High prices in AR7 and extended contracts are set to increase electricity prices.

DAVID TURVER

Introduction

Last night, Ed Miliband announced the Administrative Strike Prices for the forthcoming Allocation Round 7 (AR7) auction of renewable energy capacity. As shown in the table below, prices for the most important technologies have risen from those offered in last year’s AR6, despite the contract lengths being extended from 15 to 20 years.

Prices for Fixed Bottom Offshore wind are up 11% to £117/MWh, Floating Offshore wind up 10.2% to £280/MWh, and onshore wind up 3.1% to £95/MWh. Offer prices for solar have dropped by 11.5% to £78/MWh. Note that DESNZ provided a table in 2012 and 2024 prices, but for the comparisons below, it is better to show prices in today’s money, so an inflation factor of 1.4434 has been applied to the 2012 prices, in-line with the indexation on current CfD contracts.

The Government have extended the contract term to 20 years, meaning prices will be indexed upwards in line with inflation each year for 20 years. In their impact assessment for this change, they expected strike price reductions of 11-13%. On a like-for like basis, fixed bottom offshore wind is being offered ~£131/MWh. By pure coincidence, this is the same as £131/MWh I estimated as an offshore wind cost when taking apart the Government’s 2023 Generation Cost report that estimated offshore wind for 2030 delivery would cost just £39/MWh (in 2021 prices).

Part of the reason for rising strike prices will be in the increase in hurdle rates, reflecting the recent surge in long term UK bond prices. Moreover, the Government have also reduced their expected load factor for some technologies.

These staggering prices do not include the extra costs of grid balancing and backup that currently cost an extra £32/MWh, nor the costs of the grid expansion to connect them that Ofgem says will cost £80bn and add £74 to our electricity bills by 2030.

We can now compare prices to gas-fired electricity and to the risible assumptions made by the Climate Change Committee (CCC) when they estimated the costs of Net Zero in their 7th Carbon Budget.

Comparison to Gas-Fired Electricity

Last night, the day ahead price of electricity was £73/MWh including carbon taxes. This is lower than the current strike price of all the renewables technologies and much lower than the full cost of renewables taking account of the extra costs identified above.

Last night UK gas was trading at 78.9p/therm which is about £27/MWh. A modern gas-fired power plant, working at 55% efficiency could produce electricity from that gas at about £49/MWh excluding carbon taxes. We can see that electricity from gas unencumbered by Net Zero policies would be many times cheaper than renewables. It is obvious why we have the most expensive industrial electricity prices in the developed world, why we are deindustrialising at a rapid rate, why your electricity bills are so high and why the economy is struggling to grow.

If this auction is allowed to go ahead, electricity prices will go up even further which will be catastrophically bad for the economy.

Comparison of AR7 to 7th Carbon Budget and Earlier Rounds

It is instructive to see how these new prices compare to earlier rounds and to the CCC’s estimates.

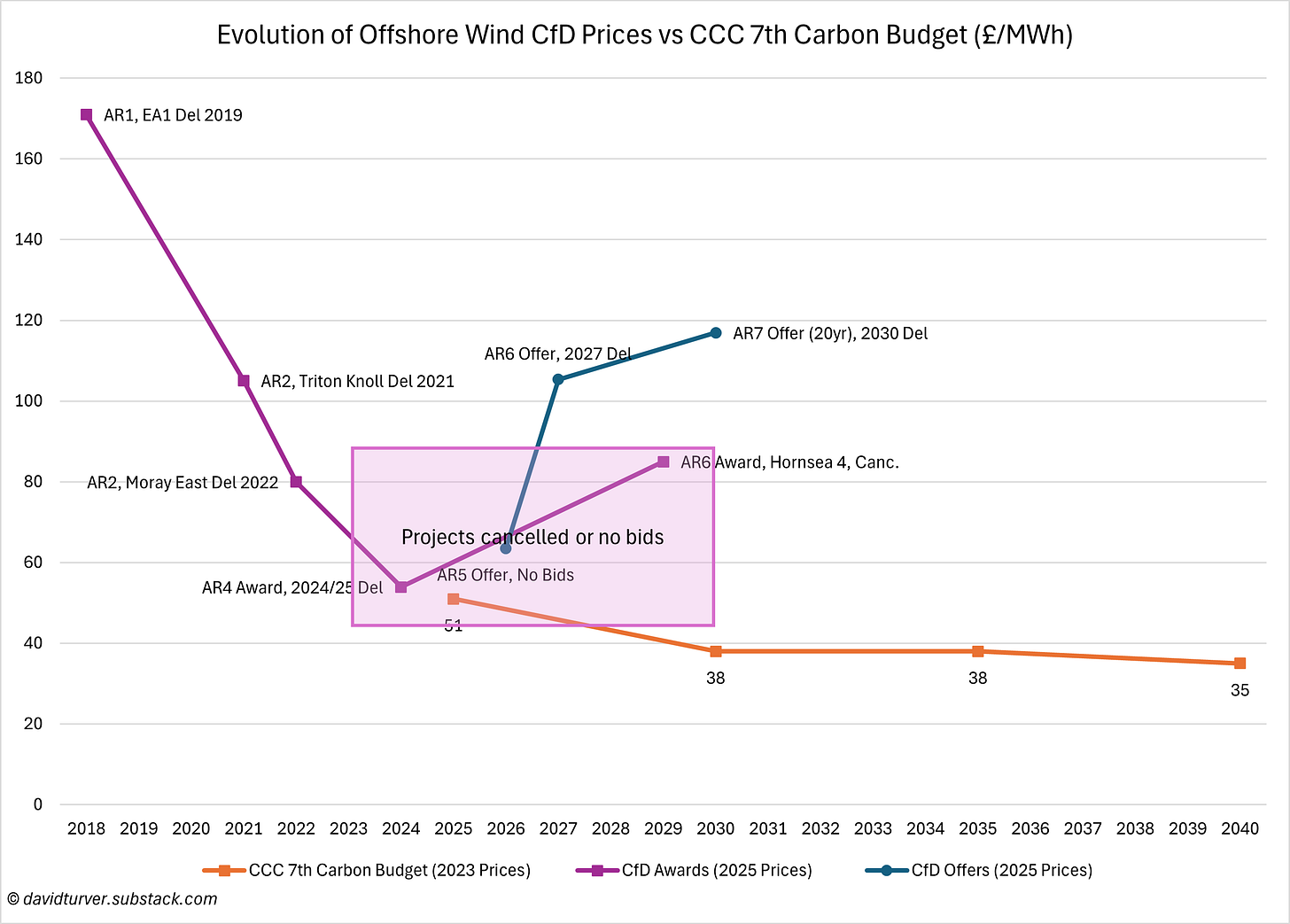

Fixed Bottom Offshore Wind

We start with fixed bottom offshore wind that is supposed to form the backbone of generation in the Net Zero world, see Figure 1.

Strike prices fell from AR1 to AR4 but then started to rise again. Norfolk Boreas was awarded a contract in AR4 which was then cancelled. The other AR4 projects have rebid part of their capacity at higher prices, so the contract awards do not reflect reality. Of course, no bids were received in AR5. The flagship AR6 project Hornsea 4, awarded a contract with a current price of £85/MWh was cancelled by Orsted earlier this year. The AR7 offer price of £117/MWh (2025 prices) is higher than the current price of £105/MWh for Triton Knoll, awarded a contract in AR2, despite a longer contract term. The AR7 offer price is some three times more than the 2030 price of £38/MWh (albeit at 2023 prices) expected by the CCC.

There is no sign that offshore wind prices are falling and even if contracts are awarded in AR7, there is no guarantee the projects will be delivered.

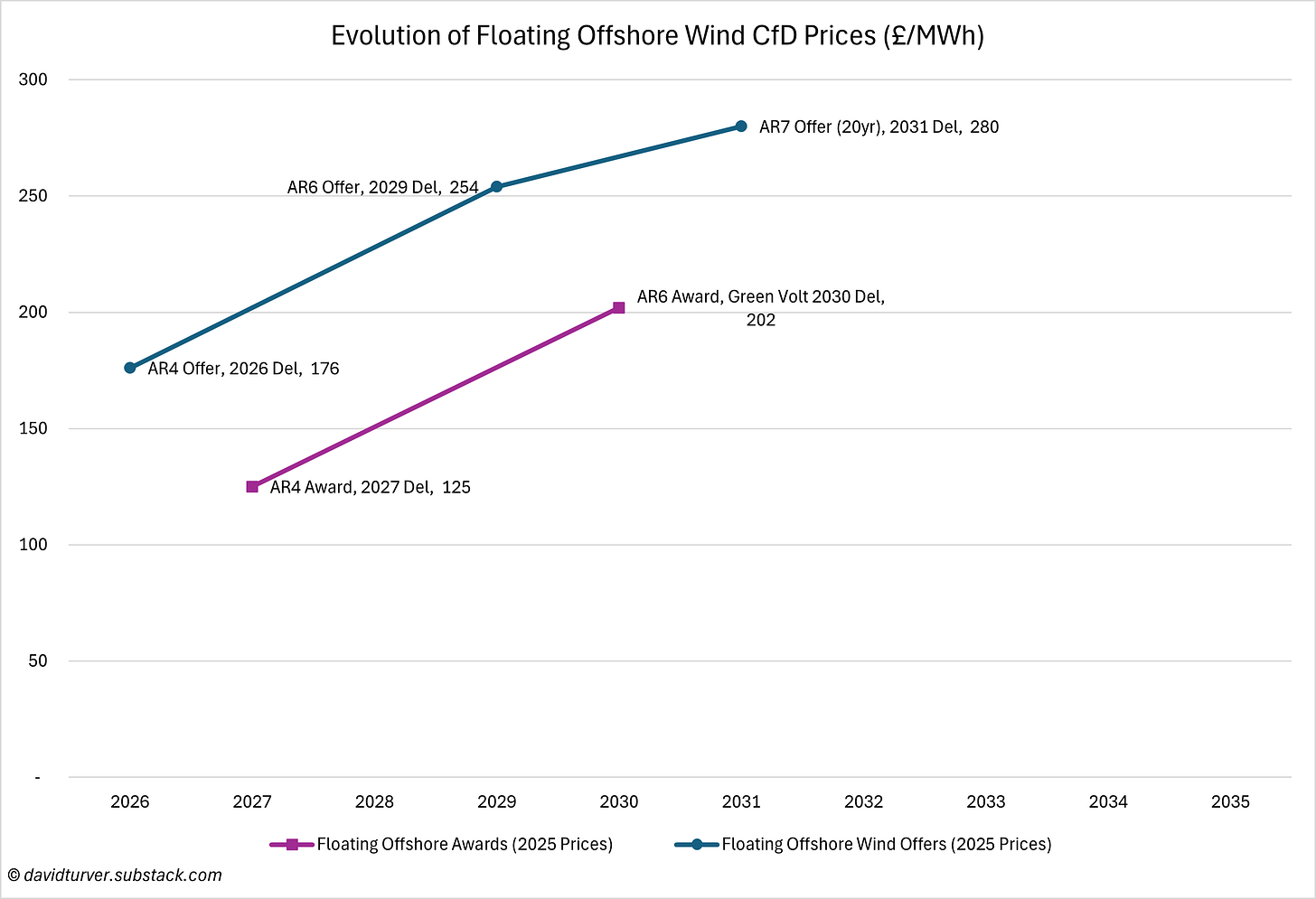

Floating Offshore Wind

There is a growing realisation in Government that if they are to hit their Net Zero offshore wind capacity targets they will need to rely on floating offshore wind. The trouble is, as Figure 2 shows, floating offshore wind is even more expensive and shows no sign of getting cheaper.

A tiny 32MW floating offshore wind contract was awarded to the Twin Hub project in AR4 at a current price of £125/MWh. IN 2025 money, contracts were offered at £254/MWh in AR6 and the 400MW Green Volt project was awarded a contract with a current value of £202/MWh. Despite contract awards coming in lower than the offers last year, the offer price has been raised to £280/MWh with extended 20-year contracts. This wholesale price offer equates to 28p/kWh, more than the current Ofgem retail price cap of ~26p/kWh. These are simply staggering amounts of our cash being offered.

The CCC did not offer a view on the cost of floating offshore wind in the latest carbon budget.

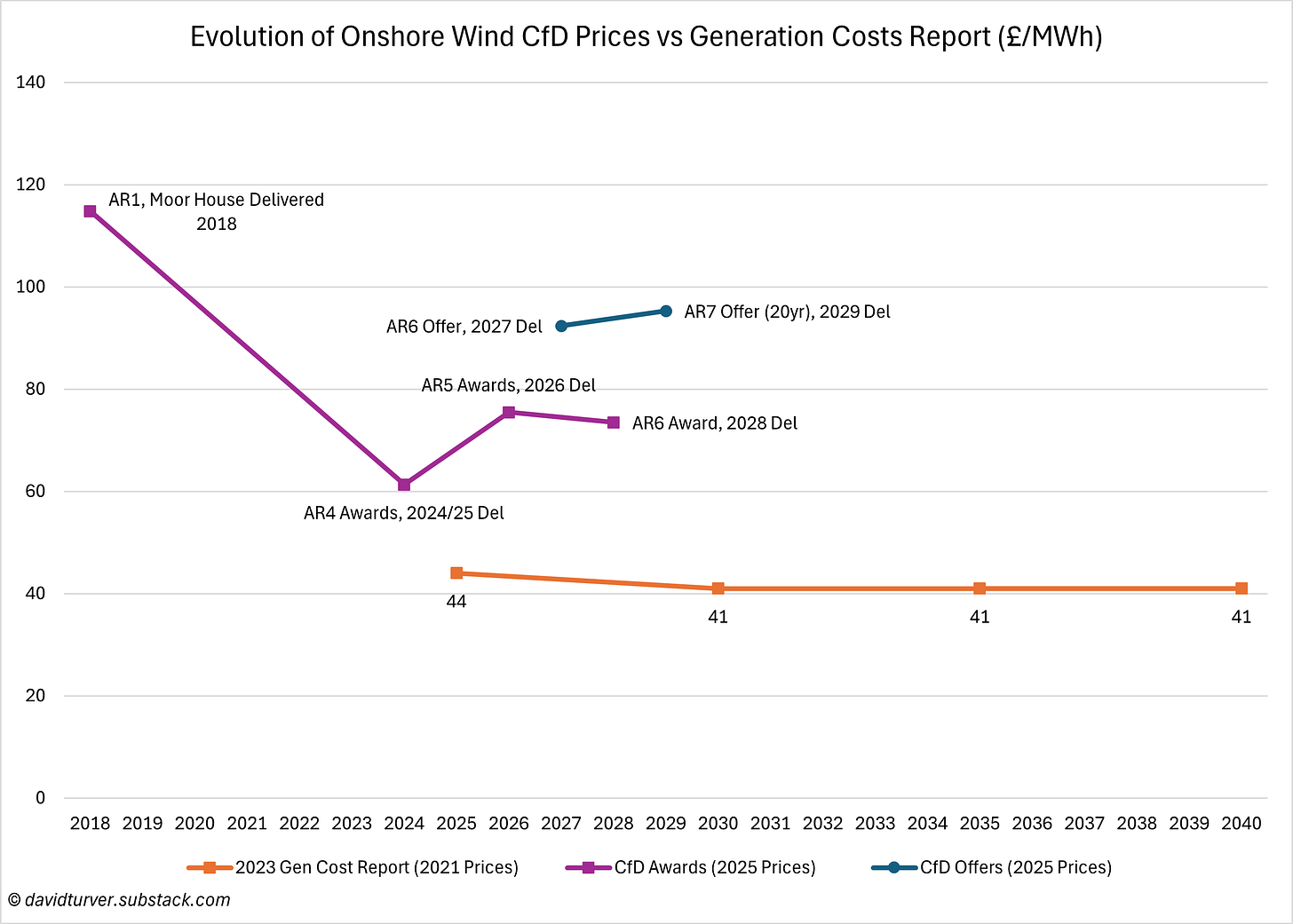

Onshore Wind

Miliband has lifted the de facto ban on onshore wind development and has sweetened the deal on offer to developers as shown in Figure 3.

Again onshore wind strike prices fell from £115/MWh in 2025 money for contracts awarded in AR1 to £61/MWh for AR4 contract awards. Prices began rising again with awards at £75/MWh in AR5, before falling back slightly to £73/MWh in last year’s AR6. The AR6 contract awards were significantly lower than prices on offer which makes it difficult to understand why offer prices have risen in AR7 to £95/MWh when contracts have been extended.

AR6 contract awards are almost double the CCC’s estimate and AR7 offers are more then twice the CCC estimates.

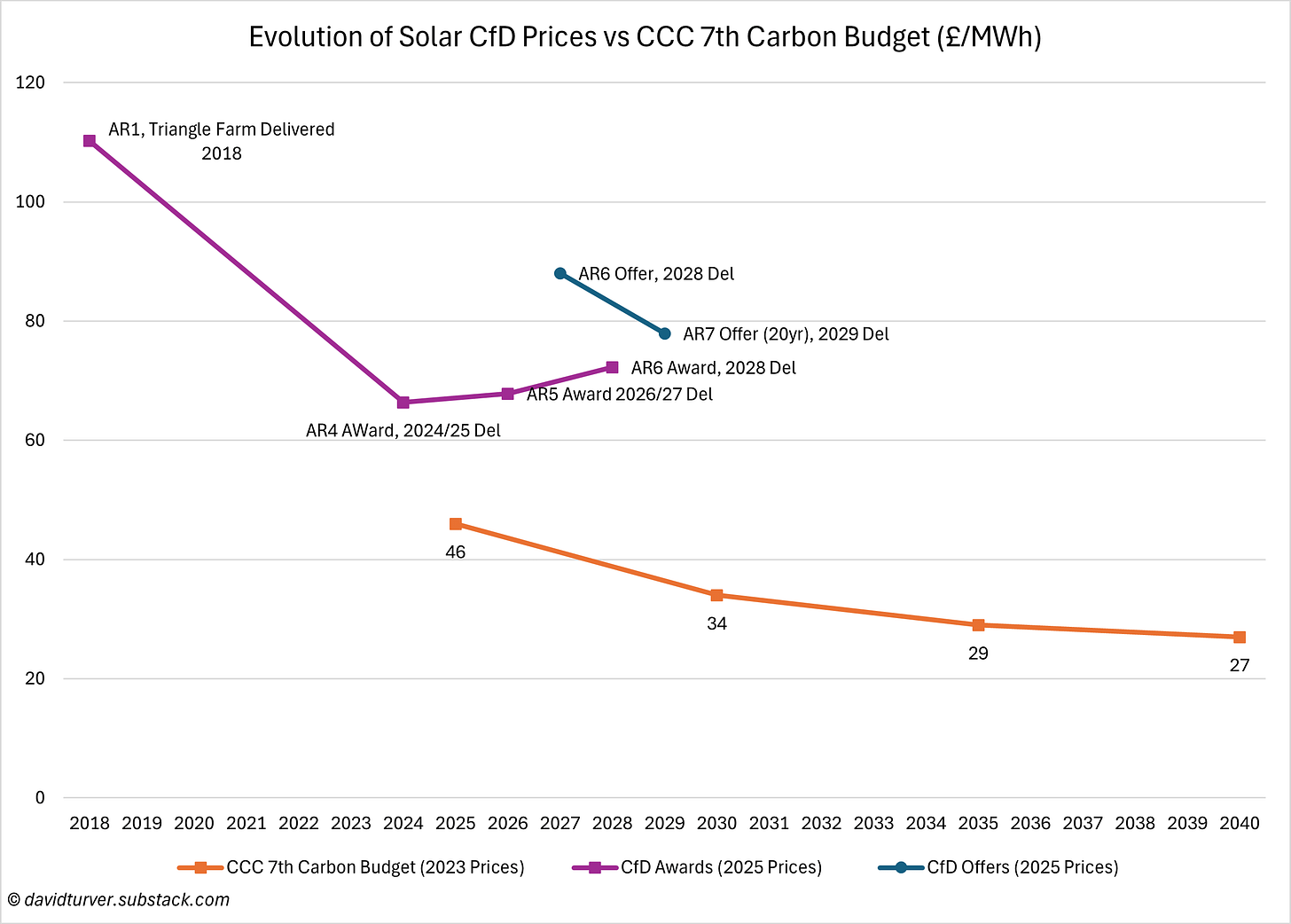

Solar Power

Figure 4 shows a brighter picture for solar power than for the other technologies.

AR7 offer prices have fallen to £78/MWh from £88/MWh offered in AR6. However, the offer price for this year’s 20-year contract is still higher than the current value of £72/MWh awarded in AR6.

The offer prices are more than double the CCC estimates, and tellingly higher even than prices for gas-fired electricity with a carbon tax added on. If we added the grid balancing and backup costs to solar and removed the carbon tax from gas, solar power would cost more than twice gas-fired electricity.

Conclusions

It is truly shocking that all the strike prices for these projects, expressed in 2025 terms are higher than the current day ahead price of £73/MWh set by gas with a carbon tax. And that is before adding on the extra costs of backup, grid balancing and extension.

These offer prices for AR7 make it clear that DESNZ energy policy is being driven by clowns and ideologues, hell bent on delivering their Net Zero vision no matter the cost. Clowns, because they still have not withdrawn their ridiculous Gen Cost report from 2023. Ideologues, because they’re pressing ahead with this, despite the enormous costs. It is also plain that the CCC does not have the faintest clue about the cost of renewables. Its risible estimates underpin the ridiculous claim that Net Zero will be saving us money by 2040. None of them can admit the truth about the real costs or the whole Net Zero edifice will come tumbling down and they will have to find other, less lucrative jobs to do. They are literally sacrificing everyone else to save their own jobs.

If this auction goes ahead, with contracts awarded at these values, then electricity prices will soar, sending a job destroying tsunami through the economy. These AR7 offer prices cannot be described as anything other than catastrophically bad. It goes without saying that Labour’s promise to cut energy bills by £300 was simply a lie to get them into office. Miliband and his cheerleaders in DESNZ, NESO, the CCC and Ofgem must be stopped.

This Substack now has well over 4,300 subscribers and is growing fast. If you enjoyed this article, please share it with your family, friends and colleagues and sign up to receive more content. I would be grateful if more people would sign up for a paid subscription, so for a limited time I am offering a discount off annual subscriptions.

This article (Miliband to Wreck the Economy with AR7) was created and published by David Turver and is republished here under “Fair Use”

See Related Article Below

Miliband’s ‘eye-watering’ wind power price increase to hit energy bills

Energy Secretary’s offer to developers to build in UK branded ‘lunacy’

Ed Miliband has unveiled plans to pay “eye-watering” prices to offshore wind farms as he seeks to tempt developers to build in UK waters.

Under the revised scheme, Mr Miliband will offer international developers up to £116 per megawatt hour for the power they generate from the farms – far above the wholesale price of power, which last year averaged around £72.

The extra money risks being added to power bills via a levy, inflating costs for households, industry and businesses.

The levy adds an estimated £24 a year to the average domestic power bill via a system known as contracts for difference. The sum was already expected to rise as the number of offshore and onshore wind farms expands and more solar plants are built. The higher prices will accelerate that increase.

The subsidies will also inflate costs for UK industry and business, which already face some of the world’s highest energy costs.

The move comes as Mr Miliband faces a growing struggle to fulfil his pledge to decarbonise the UK power grid by 2030.

He is also facing increasing political challenges, with Nigel Farage’s Reform UK warning it would scrap new offshore wind contracts if it wins power.

A report published by the Department for Energy Security and Net Zero (DESNZ) said the sharply increased prices were essential to overcome rising costs faced by offshore developers.

“Renewable technologies continue to face macroeconomic uncertainty and supply chain constraints – this is particularly true for wind technologies.

“The Government is continuing with the strategy of setting strike prices meaningfully above expected [electricity market] clearing prices.”

Claire Coutinho, the shadow energy secretary, said: “These are eye-watering prices – the highest in a decade and way above the average cost of electricity last year.

“And this is before the hidden extra costs of grid, storage and wasted wind – all of which end up on our energy bills.

“Ed Miliband can’t cut bills by £300 like he promised because he will always put his net zero zealotry above the economy and the cost of living. Cheap energy must come first.”

The price rise for wind developers follows the disastrous cancellation of key wind farm projects seen as essential for the UK to meet its renewables and decarbonisation targets.

The massive Hornsea 4 wind farm was cancelled by Ørsted earlier this year, arguing it could never be profitable.

Hornsea had a capacity of 2.4 gigawatts (GW) – one of the largest yet planned but the company said the £85 per megawatt hour subsidy on offer from the Government was too low.

Another project, Norfolk Boreas, was also cancelled by developers Vattenfall due to low prices.

‘Definition of insanity’

If Mr Miliband wants to meet his targets he must triple offshore wind to about 50GW by 2030, double onshore wind to 30GW and nearly triple solar power to 47GW.

But the rising cost of borrowing for renewable developments plus inflation across the industry is putting all such targets in jeopardy.

Ashley Kelty, from Panmure Liberum, said the cancellation of such major projects had spooked Mr Miliband into offering ever higher prices – but he predicted it would not work.

“It’s lunacy to think it could meet his targets. Supply chain constraints and rising costs means the build-out will be even slower.

“These high prices will also drive up bills. Renewables are not cheap by any metric. The gas needed to supply stable baseload will have to be imported at high cost – which is also passed through to consumers. This is the clear definition of insanity.”

The Telegraph: continue reading

Featured image: Flickr

••••

The Liberty Beacon Project is now expanding at a near exponential rate, and for this we are grateful and excited! But we must also be practical. For 7 years we have not asked for any donations, and have built this project with our own funds as we grew. We are now experiencing ever increasing growing pains due to the large number of websites and projects we represent. So we have just installed donation buttons on our websites and ask that you consider this when you visit them. Nothing is too small. We thank you for all your support and your considerations … (TLB)

••••

Comment Policy: As a privately owned web site, we reserve the right to remove comments that contain spam, advertising, vulgarity, threats of violence, racism, or personal/abusive attacks on other users. This also applies to trolling, the use of more than one alias, or just intentional mischief. Enforcement of this policy is at the discretion of this websites administrators. Repeat offenders may be blocked or permanently banned without prior warning.

••••

Disclaimer: TLB websites contain copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available to our readers under the provisions of “fair use” in an effort to advance a better understanding of political, health, economic and social issues. The material on this site is distributed without profit to those who have expressed a prior interest in receiving it for research and educational purposes. If you wish to use copyrighted material for purposes other than “fair use” you must request permission from the copyright owner.

••••

Disclaimer: The information and opinions shared are for informational purposes only including, but not limited to, text, graphics, images and other material are not intended as medical advice or instruction. Nothing mentioned is intended to be a substitute for professional medical advice, diagnosis or treatment.

Disclaimer: The views and opinions expressed in this article are those of the author and do not necessarily reflect the official policy or position of The Liberty Beacon Project.

Leave a Reply