An important update

ALEX KLAUSHOFER

When just after the November Budget, I published an essay about taxation I knew things were going awry with the financial arrangements that underpin British democracy.

As an extended think-piece, TaxNation was intended to highlight an undiscussed shift in the official story which – arguably, depending on your ideas about governance – makes taxation legitimate. Before Labour took power in 2024, it had never occurred to me to write about tax. But it’s become clear that a change in the way the tax system is being used has accelerated, and in ways that connect closely with the subjects I cover on this Substack.

In November, it already looked as if the justification for tax was shifting from necessary contributions-to-the-public-pot to charges aimed at changing behaviour and reshaping society. The eco-system around the political establishment buzzed with new ideas for levies, on food, flights and other areas of life that could be further monetised. Manifesto promises to not raise taxes seemed to mean nothing. And somehow it had become acceptable for the Chancellor to wave a brief case and impose changes that overturn life plans and end livelihoods. These are what I call “upending taxes”.

Taxation is becoming untethered from public consent. This affects all of us individually and makes for an unstable society in which planning is difficult.

All this is bad enough, but what I didn’t anticipate in November were two particular developments which give this shift concrete form. The implications of one are pressing. So this is a coda to that first piece, a kind of heads up about what we can expect in the months to come.

The Deceptions of the Budget

During the run-up to the Budget, expectations that tax rises were essential were fostered by repeated talk of the “black hole” in the public finances, repeatig a similar pattern of what had happened in 2024.

But once Budget Day brought tax rises of £26 billion, it emerged that – far from being in deficit – the public coffers actually had a surplus of £4.2 billion. This was the result of changing forecasts from the Office for Budget Responsibility who had informed Rachel Reeves of the change a month earlier. You can find the timeline of events here.

In sum: the Chancellor, with the approval of the Prime Minister, lied to the British people about the state of public finances in order to take more money from them.

There was, understandably, outrage at the revelations. They were a clear case of malfeasance and Misconduct in Public Office. In the British system, the Ministerial Code states if a minister is found to have knowingly misled Parliament, they should resign. In the past, ministers have resigned for much lesser offences to do with personal affairs. The sixth of the Seven Principles of Public Life set out by Lord Nolan in 1995 is honesty, with the requirement that “holders of public office should be truthful”.

Consequences for politicians who lie are, in the British system, a matter of convention. But recent years have seen a dramatic shift in what is acceptable. And so, in the days that followed the Budget, the cries for resignation abated. One head did roll, but it was that of the chair of the OBR, ostensibly for having released details of the Budget early.

This means that Parliament and, by extension, the British Establishment and the public have tacitly agreed that:

- lying in order to justify tax rises is acceptable

- government is not to be held accountable for manifesto promises about taxes

This in turn means that an elected government can continue to raise taxes at will, wielding a level of power that determines the standard of living for the majority and which sectors and businesses are able to prosper.

And so it is hardly surprising that the Chancellor promptly set a date for the next Budget for early March – the shortest gap ever between Budgets – and began the prepping for the next round of tax rises.

A second deception came with reforms to business rates, the property tax on the occupants of commercial premises. Changes to the rates, which are based on property valuations in combination with a government-set multiplier, were presented as reducing liabilities for small businesses such as pubs, cafes and shops.

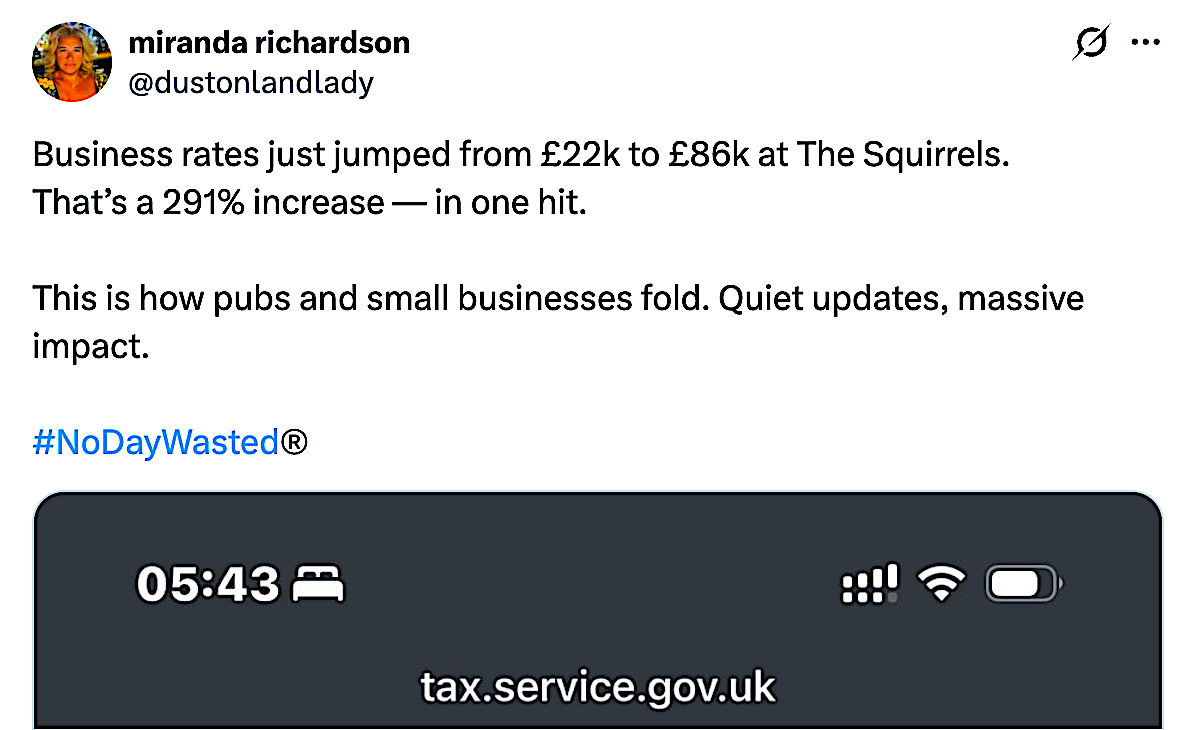

But the reality was different. On social media, I saw realisation dawn in real time as one after the other, business owners did their calculations for the next financial year and saw their costs leap. With the removal of discounts from April 2026, many tax bills are to double or triple.

The tax hikes affect restaurants, hotels and office-based businesses, hairdressers and health professionals and any event held in commercial premises. A sharp jump in operational costs can only mean one of two things: closure of the business or higher prices for customers. A survey by the British Institute of Innkeeping suggests that from April fewer than one in ten pubs will be profitable.

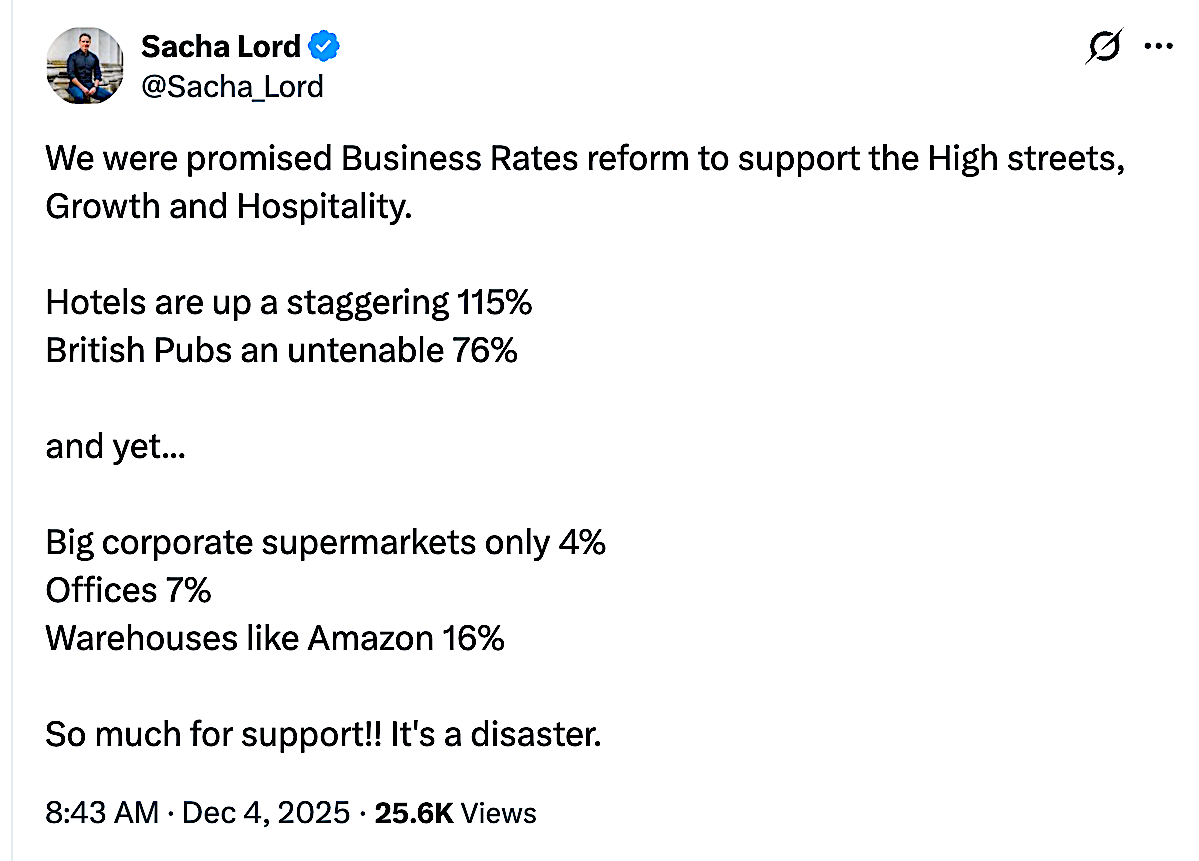

The leaders and spokespeople of the hospitality and leisure sectors – people you would expect to have foreknowledge – seemed to have been taken by surprise. And, as they ran their calculations, something strange emerged. The tax hikes will only affect small businesses; large corporations will do quite nicely.

The business rates bill for Harrods, Lord went on to point out, will fall by £1.1 million.

What are we to make of this bizarre turn of events?

A few points for context:

First, the enforced closures of lockdown, rising energy bills and increases in NI employers’ contributions over the past six years have put huge pressure on retail and hospitality. Government measures account for a large proportion of the business closures and higher prices since 2020.

Second, the sudden hikes in business rates are a re-run of what happened in the Autumn Budget of 2024. The decision to levy inheritance tax on farms never made sense in terms of revenue raising: it’s only expected to bring in around £500,000 million a year. As statistician Jamie Jenkins points out, this amounts to one day of the cost of public borrowing. But it’s has already had a tangible effect on agriculture. Farms have been closing at record rates – over 6000 in the first half of 2025, according to the Office for National Statistics.

Third, with the tax take higher than it’s ever been in UK history and the deception of the Black Holes, it is impossible to consider the business rate rises “necessary”.

So, in my role as the child pointing out that the emperor is naked, I have to state something that is both blindingly obvious and being widely ignored.

The dramatic unexpected rises in business rates can only be understood as a deliberate strategy. Gradual and disguised as something worthy – in this case, “public finances” – their purpose is to dismantle parts of British life that do not fit with in the government’s plans.

The Budget Business Shutdown is Lockdown 2.0. In central London, where few independent shops and cafes survive, the success of the Covid lockdowns is visible. Of course, other trends played a part in the decline of small businesses, but the final nail came in 2020. Walking the empty streets with a small team feeding the homeless, there was agreement that when the capital finally reopened, the big chains would prosper, establishing new branches in the premises formerly occupied by independents.

That is exactly what happened.

Taxation has long been used by power-hungry governments to achieve their social and political goals. But history never repeats itself. This time around, the aims and motives are different. So what might the government be trying to achieve?

The first part of the answer has to do with corporations. Since 2020, it’s been clear that government and corporations work well together. “Alliance” might be too strong a word, but a cooperative relationship born of overlapping interests is obvious. Big companies tend to be the first to implement new practices, citing government regulations as the reason they “have” to do things that benefit them. Meanwhile, governments are increasingly using companies as arms-length mechanisms for policies such as censorship.

I don’t think it’s a coincidence that in 2023, following a meeting with Facewatch (a company supplying surveillance tech to the retail sector), Home Office officials wrote to the Information Commissioners’ office to persuade them of the “benefits” of facial recognition in tackling shop lifting. Government encouragement is working: chains like Southern Coop now routinely use facial recognition in their stores and Sainsbury’s bosses have announced plans to introduce customer surveillance courtesy of Facewatch.

The government wants surveillance in public spaces – it is consulting on plans to introduce facial recognition in every town and city in the UK here. Corporations will help to achieve that in indoor spaces.

At the same time, a certain kind of government instinctively resents the independence of small business folk and the self-employed. This is an old truth: the nonconformists I drew inspiration from in my piece about non-compliance were merchants, crafters and traders who were immune to the threat of losing their jobs.

On a social level, pubs foster independence in talk and thought in quintessential British fashion. A thriving town has a network of places where people of all kinds gather to meet different needs. These are the third spaces that make up what we call “community” – and on a chilly island, they’re key to our freedom of association. Shut them down and society becomes quieter and easier to manage.

The response from those affected

Since then, a number of things have happened, all of which strike me as typically British and illustrative of where we are. They show both what is changing and how some people are clinging onto beliefs and approaches which no longer make sense.

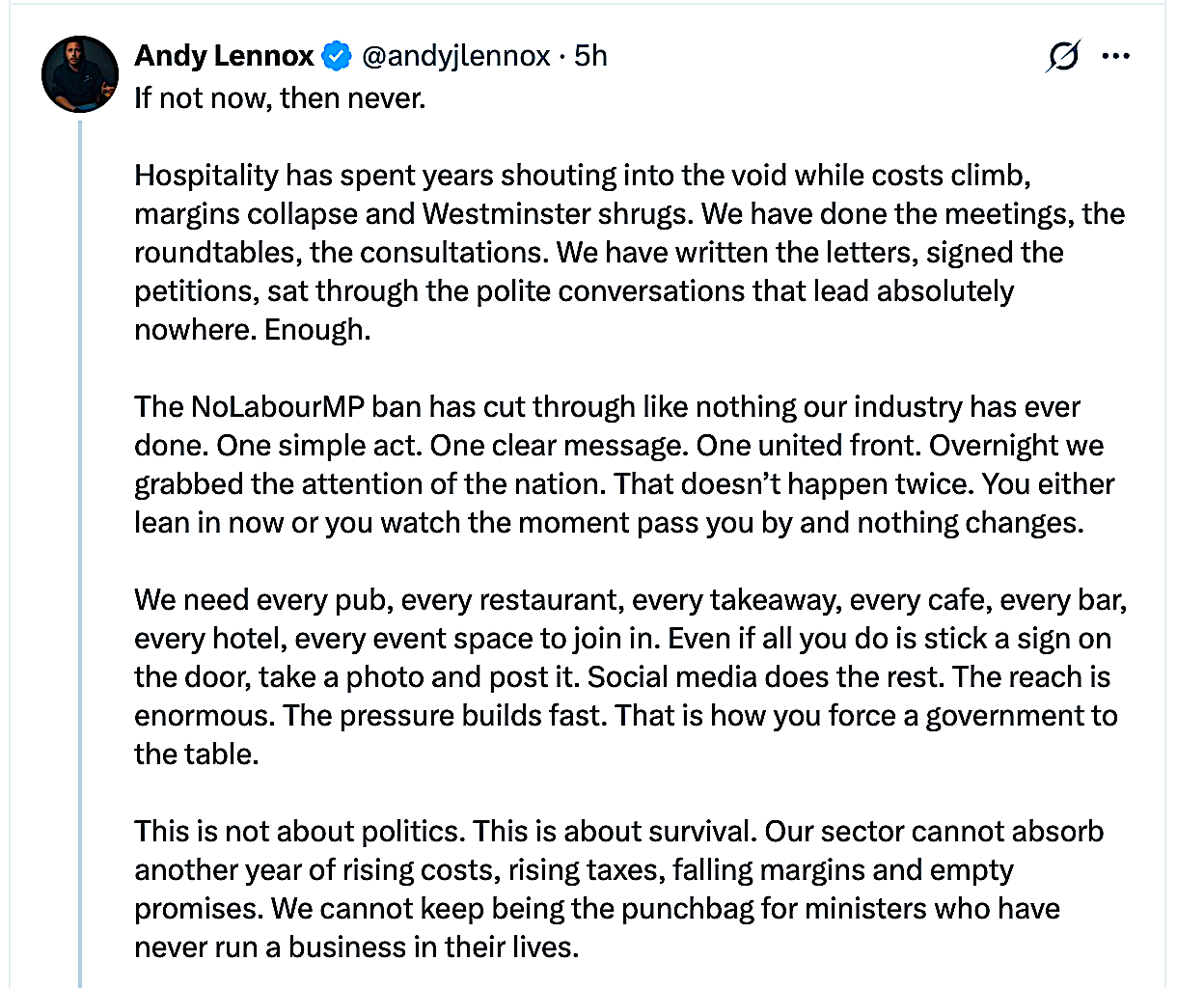

- The leading trades body UKHospitality has continued with the ineffectual campaigning it has conducted since 2020, pointing out the effects of government actions in the polite tones of the humble petitioner.

- New, more robust campaigns have quickly sprung up from the grassroots, led by business owners with a clear understanding that their businesses, and the way of life they enable, are at risk of extinction.

.

- At the same time, a comforting narrative that the Reeves-Starmer government “doesn’t understand” business or “doesn’t care” about rural life is keeping the old paradigm intact. This fuels the belief that all we need to do is explain well enough and politicians will “listen”.

Campaigning conventions are making for narrow vision, ignoring the wider picture and calling for concessions for particular sectors. Much of the “Save the Pub” campaign focuses on measures that will only help pubs. Like a child shouting “me too!” the Booksellers Association is asking the government to consider bookshops as well as pubs.

And the u-turns?

Just before Christmas, the government announced that the threshold for inheritance tax on farms would be raised from £1 million to £2.5 million, enabling more farms to be handed down to the next generation. Much of the mainstream characterised this as a “u-turn”, but it is only a tactical retreat. Parliament has already voted the new tax into law and the government can easily adjust the thresholds and rates when it suits. (You can see how your MP voted here).

Another “u-turn” on business rates is on the way, but at the time of writing may only provide temporary relief for pubs.

Another obvious but under-recognised point: such abrupt and arbitrary changes confirm the impression that, with the New Normal of Ever Rising Taxes, the government is testing to see what it can get away with.

The response from the public

The majority of people don’t seem to realise that their society is being dismantled around them. While a minority supports the campaigns mentioned above, a significant contingent defend the tax rises in a way that resembles the calls for longer lockdowns and stricter enforcement of Covid measures. They’re the foot soldiers of the MORE TAX! lobby I wrote about previously who see tax rises as virtuous and a way of punishing the greedy.

So when I put a brief heads up about the business rate rises in my local Facebook group, I was immediately shouted down, my post adorned with laughing emojis. My area is inhabited by a community particularly vocal in its support for independent businesses, its antipathy to chains and its pride in local amenities. Over the past year, a number have closed down and the busiest stretch of the high street now has half a dozen empty retail units. Every time a new closure is announced on that same Facebook group, locals post crying emojis.

How successful is Lockdown 2.0 likely to be?

The failure to make connections and absence of consequential thinking demonstrated by my local community will be key to how the TaxNation story plays out. It’s about more than illiteracy about tax; we saw the same kind of disconnection when people supported lockdowns and then bemoaned “the cost of living crisis”.

To create an impoverished, atomised society all the British have to do is nothing. The government will Carry On Taxing and the natural consequences will unfold.

We are not in the same position the last time government shut down “unnecessary” businesses. Among some sections of the public there is greater awareness of the ill-wisdom of handing this much power to those at the top. A few MPs are asking sharp questions and there are indications that some parts of the Establishment may, just may, be realising that Britain is under threat.

On a brighter note, I am very much looking forward to the Carnival of Alternative Politics in February. If you’re near enough to Bournemouth to make it feasible, do come. It promises to be fun.

This article (Carry On Taxing) was created and published by Alex Klaushofer and is republished here under “Fair Use”

After Operation Talla, the Starmer government is illegitimate anyway. Why are you financing it?