the use of more than one alias, or just intentional mischief. Enforcement of this policy is at the discretion of this websites administrators. Repeat offenders may be blocked or permanently banned without prior warning.

••••

Disclaimer: TLB websites contain copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available to our readers under the provisions of “fair use” in an effort to advance a better understanding of political, health, economic and social issues. The material on this site is distributed without profit to those who have expressed a prior interest in receiving it for research and educational purposes. If you wish to use copyrighted material for purposes other than “fair use” you must request permission from the copyright owner.

••••

Disclaimer: The information and opinions shared are for informational purposes only including, but not limited to, text, graphics, images and other material are not intended as medical advice or instruction. Nothing mentioned is intended to be a substitute for professional medical advice, diagnosis or treatment.

Disclaimer: The views and opinions expressed in this article are those of the author and do not necessarily reflect the official policy or position of The Liberty Beacon Project.

Leave a Reply