Remove carbon costs to cut electricity bills

DAVID TURVER

Introduction

Gas prices have fallen in recent months, from a peak around 140p/therm in February last year, to a few pence above or below 80p/therm from May to November, when they fell again to 70-75p/therm. The supporters of Net Zero like to remind us that gas sets the wholesale electricity price most of the time, so we might expect electricity prices to have fallen too. It is true that wholesale prices have fallen, but not by as much as the gas price and of course, the electricity price cap went up again this month.

We have often explored the impact subsidies for renewables have on our bills as well as the extra backup, grid balancing and expansion costs have on our electricity bills. However, there is another hidden cost that is keeping our bills artificially high.

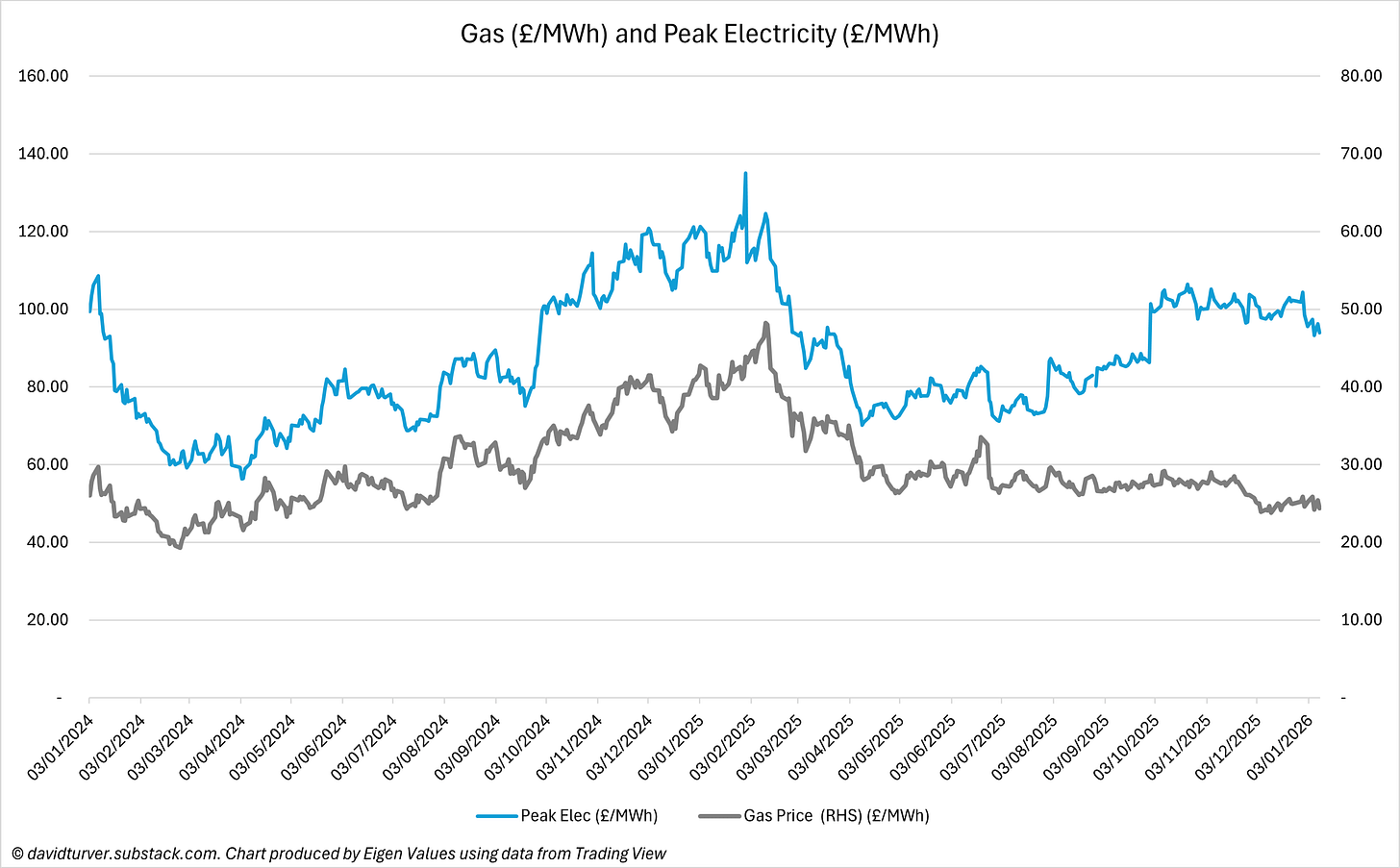

Electricity and Gas Prices

We can see from Figure 1 that electricity prices track gas prices quite well. The data is the daily front month futures price for both gas (GWM1!) and peak electricity (UPL1!), sourced from Trading View.

In recent months, the gap between gas and electricity prices has widened. We should note that the big leap in electricity prices at the end of September 2024 and 2025 is probably a seasonal effect that exaggerates the gap somewhat. However, we can see that the big drop in gas prices at the end of November 2025 was not matched by a similar decrease in electricity prices. There must be something else going on.

Carbon Price Impact

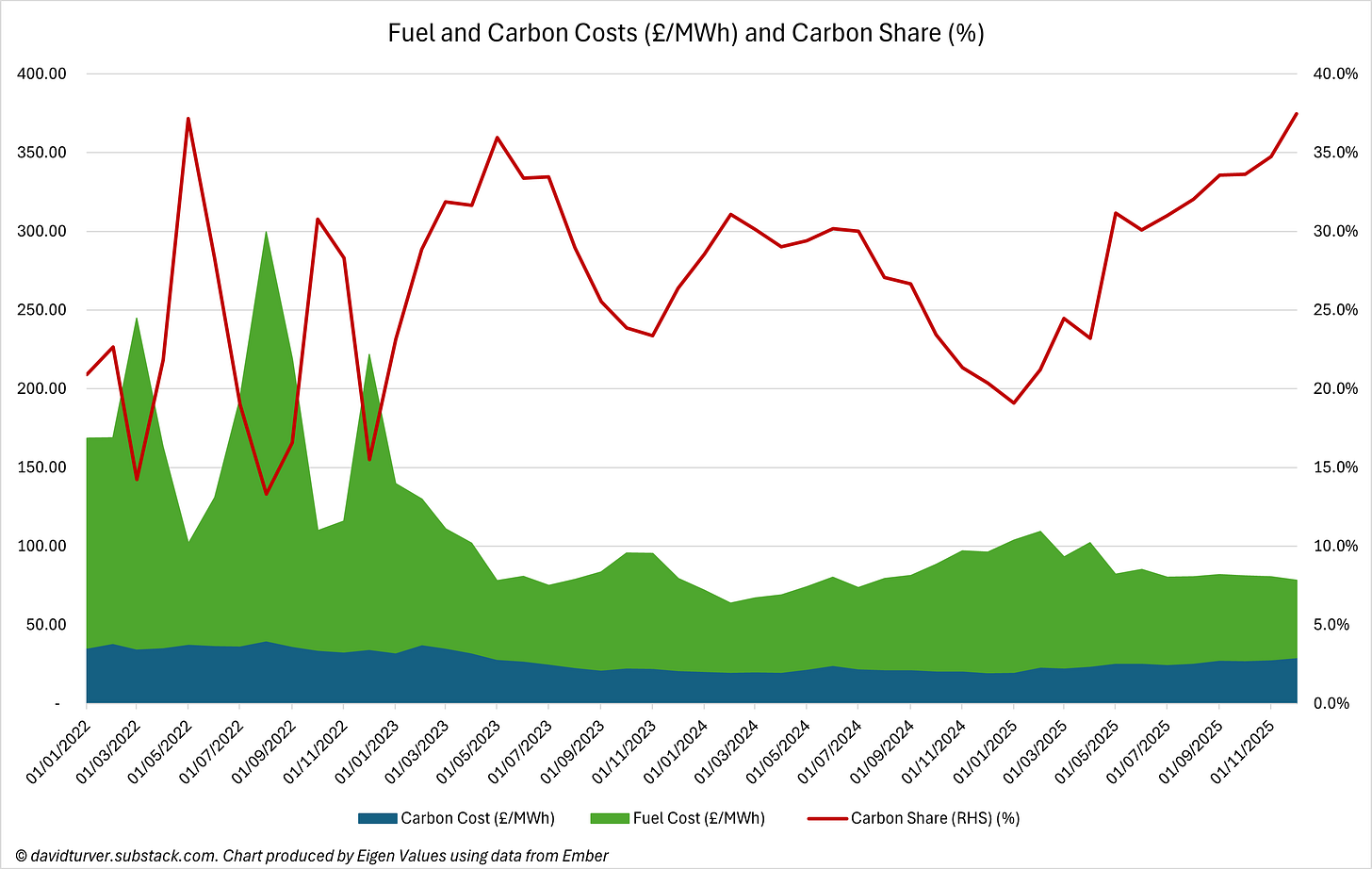

Helpfully, Ember produces a chart showing fuel costs and carbon costs by country. Figure 2 has been produced using data from that chart, from the beginning of 2022.

Carbon costs comprise two elements. The first is the Carbon Price support mechanism, where prices have been held at £18/t since 2018. The second part is the carbon cost arising from the UK Emissions Trading Scheme (ETS) and these costs fluctuate quite a lot.

The total carbon costs fluctuated in a £35-40/MWh range from the beginning of 2022 to March 2023 before falling steadily to under £20/MWh in February 2024. Carbon costs then fluctuated in the £20-25/MWh range until April 2025 and then began to rise to £29.35/MWh in December.

Carbon costs made up 37.5% of the wholesale price of electricity in December 2025. The daily data from Ember suggests that carbon costs have continued rising in January this year too. If carbon costs were removed, wholesale prices would fall from December’s £78.45/MWh to just under £49/MWh.

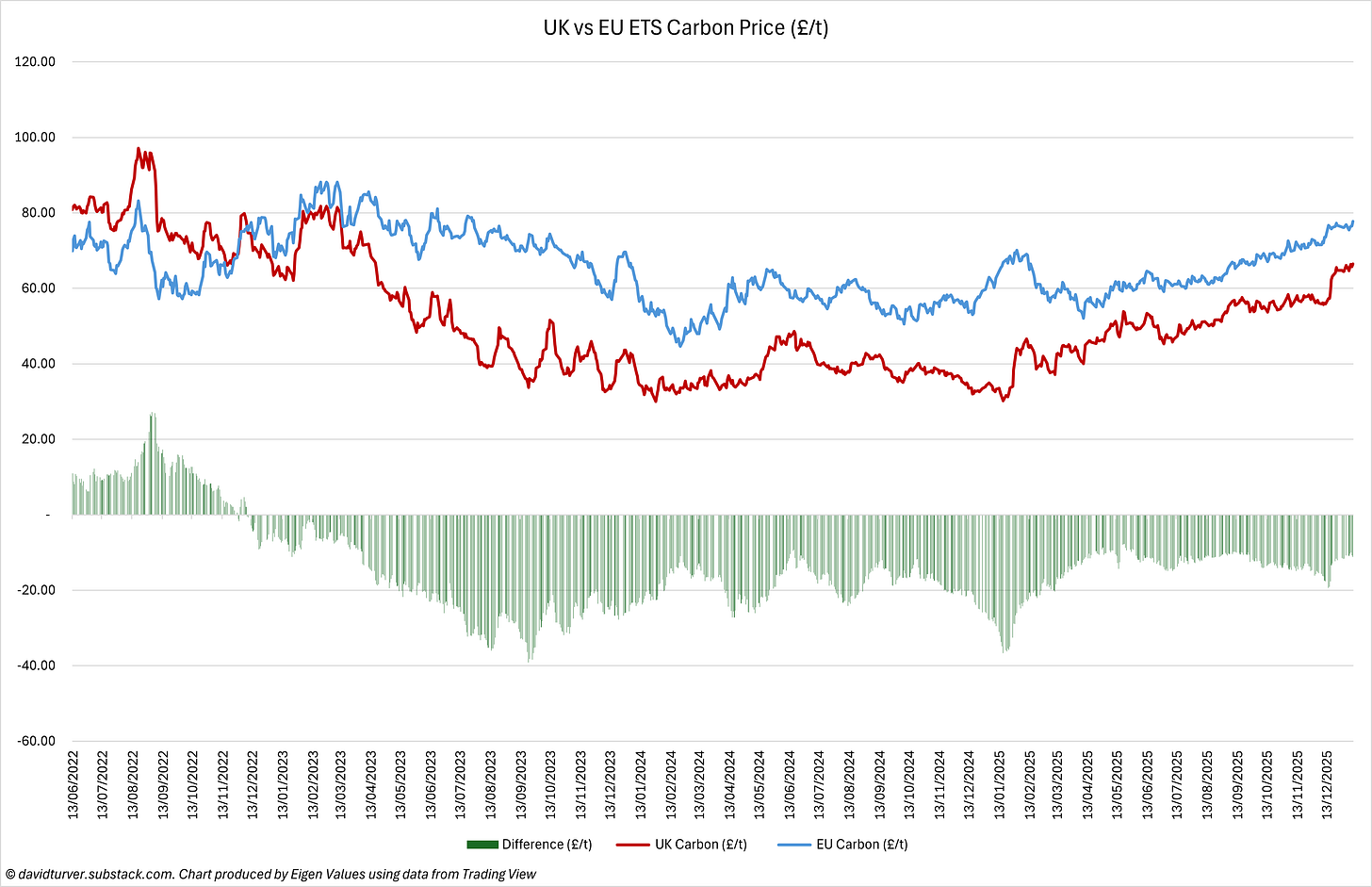

UK-EU ETS Alignment

The beginning of the increase in carbon costs in May last year coincides exactly with Keir Starmer’s announcement to align the UK-EU ETS schemes. Figure 3 shows the front month futures price of the UK (UKA1!) and EU (ECF1!, converted to GBP from EUR) in £/t, sourced from Trading View.

In the early days of the UK ETS, UK carbon prices were higher than EU prices. UK prices dipped under EU prices in late 2022 and have been lower since. The difference fluctuated, but the peak difference with UK carbon prices more than £36.67/t lower than EU prices occurred on 17 January 2025. This coincided with carbon prices reaching a low point of just over £30/t. On 28 January 2025, the FT ran a story claiming Keir Starmer was looking to link the UK and EU ETS schemes as part of his EU reset discussions. Since then UK carbon prices have more than doubled to over £66/t on 9 January 2026 and the difference to EU prices has closed to about £11/t.

Despite Labour’s pledge to reduce energy bills by £300, they are in active discussions to make our electricity more expensive. These discussions are already having an impact as the market anticipates alignment of UK and EU carbon prices.

Impact of Higher Carbon Costs

As we have seen, higher carbon costs push up the wholesale cost of electricity and that impacts everyone. It impacts families struggling with bills as well as large and small businesses. Of course, higher business costs are passed on in the form of higher prices for everything we buy. Almost everyone loses from higher electricity prices.

However, there are some winners. Top of the list are renewable electricity generators subsidised by Renewable Obligation Certificates (ROCs). They get paid the wholesale price plus their certificates on top. Higher wholesale prices mean more revenue for them. In effect, they are benefiting from a tax on gas-fired generation. Second are any non-gas generators operating on a merchant basis. This includes unsubsidised intermittent renewables such as wind and solar, hydro and even our remaining nuclear plants. Again, these companies are effectively receiving a hidden subsidy because of the carbon costs loaded on to gas-fired generation. Renewables funded by Contracts for Difference (CfDs) or Feed-in-Tariffs (FiTs) do not benefit from higher carbon prices because the amount they receive is fixed. However, it does change the mix of their revenue for CfD-funded operators with more coming from the market and less from subsidies. But as we shall see in the forthcoming article, this has not stopped CfD subsidies reaching record levels in 2025.

Conclusions

We have often discussed the impact of subsidies for renewables and their associated extra costs have on our electricity bills. The carbon costs loaded on to our electricity bills are often overlooked. However, carbon costs have been rising recently as the UK and EU discuss aligning their Emissions Trading Scheme. Carbon costs now make up over 37% of wholesale electricity prices. If the Government adopted the Tory policy of removing carbon costs from gas-fired electricity, we would see an immediate reduction in bills, giving welcome relief to families and businesses.

Only ROC and merchant operators would suffer, but renewables advocates have been claiming for years that renewables are cheap. Time to put that claim to the test and remove carbon costs from our electricity bills.

This article (Carbon Costs Driving Up Electricity Prices) was created and published by David Turver and is republished here under “Fair Use”

Leave a Reply