NESO’s economic annex dramatically understates the cost of Net Zero.

DAVID TURVER

Introduction

Over the summer NESO promised to publish an Economic Annex to its Future Energy Scenarios (FES) report setting out the cost of its various Net Zero pathways. It was originally due to be published in late summer, then early October, then late October and it finally arrived last week. We can only speculate about the cause of the delays, but NESO’s analysis certainly blows the doors off any claim that Net Zero is going to be affordable.

It has been reported in the press that NESO’s Holistic Pathway to Net Zero will cost £350bn more than their Falling Behind scenario that does not achieve the emissions reductions targets by 2050. However, more detailed examination of the underlying data shows the real situation is far worse than that. Let’s dig in.

Net Zero Pathway Costs More than Falling Behind

Alongside the Annex NESO has published several workbooks that contain their underlying assumptions and calculations. We should also note that the underlying data in each workbook do not always entirely agree with the top level. That may be a mistake in my interpretation, or a mistake in the underlying data. Nevertheless, the numbers are close enough for high level analysis.

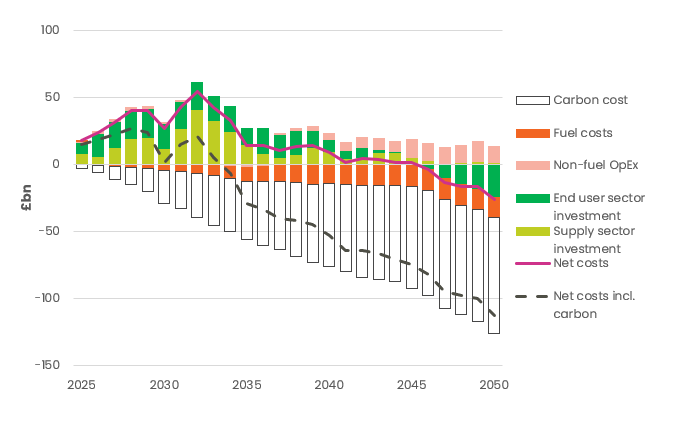

The headlines above are generated by the underlying data supporting Figure 1 below.

The source data shows the cumulative net cost from 2025 to 2050 of the Holistic Transition pathway being some £362bn higher than Falling Behind, even though there are small net savings from 2046 onwards. If carbon costs are included, Holistic Transition becomes cheaper than Falling behind by a total of £928bn. But as we shall see below, the carbon costs are made-up figures to make fossil fuels look expensive and renewables cheap.

Figure 1 (NESO’s Figure 11) is based on the cash capital expenditure (capex) and operating expenses (opex). It does not include an allowance for cost of capital. Their Figure 12 calculates the annualised cost by spreading the capex over the life of the asset and assuming various interest rates as cost of capital. This shows the cumulative extra cost of the Holistic Pathway rises to £614bn and the saving with carbon costs included falls to £675bn.

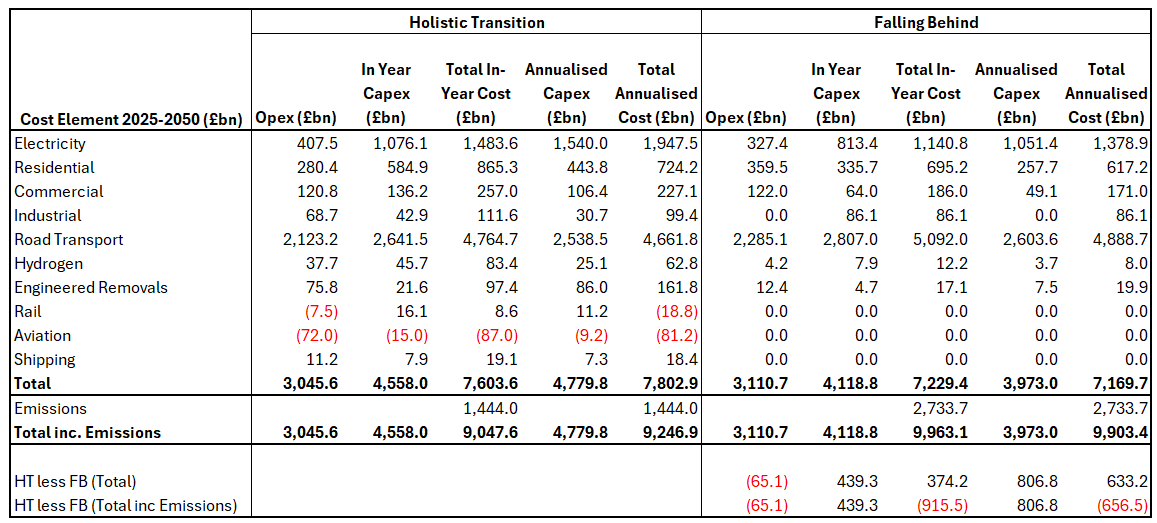

However, if we delve into their Economic Output Workbook and summarise the costs of each element an even worse picture emerges, see Figure 2.

The total in-year opex and capex for Holistic Transition is £7,603bn compared to £7,229bn for Falling behind, putting the difference at around £374bn. The difference in the total annualised cost rises to almost £633bn. The savings from including carbon costs both fall too.

Even by their own figures we can see that continuing at a breakneck speed on the Holistic Transition pathway is going to be hundreds of billions of pounds more expensive than going more slowly on the Falling Behind path. The Falling Behind pathway still includes a lot of spending on renewables and other infrastructure making that pathway even more expensive than doing nothing further, what we might terms the Stop the Race scenario.

Fake Costs to Reduce Cost of Net Zero

Now of course the difference between two very large numbers is extremely sensitive to small changes in either number. As we shall see below we have reason to believe that the costs of Holistic Transition have been under-stated and the costs of Falling Behind have been over-stated, meaning in reality the extra cost of remaining on the path to Net Zero is much larger than falling behind the targets.

Let us take a canter through some of the most important areas starting with the electricity sector.

Optimistic Capital Costs

In its Economics Assumptions workbook NESO explains that it uses the government’s discredited Generation Cost 2023 report as the basis for its capex calculations. They do say they have made some adjustments to the Government figures, but it is sad that NESO chooses to use a discredited report based on models rather than look at the accounts of actual wind and solar farms and the prices on offer in the current renewables Allocation Round 7.

For offshore wind they assume £2.6bn/GW of capacity for delivery in 2025 and they assume costs fall to just £2.0bn/GW by 2035. The Planning Inspectorate forecast the 2.4GW Hornsea 4 project would cost £5-8bn in 2021. Hornsea 4 was recently cancelled by Orsted, so the costs have likely ballooned above even the high estimate that would have meant a cost of £3,333/kW, well above NESO’s estimates. We should note that it is not clear whether the cost of the offshore transmission asset is included in either figure.

NESO estimates capital costs for solar of £616.6/kW for projects delivering in 2025, falling to £379.5/kW in 2035. Both Alfreton and Stokeford solar farms were awarded contracts in AR4 and activated their CfDs earlier this year. We now have the 2024 accounts for both projects and we can see that Stokeford has spent £952/kW and Alfreton some £995/kW, both well above NESO’s estimate.

Optimistic Asset Lives

They assume assets lives of 35, 25, 30 and 28 years for solar, onshore wind, fixed offshore wind and floating offshore wind, respectively. Renewables Obligation subsidies last 20 years, current Contracts for Difference 15 years and new contracts on offer for AR7 have been extended to 20 years.

The reality of the UK weather is that when it is sunny, it tends to be sunny across most of the country. Similarly, it tends to be windy across the whole country and the North Sea at the same time. This means that solar panels will produce most of their output on sunny days when demand is low and windfarms produce most on windy days. At these times, the value of the output of solar and windfarms can fall to zero. It is fanciful to believe that solar and wind installations can operate profitably without subsidy beyond the subsidy period.

Yet, NESO assumes long asset lives which mean capital costs are spread over a much longer period, bringing down their estimate of the cost of electricity. At the same time they assume a 25-year life for gas-fired plants, when we are currently working out how to run our existing fleet to 30 or even 40 years. This of course pushes up their estimates of the cost of gas-fired generation.

Low Cost of Capital

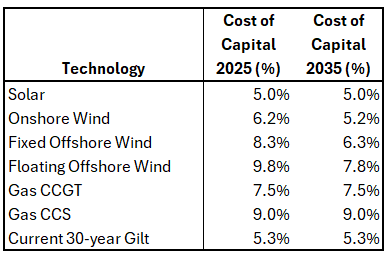

NESO records the expected cost of capital for the various technologies as shown in Figure 3.

NESO assumes a cost of capital of just 5% for solar power, less than the current yield on 30-year gilts around 5.3%. They also assume the cost of capital for onshore wind falls to just 5.2% in 2035. Why would any rational investor take the risk of a solar or wind investment when they can achieve better returns buying gilts?

For offshore wind they start with a cost of capital of 8.3% in 2025 and then say this will fall to 6.3% in 2035. Orsted’s cost of capital is around 6.5% and they aim for returns 1.5-3% above their cost of capital so, their target discount rate will be 8-9.5%, well above the NESO assumptions for 2035.

For gas-fired generation they assume discount rates in 2035 of 7.5%, higher than solar, onshore and fixed bottom offshore wind. The impact of using low discount rates for renewables drives down their reported cost of electricity and higher discount rates for gas drive up the calculated cost of gas-fired power.

Optimistic Load Factors

For fixed-bottom offshore wind NESO assumes a load factor of 51% in 2025, falling to 46.8% in 2035. The CfD-funded offshore wind fleet achieved 46.8% for just one year in 2020 and all other years have seen lower load factors with 2024 falling to 38.8%. Similarly, they assume 30.3-31.3% load factors for onshore wind. The CfD-funded onshore wind fleet averaged a load factor around 25% from 2021-2024.

Optimistic load factors again bring down the calculated cost of electricity from renewables.

Fantasy Costs of Electricity

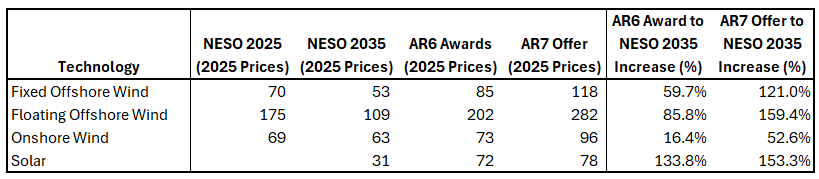

They use these optimistic assumptions to calculate the cost of electricity as shown in Figure 4 below.

They calculate the cost of offshore wind as £70.10/MWh in 2025, falling to just £53.20/MWh in 2035. In the same 2025 prices, Hornsea 4 won a contract last year at £85/MWh and was cancelled as uneconomic. AR7 is offering £118/MWh in September 2025 prices for 20-year contracts, some 121% above NESO’s estimate for 2035.

They assume Floating Offshore wind will cost £109/MWh in 2035 despite contracts being awarded at £202/MWh in AR6 and £282/MWh being on offer in AR7. Onshore wind will apparently cost just £63/MWh in 2035 despite £96/MWh being on offer in AR7. They assume solar will cost just £31/MWh in 20235 despite AR6 contract awards ~£72/MWh and £78/MWh being on offer in AR7.

Impact of Fake Electricity Costs

NESO’s levelised costs are from the realms of fantasy which means that their cost estimates for Holistic Transition are way too low. Holistic Transition assumes spending £580bn on generation assets out to 2050, but what is surprising is that Falling Behind assumes £390bn of spending on generation assets. This is because Falling Behind assumes offshore wind capacity goes up more than five-fold from 15.5GW in 2024 to over 80GW in 2050. Onshore wind more than doubles to 36GW and solar more than triples to 62.8GW. Under Falling Behind, unabated gas capacity rises from 39.3GW to 45.2 GW and CCUS enabled gas goes from zero to 16.8GW, or a total of 62GW of gas-fired capacity. A notional Stop the Race scenario could avoid much of these costs, saving ~£200bn of the spend on new renewables capacity planned in Falling Behind.

NESO’s treatment of transmission costs also leaves a lot to be desired. They calculate a total of £315.6bn of onshore and offshore spending on transmission by 2050 under the Holistic Transition scenario and £272.8bn on Falling behind. Almost all this extra spending is to connect and manage the impact of remote renewables situated far from the source of demand. Most of this spending could be avoided if we adopted the notional Stop the Race scenario, saving at least another £200bn.

If we stopped the hydrogen and engineered removals programme, we could save £180bn from the Holistic Transition and £29bn from the costs of Falling Behind.

A hundred billion here, a hundred billion there and soon you are talking real money – if we stopped Net Zero now, there is well over £400bn to save against the Falling Behind Pathway from not spending on renewables generation and the associated transmission infrastructure. We would no doubt find even more savings if we dug into Distribution with £139bn of spending in Falling Behind), Storage (£12.4bn) and Interconnector costs (£1.9bn).

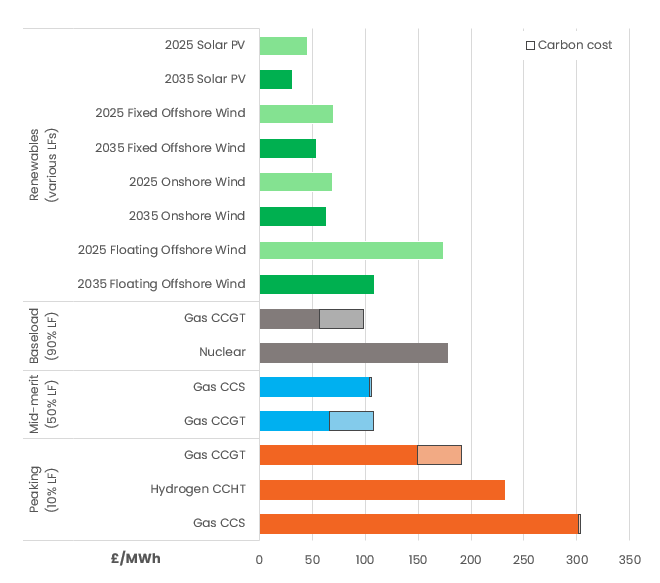

It is also important to note that the assumed operating cost savings from electrification of everything will not materialise because they are assuming costs of renewables electricity that are far too low and gas-fired electricity that is too high, see Figure 5.

They say the basic baseload cost of gas-fired generation will be £57/MWh in 2035 which looks like a reasonable assumption. But they add £41.80/MWh of carbon costs giving a total of almost £99/MWh make the electricity look much more expensive. They assume traded carbon costs £78.70/t in 2025 and rises to £114.7/t in 2050. UK carbon prices were about £30/t in January this year, then leapt to £44/t as it was rumoured the UK would align with the EU emissions trading scheme. Since then Keir Starmer has announced we will indeed align with the EU and the carbon price has risen to about £56/t. Even though these costs are too high, NESO is assuming even higher and steadily rising costs to make gas-fired generation look even more expensive.

Just as an aside they assume hydrogen will cost just £56.43/MWh in 2035, yet the government awarded contracts for green hydrogen in HAR1 at £175/MWh in 2012 prices, or over £250/MWh in 2025 money. This means the cost of electricity they assume from a hydrogen peaking plant of £231/MWh is also much too low, less than half the likely cost.

If we use realistic costs for renewables and remove the made-up fake costs of carbon, gas-fired electricity becomes cheap. This would push up the operating costs of Holistic Transition, reduce the costs of Falling Behind and adopting the Stop the Race scenario and save trillions of pounds.

Other Glaring Issues

For 2025, NESO assumes that a petrol/diesel car will cost £38,354, slightly less than a hybrid car costing £39,160 and a full battery electric vehicle costing £43,254. By 2028, petrol cars will go up to £39,999, but hybrid cars with a petrol engine, battery and electric motor will cost less than a basic petrol car at £39,250 and EV costs will fall to £38,500.

First, as an average this looks too high and second, the current differential between petrol cars and EVs is much higher than their 12.8% estimate. The manufacturers recommended price of a VW Golf Life 1.5l is £24,470 and the most basic VW ID.3 Life costs £32,990 (or £29,990 with subsidy) some 34.8% (22.6%) more than the petrol model. Differentials get even wider for higher specification Style models, 42.8% before subsidy and 31.1% after. Of course, using a tight differential between petrol cars and EVs makes the capital cost of the transition look cheaper than reality.

NESO duck the actual costs of Rail, Aviation and Shipping by adopting the Climate Change Committee approach of simply reporting the difference in costs compared to the Falling Behind scenario. It does seem rather unlikely that we will save £87bn of in-year opex and capex costs in aviation by continuing with the Holistic Transition.

Conclusions

The original press reports claiming that adopting the Falling Behind scenario would save £350bn compared to continuing with Holistic Transition were very damaging to the Net Zero cause. However, detailed analysis of the numbers demonstrates that the cost of Holistic Transition is under-stated by a considerable margin and the costs of Falling behind are over-stated.

There are hundreds of billions of electricity generation and infrastructure capex savings and hundreds of billions more savings in the cost of vehicles and the cost of electricity if we cease this nonsense. Both NESO scenarios are much more expensive than Stopping the Race to Net Zero. We can see now why the Economic Annex was delayed – NESO has inadvertently blown the doors off Net Zero.

This article (NESO Blows the Doors Off Net Zero) was created and published by David Turver and is republished here under “Fair Use”

••••

The Liberty Beacon Project is now expanding at a near exponential rate, and for this we are grateful and excited! But we must also be practical. For 7 years we have not asked for any donations, and have built this project with our own funds as we grew. We are now experiencing ever increasing growing pains due to the large number of websites and projects we represent. So we have just installed donation buttons on our websites and ask that you consider this when you visit them. Nothing is too small. We thank you for all your support and your considerations … (TLB)

••••

Comment Policy: As a privately owned web site, we reserve the right to remove comments that contain spam, advertising, vulgarity, threats of violence, racism, or personal/abusive attacks on other users. This also applies to trolling, the use of more than one alias, or just intentional mischief. Enforcement of this policy is at the discretion of this websites administrators. Repeat offenders may be blocked or permanently banned without prior warning.

••••

Disclaimer: TLB websites contain copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available to our readers under the provisions of “fair use” in an effort to advance a better understanding of political, health, economic and social issues. The material on this site is distributed without profit to those who have expressed a prior interest in receiving it for research and educational purposes. If you wish to use copyrighted material for purposes other than “fair use” you must request permission from the copyright owner.

••••

Disclaimer: The information and opinions shared are for informational purposes only including, but not limited to, text, graphics, images and other material are not intended as medical advice or instruction. Nothing mentioned is intended to be a substitute for professional medical advice, diagnosis or treatment.

Disclaimer: The views and opinions expressed in this article are those of the author and do not necessarily reflect the official policy or position of The Liberty Beacon Project.

Leave a Reply