Labour is rolling out to the ‘pork barrel’ for its clientèle, and that puts an end to any Social Contract

CP

Economic and financial issues expert, Bob Lyddon explains how Labour’s long-term investment agenda (set out in its Industrial Strategy, Infrastructure Strategy, and Net Zero/Clean Power plans) amounts to a vast expansion of state-directed spending that will burden taxpayers for decades. He argues that these projects, heavily reliant on borrowing and often financed through opaque “shadow taxation,” function as a large-scale exercise in pork-barrel politics aimed at Labour’s traditional heartlands. While certain regions and groups stand to benefit, Lyddon contends that the costs will fall overwhelmingly on the wider population, undermining the Social Contract and locking the UK into trillions of pounds of future liabilities.

As we await the Budget on 26th November, all focus is on the government’s day-to-day expenditure and how it will be financed. This allows the government’s borrowing-and-spending for ‘investment’ to fall below the radar. In this segment of its expenditure the government plans a dramatic expansion of the state-directed sector, as part of its claimed ‘decade of national renewal’. In truth the plans are an example of ‘pork barrel politics’: ‘national government politicians spending huge amounts of money in their local voting districts to encourage voters to re-elect them at the next election’.[1] Few will benefit, but all will pay. This negates any Social Contract: there ceases to be an overlap between the constituency that benefits from government policy and the constituency that pays for it.

What Labour’s plans consist of

Labour’s plans are laid out in their papers on Industrial Strategy, Infrastructure Strategy, and on Net Zero/Clean Power. They cover the period 2025-35, based on the assumption that Labour would be in power for 10 years. Instead we can observe an acceleration of commitments being made during this Parliament so that, even if Labour are ejected from power in 2029, they will already have secured their legacy: burying the UK in debt.

Labour’s plans were dissected in our report published in October 2025 for the Institute for Research in Economic and Fiscal Issues entitled ‘The United Kingdom as a sandbox for state-directed investment: major increase in ‘shadow debt’, and in the ‘shadow taxation’ required to service that debt’.[2]

The expenditures total £1.64 trillion. Given that 100% of this amount will be borrowed – and that around 85% will be borrowed from the expensive source of ‘shadow banks’ – the lifetime cost comes out as £6.7 trillion, or 234% of the UK’s 2024 Gross National Product.[3]

Where money will be spent

Landscape-destroying investments in solar panel farms and onshore wind will be concentrated on arable land in rural areas considered likely to vote Reform, LibDem, or Tory: Norfolk, Suffolk, and Lincolnshire.

The investments likely to bring jobs and wealth will go into the ‘clusters’ and ‘city regions’, which were the base in the nineteenth and twentieth centuries for the now-dead industries of coal, iron, steel, shipbuilding, and textiles. The plans contain a regressive Industrial Revolution-based mindset: these were the heartlands of the original Labour Party.

A smattering of the proposed projects will suffice:

- Net Zero Teesside, the first at-scale gas power plant with carbon capture

- The HyNet carbon capture cluster in north-west England and north Wales

- STEP prototype ‘fusion’ power station in West Burton in Yorkshire

- Transport for City Regions settlement

- New local growth fund in Scotland, Wales, and Northern Ireland

- TransPennine Rail Route Upgrade

- Tees Valley Creative Investment Zone

- Leeds station enhancement and progressing the Midlands Rail Hub

- Edinburgh supercomputer

- Expansion of the Port of Cromarty Firth

- Barrow-in-Furness regeneration

- Recyclable Mayoral Growth Fund for the North and Midlands

Who will decide where money is spent

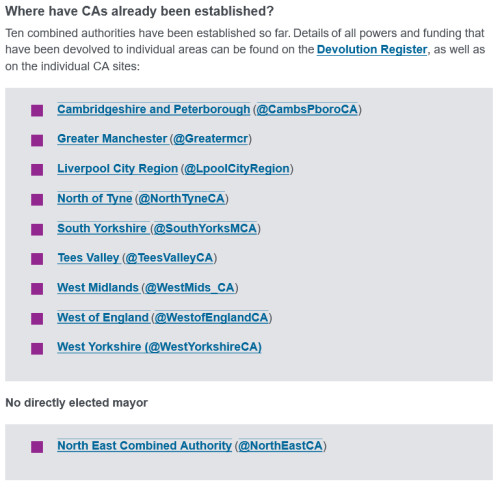

The wealth transfer will be directed principally at these historical ‘heavy industry’ areas in the English North and Midlands which have a Combined Mayoral Authority, as well as at Scotland and Wales:

Other Labour areas do not feature, like London or the Golden Triangle in the East Midlands of Derby, Leicester, and Nottingham. Non-Labour areas do not exist on the Labour map.

Who will benefit

Labour’s plans are backed by a flimsy financial business case. In practice they favour the sections of UK society that are Labour’s clientèle in an archetypal ‘pork barrel’ approach, at the expense of everyone else:

- the unemployed, those on long-term sickness benefits, those ‘working’ in the public sector, ethnic minority communities;

- the English North, the English West Midlands, Scotland, and Wales;

- ‘Working people’, meaning not the young, or pensioners, or anyone at all outside the above regions.

How payment will be extracted

Labour intend to use the Private Finance Initiative funding model where projects, for example those for Health, Education, and Justice, have a public sector entity as their principal.[4] In that case the payments under the respective contract fall into day-to-day public sector costs and will be funded from general taxation i.e. taxpayers pay, regardless of whether they draw any benefit from the investment, and non-taxpayers do not pay.

This is the same funding model New Labour used between 1997 and 2010, under which a capital expenditure of £50 billion will have resulted in a lifetime cost of £278 billion by the time the last contract is paid off in 2052-3.[5] That gives a reasonable steer as to the relationship between capital cost and lifetime cost.

On the face of it, though, the majority of Labour’s planned investments are meant to present bills directly to UK businesses and individuals, which is the ‘shadow taxation’ referred to in the report’s title. This will impose a devastating new financial burden on UK businesses and individuals.

Mitigation of cost through subsidies and wealth transfers

The burden on UK businesses and individuals will be mitigated firstly in cases where the project itself receives a public subsidy, such as through a Contract for Difference:[6]

- A UK business or individual has their energy bill subsidised by the government;

- UK businesses and individuals pay more tax to the government to supply the money for the subsidy.

This is round-trip but also a deception: part of the cost is hidden and buyers are deluded into believing that the cost is less than it really is. It is also a wealth transfer: those that pay more tax fund the subsidy for those that pay less tax, namely Labour’s clientèle.

The burden will be further mitigated for some via cross-subsidisation within the accounts of the supplier of one customer by another: energy companies are already positioning themselves – and getting support from the government and from regulators – to raise the bills of the UK businesses and individuals who are able to pay, so that others do not have to pay: Labour’s clientèle again.[7]

Role of the mooted ‘Mansion tax’

The rumoured ‘Mansion tax’ fits into this picture: this will not be an addition to Council Tax, which goes to the local authority in which it is levied and which can only be spent on local services in the same local authority area. The ‘Mansion tax’ will be attributable to central government, will be largely drawn from non-Labour areas, and will be available to the government to increase local government grants to Labour areas or otherwise to fund other benefits and subsidies for Labour’s clientèle.

Summary

Labour’s ‘investment’ plans are a tremendous ‘pork barrel’ exercise to try and secure votes for themselves from their traditional heartlands. Everyone will pay, though, except Labour’s clientèle. Labour creativity, with the support of industry regulators like Ofgem and Ofwat, is inventing new channels – beyond visible taxation – for extracting money from non-Labour areas to subsidise Labour’s clientèle. This is ‘shadow taxation’, and it negates the Social Contract where everybody should pay tax so as to contribute to public services. Instead it opens up an infinite space in which prices of all goods and services can be increased for contributors so that non-contributors need pay nothing at all.

By Bob Lyddon.

Bob Lyddon is best known as a commentator on fiscal, economic and financial issues, but he is also a historian, having been awarded an MA with Distinction in 2021 by the Open University, his dissertation being entitled ‘King’s Lynn and the ‘new police’, 1830-45’.

[1] https://www.polyas.com/election-glossary/pork-barrel-politics accessed on 16 September 2025

[2] Available through this link – https://www.lyddonconsulting.com/the-united-kingdom-as-a-sandbox-for-state-directed-investment-with-a-major-increase-in-shadow-debt-and-in-the-shadow-taxation-required-to-service-that-de/

[3] A summary of the report’s numbers is available through this link – https://www.lyddonconsulting.com/main-numbers-in-iref-report-the-united-kingdom-as-a-sandbox-for-state-directed-investment/

[4] This would apply to a sizeable share of the £725 billion expenditure on ‘Social infrastructure’ referred to in Labour’s ‘Infrastructure Strategy’ Chapter 5 pp. 85-93

[5] Source: Excel spreadsheet issued by HM Treasury in March 2023

[6] https://www.gov.uk/government/collections/contracts-for-difference accessed on 1 September 2025

[7] https://www.telegraph.co.uk/business/2025/10/30/unpaid-energy-debts-to-paid-off-by-middle-class-households/ accessed on 17 November 2025

Leave a Reply