How Do You Do, Mr Bradbury

IAIN HUNTER

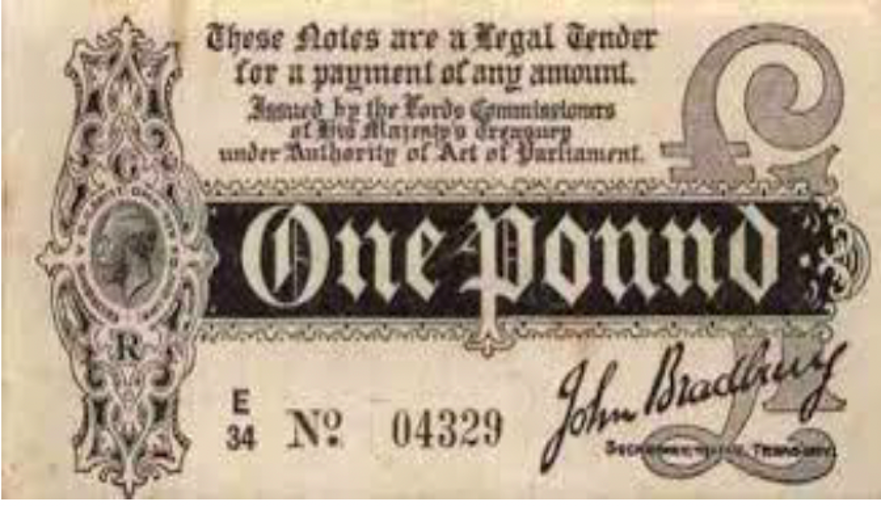

A brief anecdote to begin: In my early days in the RAF in the 1970s, I knew a squadron adjutant who used to call a one-pound bank note a ‘Bradbury’. I’d never heard the expression before, so I asked him why he used it. He said it was the name of the fellow whose signature appeared on bank notes promising to ‘pay the bearer on demand’. I thought it was different, a bit cool even, so I dropped ‘quid’ and ‘nicker’ and used the term myself for a few years. I thought no more about it until quite recently but it’s not quite true anyway.

Thomas Jefferson, the third President of the United States, certainly grasped the problem of private banks and the issuance of money when he wrote the following in 1816, shortly after Nathan Mayer Rothschild had made his colossal fortune in the wake of the Battle of Waterloo:

“If the American people ever allow private banks to control the issue of their currency, first by inflation, then by deflation, the banks and corporations that will grow up around [the banks] will deprive the people of all property until their children wake-up homeless on the continent their fathers conquered. The issuing power should be taken from the banks and restored to the people, to whom it properly belongs.”

“I sincerely believe that banking establishments are more dangerous than standing armies, and that the principle of spending money to be paid by posterity under the name of funding is but swindling futurity on a large scale.”

Nearly fifty years later, during the American Civil War in the 1860s, President Abraham Lincoln faced a funding problem if he was to defeat the South. Knowing that using loans from private bankers at interest rates of between 24 and 36 per cent would strangle the country after the war and be almost impossible to repay, he opted for a different solution.

He took the advice of a trusted businessman, a Colonel Dick Taylor of Illinois, and printed debt-free and interest-free paper dollars based on nothing more than the integrity of his government. These were the famed ‘greenbacks’, so-called because they were green on one side only.

The United States Treasury issued 450 million dollars’ worth of these notes which were readily accepted by the people as legal tender. The North won the war and the currency, which proved very popular, seemed set to continue. In the words of Lincoln himself:

“The government should create issue and circulate all the currency and credit needed to satisfy the spending power of the government and the buying power of consumers….. The privilege of creating and issuing money is not only the supreme prerogative of Government, but it is the Government’s greatest creative opportunity. By the adoption of these principles, the long-felt want for a uniform medium will be satisfied. The taxpayers will be saved immense sums of interest, discounts and exchanges. The financing of all public enterprises, the maintenance of stable government and ordered progress, and the conduct of the Treasury will become matters of practical administration. The people can and will be furnished with a currency as safe as their own government. Money will cease to be the master and become the servant of humanity. Democracy will rise superior to the money power.”

However, the response by the private bankers to this sudden threat to their banking empire was swift and brutal as this extract from The Times of London in 1865 shows:

“If that mischievous financial policy, which had its origin in the North American Republic, should become indurated down to a fixture, then that Government will furnish its own money without cost. It will pay off debts and be without a debt. It will have all the money necessary to carry on its commerce. It will become prosperous beyond precedence in the history of the civilised governments of the world. The brains and the wealth of all countries will go to North America. That government must be destroyed, or it will destroy every monarchy on the globe.”

On Good Friday, April 14th 1865, the actor John Wilkes Booth shot President Abraham Lincoln. His greenback dollars died with him as, in the aftermath of his assassination, the private bankers managed to ‘persuade’ the US Congress to revoke Lincoln’s initiative and replace it with the debt creating National Banking Act. This in turn paved the way for the creation of the privately-owned (but public sounding) Federal Reserve system in 1913. The story of this is told in G Edward Griffin’s well-known book The Creature from Jekyll Island. Since then, America’s federal debt mountain has ballooned; it now stands at $37.5 trillion, and it is still growing. These numbers are terrifying even for a country such as the USA.

It may surprise some, but Britain has had its own experience with treasury-issued money. To borrow a phrase, ‘Not a lot of people know that’. The best way to relate what happened is to let someone who was there tell the story. The Rt. Hon Thomas Johnston MP, a former Lord Privy Seal and Secretary of State for Scotland during the Second World war, wrote The Financiers and the Nation in 1934. There is no mention of this book on his Wikipedia page. It was republished in 1994 by Ossian Publishers Ltd but the text of the book is available here. The following is from Chapter 6 Usury on the Great War.

WHEN the whistle blew for the start of the Great War in August 1914 the Bank of England possessed only nine millions sterling of a gold reserve, and, as the Bank of England was the Bankers’ Bank, this sum constituted the effective reserve of all the other Banking Institutions in Great Britain.

The bank managers at the outbreak of War were seriously afraid that the depositing public, in a panic, would demand the return of their money. And, inasmuch as the deposits and savings left in the hands of the bankers by the depositing public had very largely been sunk by the bankers in enterprises which, at the best, could not repay the borrowed capital quickly, and which in several and large-scale instances were likely to be submerged altogether in the stress of war and in the collapse of great areas of international trade, it followed that if there were a widespread panicky run upon the banks, the banks would be unable to pay and the whole credit system would collapse, to the ruin of millions of people.

Private enterprise banking thus being on the verge of collapse, the Government (Mr. Lloyd George at the time was Chancellor of the Exchequer) hurriedly declared a moratorium, i.e. it authorized the banks not to pay out (which in any event the banks could not do), and it extended the August Bank Holiday for another three days. During these three or four days when the banks and stock exchanges were closed, the bankers held anxious negotiation with the Chancellor of the Exchequer. And one of them has placed upon record the fact that ‘he (Mr. George) did everything that we asked him to do.’ When the banks reopened, the public discovered that, instead of getting their money back in gold, they were paid in a new legal tender of Treasury notes (the £1 notes in black and the 10s. notes in red colours). This new currency had been issued by the State, was backed by the credit of the State, and was issued to the banks to prevent the banks from utter collapse. The public cheerfully accepted the new notes; and nobody talked about inflation.

To return, however, to the early war period, no sooner had Mr. Lloyd George got the bankers out of their difficulties in the autumn of 1914 by the issue of the Treasury money, than they were round again at the Treasury door explaining forcibly that the State must, upon no account, issue any more money on this interest free basis; if the war was to be run, it must be run with borrowed money, money upon which interest must be paid, and they were the gentlemen who would see to the proper financing of a good, juicy War Loan at 31/2 per cent, interest, and to that last proposition the Treasury yielded. The War was not to be fought with interest-free money, and/or/with conscription of wealth; though it was to be fought with conscription of life. Many small businesses were to be closed and their proprietors sent overseas as redundant, and without any compensation for their losses, while Finance, as we shall see, was to be heavily and progressively remunerated.

The City of London stood exposed for all to see. Whilst millions of British servicemen were doing what they believed was their patriotic duty and being killed, maimed and psychologically wrecked in their hundreds of thousands, British bankers, safely at home, were interested only in one thing – how to make a large profit from the war. As a result of their greed and prevention of the continuance of the Bradbury Treasury Notes, Britain’s National Debt rose from £650 million in 1914 to a staggering £7.5 billion in 1919.

Not only is this not taught in the general history of the Great War – along with much else about the origins of it, I might add – this fact remains hidden today on the website of the Debt Management Office of HM Treasury. Instead, it says this:

The threat of World War One pushed British banks into crisis; exacerbated further as half the world’s trade was financed by British banks and as a consequence international payments dried up. In response to this crisis, John Maynard Keynes (the renowned economist), persuaded the Chancellor Lloyd George to use the Bank of England’s gold reserves to support the banks, which ended the immediate crisis. Keynes stayed with the Treasury until 1919. The war years of 1914-18 had seen an increase in the National Debt from £650 million at the start of the war to £7,500 million by 1919. This ensured that the Treasury developed new expertise in foreign exchange, currency, credit and price control skills and were put to use in the management of the post-war economy. The slump of the 1930s necessitated the restructuring of the economy following World War II (the national debt stood at £21 billion by its end) and the emphasis was placed on economic planning and financial relations.

The £300 millions of Bradbury debt-free Treasury Notes issued in 1914 are not mentioned. Instead, it says Lloyd George, on the advice of John Maynard Keynes, used the Bank of England’s gold reserves which, according to Thomas Johnston, only amounted to £9 million. So, what is the truth? Are HM Government just puppets of the City of London which doesn’t want us to know about the simple but effective concept of debt-free and interest-free Treasury money?

Could we replicate this today to free ourselves from fiat currency debt slavery and the looming threat of Central Bank Digital currency? To paraphrase Lincoln, could we be furnished with a currency as safe as our own government, so that money will cease to be the master and become the servant of humanity, and democracy rise superior to the money power?

First, we must be aware that if a government suddenly started to print its own money through its treasury based on the credit and wealth of the country, instead of going through its central bank, we could be heading towards what happened in the Weimar Republic. However, a close look at what actually happened in Germany at that time will reveal that it wasn’t Germany’s treasury but the privately controlled central bank, the Reichsbank, which was printing the money coupled with the extreme actions of currency speculators and foreign investors.

Hyperinflation should not happen as a result of Treasury issued money because a democratically elected government would actually ‘govern’. What a wild idea! Speculation would be prevented, and most importantly, the newly created money would be spent on a productive economy and put towards outrageous and grand ideas such as re-industrialising the country.

An objection that might come from system-servers is that the country is already printing its own money with Quantitative Easing, that injection of money into the economy which only seems to get as far as the banks. But it is the Bank of England doing the printing and not HM Treasury. Based as it is on government issued Bonds (promissory notes based on the wealth of the nation), this process only increases the National Debt, and it solves nothing.

If we were to switch to Treasury money on what would it be based? How about taking the net worth of the entire country? From the Office of National Statistics, the total net worth of the United Kingdom in June this year was £31.9 trillion . To this we could add the value of the Human Capital Stocks which was last estimated in 2022 to be £25.5 trillion making £57.4 trillion in total. We wouldn’t even have to add our annual GDP, and this doesn’t include the value of untapped natural resources. The current total broad money supply is £3.122 trillion so that would be covered 18 times over or 10 times over if we were to ignore Human Capital Stocks.

We’d need the political will and a crisis, which may not be far off, to take advantage of. It could have been done in the financial crisis of 2008. Instead of issuing gilt stocks which the bank of England ‘bought’ with money newly created for the purpose, Prime Minister Gordon Brown could instead have instructed Chancellor Alistair Darling to issue Treasury money and told the central bankers to go whistle. Would such a move come from the ‘uniparty’? I seriously doubt it. From ReformUK? Maybe, but it is not yet showing the intellectual heft for this sort of imaginative action. We would first need a government which the people can trust, and we would need a thoroughly purged and reformed Civil Service running the Treasury.

Just think about it though. We could have no budget deficit and no national debt. All debts created by fraudulent fractional reserve banking could be written off. We could have a low flat rate of income tax such as Russia’s 13% with an income tax threshold set at average earnings or even no income tax at all. Capital Gains Tax and Inheritance Tax could be abolished. The government could be funded entirely by a far simpler Tax Code based only on transactions taxes and tariffs.

However, it wouldn’t be done without one hell of a fight, and we could expect the bankers to come out swinging. Would other countries oppose it? Maybe. Would the EU? Almost certainly. Much will depend on what happens in the United States. If President Trump implements NESARA and GESARA (look it up) the game would be on.

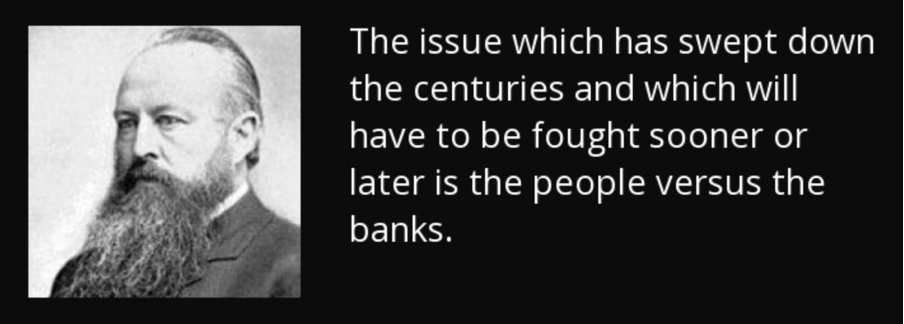

That last word on this shall be left to John Emerich Edward Dalberg-Acton (1834-1902), 1st Baron Acton, 13th Marquess of Groppoli, better known as Lord Acton, a Catholic historian, Liberal politician, and writer.

.

This article (Money Money Money – Part Three) was created and published by Iain Hunter and is republished here under “Fair Use”

••••

The Liberty Beacon Project is now expanding at a near exponential rate, and for this we are grateful and excited! But we must also be practical. For 7 years we have not asked for any donations, and have built this project with our own funds as we grew. We are now experiencing ever increasing growing pains due to the large number of websites and projects we represent. So we have just installed donation buttons on our websites and ask that you consider this when you visit them. Nothing is too small. We thank you for all your support and your considerations … (TLB)

••••

Comment Policy: As a privately owned web site, we reserve the right to remove comments that contain spam, advertising, vulgarity, threats of violence, racism, or personal/abusive attacks on other users. This also applies to trolling, the use of more than one alias, or just intentional mischief. Enforcement of this policy is at the discretion of this websites administrators. Repeat offenders may be blocked or permanently banned without prior warning.

••••

Disclaimer: TLB websites contain copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available to our readers under the provisions of “fair use” in an effort to advance a better understanding of political, health, economic and social issues. The material on this site is distributed without profit to those who have expressed a prior interest in receiving it for research and educational purposes. If you wish to use copyrighted material for purposes other than “fair use” you must request permission from the copyright owner.

••••

Disclaimer: The information and opinions shared are for informational purposes only including, but not limited to, text, graphics, images and other material are not intended as medical advice or instruction. Nothing mentioned is intended to be a substitute for professional medical advice, diagnosis or treatment.

Disclaimer: The views and opinions expressed in this article are those of the author and do not necessarily reflect the official policy or position of The Liberty Beacon Project.

Leave a Reply