Allocation Round 7 strike prices imply higher costs than Miliband’s Clean Power 2030 Plan

DAVID TURVER

Introduction

A subscriber got in touch and asked how the recently announced strike prices for renewables auction Allocation Round 7 (AR7) compared to the costs assumed in the Clean Power 2030 (CP2030) plan prepared by the National Energy System Operator (NESO) in the autumn of last year.

This is an important point, because as we have covered before, the original sums for CP2030 did not add up. After a bit of analysis, we can see that Miliband is going to need a much bigger budget and we are going to get even bigger bills. Let’s dig into the detail.

Higher Cost of Renewables in AR7

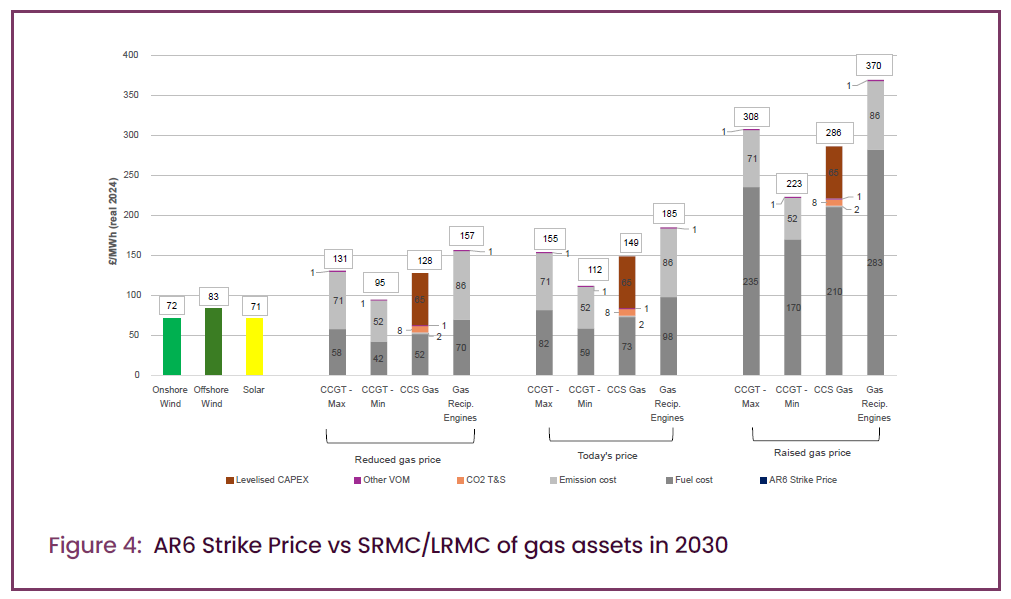

In their comparison of costs of different technologies for CP2030 (see Figure 1), NESO assumed prices for onshore wind, offshore wind and solar of £72/MWh, £83/MWh and £71/MWh, respectively in 2024 prices.

This is well below the price they estimated for gas-fired generation, but only because they assumed roughly half the cost of gas-fired generation would be “emissions costs,” or carbon taxes.

There is something of a sleight of hand in their calculations because the Contract for Difference strike price of active contracts in 2024 was well above their assumption at £112/MWh, £153/MWh and £110/MWh, respectively. All these projects will still be in operation by 2030.

Leaving that aside for the moment, their prices were derived from the strike prices awarded in the AR6 auction. However, we now know that the huge 2.4GW Hornsea 4 offshore wind project from AR6 has been cancelled as uneconomic.

In the same 2024 prices, the recently announced AR7 offer prices are significantly above NESO’s CP2030 assumptions (see Table below)

Onshore wind offers are £92/MWh, up 27.8% compared to the CP2030 assumption. Offshore wind is up 35.7% to £113/MWh. Solar is up slightly to £75/MWh. I have added a column for floating offshore wind too. NESO did include floating offshore wind in some of their detailed spreadsheets but stopped short of including it in their summary cost estimates.

These new AR7 offer prices blow the CP2030 plan and its generation cost estimates out of the water.

AR7 Prices Imply Higher Capital Spending

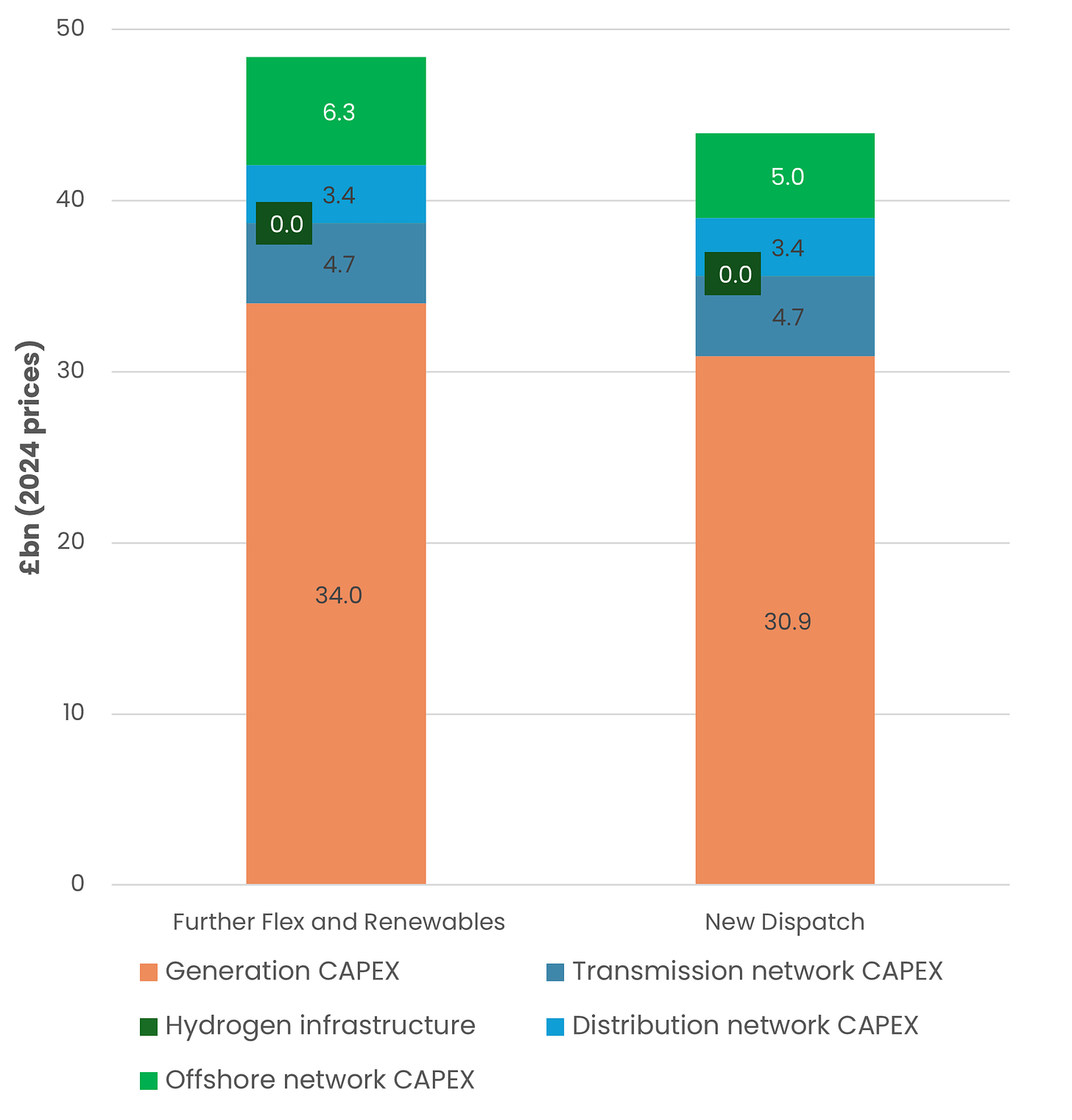

Regular readers may recall that NESO calculated the cost of the CP2030 plan at somewhere between £44bn and £48bn per year which works out at a total of £260-290bn over the six years to 2030 (see Figure 2).

Most of this cash, £30.9-34bn/yr for a total of £185-204bn, is due to be spent on generation assets. More detailed cost data has been released under FOI that allows us to dig a little deeper. In their detailed model, the biggest spend component by far is on offshore wind. In their further flex model, they assume nearly 35GW of extra offshore wind capacity at a cost of £2.7bn/GW giving a total spend of £95.1bn. They also plan to spend £27.4bn on onshore wind and £21.4bn on solar. The overall level of spending is mostly driven by the capital cost of offshore wind.

Using the parameters from AR7 and NESO’s assumptions about asset life, we can calculate the capital expenditure that would result in the offer price of £113/MWh. For clarity, DESNZ assume a load factor of 49% and a cost of capital of 8.5% for fixed bottom offshore wind, and 48% and 10.9% respectively for floating offshore wind. NESO assume a design life of 30 years for offshore wind.

By plugging these numbers into a discounted cashflow model used to calculate the Levelised Cost of Energy (LCOE) we can estimate the capex that results in the AR7 offer prices, as shown in the table below.

The expected capex for fixed bottom offshore wind goes up 32% to £3.59bn/GW. This result is inline with the reported cost of Hornsea Three (£3.68bn/GW) and Hornsea Four (£3.33bn/GW) we discussed here. Floating offshore wind goes up a staggering 179.4% to £7.61bn/GW. This is higher than the reported cost of Greenvolt (£6.25bn/GW), but of course the AR7 offer price is much higher than the AR6 contract awards. We can now see why NESO did not include floating offshore wind in its final cost calculations.

Reducing the asset life to 25 years results in a slight reduction in capex to £3.4bn/GW for floating offshore wind and £7.35bn/GW for floating offshore wind.

Turning to solar, NESO assume £663K/MW of capacity, but the recently delivered solar farms of Stokeford and Alfreton spent £952K/MW and £995K/MW, respectively to deliver their farms, some 44-50% above NESO estimates.

NESO have dramatically under-estimated the capital spending on renewables in their plan, so the overall level of spending needed will blow the budget.

Ofgem Signal Higher Grid Spending

However, NESO’s under-estimates of costs does not end with the cost of renewables. Ofgem have recently approved the first £8.9bn tranche of spending on the onshore and offshore transmission network out of a total £80bn expected in the next five years.

As we can see in Figure 3 above, the expected level of spend on the transmission and offshore network is £9.6-11bn per year or £57.8bn in total to 2030. Ofgem are expecting to spend 38.4% more than the NESO budget on the transmission network.

Gas Savings

All this spending is supposed to save us from being “at the mercy of volatile international gas prices,” so how much do we spend on gas for electricity? According to DUKES (Table 5.6A), in 2024 we used 178,753GWh of gas to produce electricity. According to TradingView, the average price of gas in 2024 was 89.67p/therm. Working through the arithmetic, this gas would have cost us £5.5bn. The NESO plan expects 15TWh of gas-fired electricity to be produced from gas in 2030 that will use about 31TWh of gas, which will cost about £0.95bn at 2024 average prices. Therefore the saving from reducing gas consumption will be about £4.5bn/yr.

Conclusions

NESO made some egregious low-ball assumptions about the cost of renewables in their CP2030 plan. They ignored the cost of the current installed base which will still be generating in 2030. They compared AR6 strike prices to gas-fired generation with an unrealistically high carbon tax included. The flagship AR6 project has been cancelled as uneconomic and the new AR7 offer prices have gone up considerably.

By back-calculating the expected capital expenditure for both types of offshore wind, we can see that the real capital expenditure to deliver this plan will be massively above their estimates. Not only that, the cost of solar is significantly above their estimate and the costs of expanding the transmission grid estimated by Ofgem are 38% above NESO’s estimate.

As we covered before, even with gas prices at 120p/therm and NESO’s original cost estimates, the CP2030 sums simply did not add up. Now we can see the real costs of CP2030 are exploding upwards and gas prices have fallen so the economics of this plan are too dreadful to contemplate.

We need to throw the switch and destroy the green blob before the economy is destroyed by Net Zero ideology.

This Substack now has over 4,500 subscribers and is growing fast. If you enjoyed this article, please share it with your family, friends and colleagues and sign up to receive more content. I would be grateful if more people would sign up for a paid subscription, so for a limited time I am offering a discount off annual subscriptions. This offer ends today.

This article (AR7 to Blow Clean Power 2030 Budget) was created and published by David Turver and is republished here under “Fair Use”

••••

The Liberty Beacon Project is now expanding at a near exponential rate, and for this we are grateful and excited! But we must also be practical. For 7 years we have not asked for any donations, and have built this project with our own funds as we grew. We are now experiencing ever increasing growing pains due to the large number of websites and projects we represent. So we have just installed donation buttons on our websites and ask that you consider this when you visit them. Nothing is too small. We thank you for all your support and your considerations … (TLB)

••••

Comment Policy: As a privately owned web site, we reserve the right to remove comments that contain spam, advertising, vulgarity, threats of violence, racism, or personal/abusive attacks on other users. This also applies to trolling, the use of more than one alias, or just intentional mischief. Enforcement of this policy is at the discretion of this websites administrators. Repeat offenders may be blocked or permanently banned without prior warning.

••••

Disclaimer: TLB websites contain copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available to our readers under the provisions of “fair use” in an effort to advance a better understanding of political, health, economic and social issues. The material on this site is distributed without profit to those who have expressed a prior interest in receiving it for research and educational purposes. If you wish to use copyrighted material for purposes other than “fair use” you must request permission from the copyright owner.

••••

Disclaimer: The information and opinions shared are for informational purposes only including, but not limited to, text, graphics, images and other material are not intended as medical advice or instruction. Nothing mentioned is intended to be a substitute for professional medical advice, diagnosis or treatment.

Disclaimer: The views and opinions expressed in this article are those of the author and do not necessarily reflect the official policy or position of The Liberty Beacon Project.

Leave a Reply